In today’s article, we will discuss how UK-based cigarette manufacturers British American Tobacco (GB:BATS) and Imperial Brands (GB:IMB) are dealing with the falling sales of cigarettes and who is leading the smoke-free market.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Keeping this in mind, we have used the TipRanks stock comparison tool to compare these stocks based on various criteria. This tool can be used by investors to compare stocks within the same or different sectors to make a better decision. One can compare up to seven stocks at a time with the help of this tool.

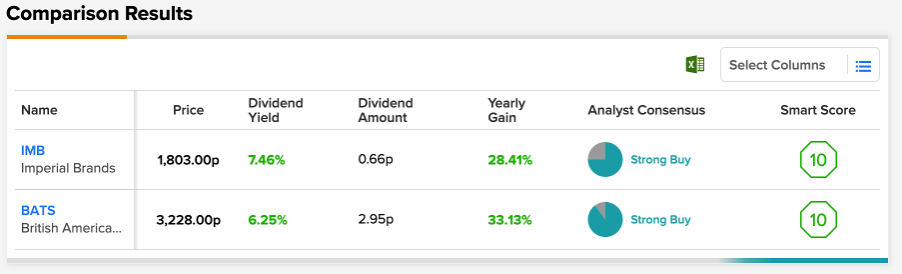

These companies are favourites among investors with their value appreciation and attractive dividend yields. Both companies have dividend yields greater than the sector average of 1.65%.

With their stock prices increasing year-over-year, both companies are mostly in the same ballpark. If we compare the last three years, BAT’s stock has jumped 42%, while the stock of Imperial Brands has grown by around 18% in the same period.

Let’s discuss the stocks in detail.

British American Tobacco – Leading the smoke-free market

BATS on Wednesday posted its numbers for the half year that ended June 30, 2022. The company saw its total sales increase by 3.7% to £12.9 Billion. The company’s adjusted profit from operations was up by 4.9%. Talking about the company’s product mix, the revenue from combustible products grew by 2.3% to £10.7 Billion, but the volume was down by 4.2%. On the other hand, smoke-free products came out shining.

Revenue from its new products saw impressive growth of 45% to £1.3 Billion, driven by its brands Vuse, Glo, and Velo. These products contributed around 15% of the total revenue.

BATS has focused its game on the new categories and spent £1 Billion on them in the first half. With the smoke-free market growing rapidly, the company is already ahead in the race. By 2025, management expects to generate £5 Billion in revenue and remain profitable in the new category business.

With its combustible category, the company has an advantage in pricing power, especially in developed markets such as the U.S. As the U.S. remains the company’s biggest region by revenues, this would be favourable for margins.

View from the City

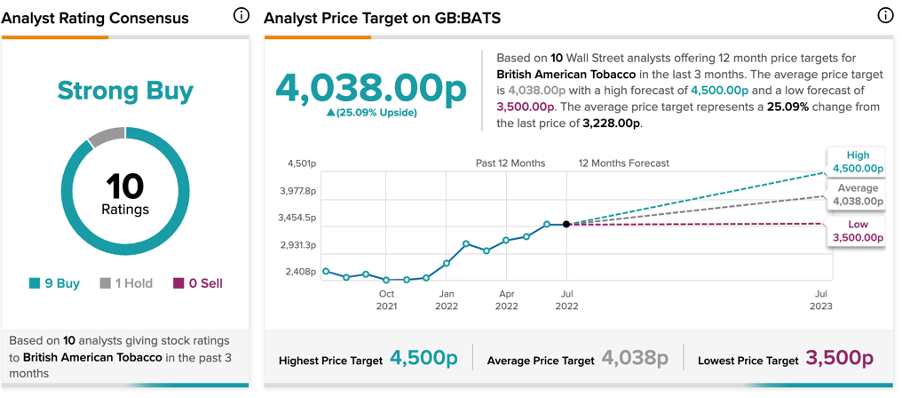

According to TipRanks’ analyst rating consensus, British American Tobacco stock has a Strong Buy rating from 10 analysts. It includes nine Buys and one Hold recommendation.

It has an average price target of 4,038.0p, which represents a 25.1% change in the price from the current level. The price has a low and high forecast of 3,500p and 4,500p, respectively.

James Edwardes Jones, an analyst at RBC Capital, who has a Hold rating on the stock, said, “The new categories segment–which includes vaping products and oral tobacco–reported revenue 10% above market views and a solid improvement in profit. It sounds like BATS is on track to make its NGP (next generation products) business profitable by 2025 as planned,”

Jones has a 78% success rate on the stock, with an average return of around 11%.

Imperial Brands – Lagging Behind

Imperial brands reported its half-year results for 2022 in May. The company’s net revenue was up by 0.3% to £3.5 Billion. The group’s adjusted operating profit increased to £1.6 Billion, up by 2.9% from last year. The company is a late entrant to the smoke-free market with its next-generation products (NGP) such as Pulze and iD, Zone X, and blu.

The products are in the trial phase in some specific markets. IMB has received a positive response from the customers for NGP, and it remains focused on more roll-outs in new markets. However, it is just in the beginning phase.

What the company lacks in NGP it more than makes up in its dividends. The company tops the chart for FTSE 100 dividend-paying stocks. IMB follows a progressive dividend policy and has increased its dividend by 1% this year.

Imperial Brands has a dividend yield of 7.5% compared to the sector average of 1.6%.

View from the city

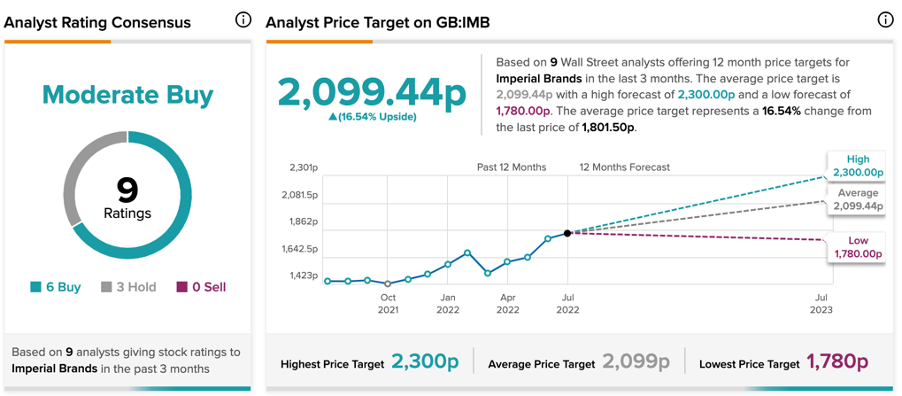

According to TipRanks’ analyst rating consensus, Imperial Brands’ stock is a Moderate Buy. This rating is based on six Buy and three Hold recommendations.

The average price target is 2099.4p, implying an upside of 16.5%. The analyst price target has a high forecast of 2,300 and a low forecast of 1,780p.

Conclusion

The industry is attractive to investors because of its dividends, especially in this inflationary environment.

BATS is well-positioned in the tobacco market as it has market dominance in combustible products and an upper hand in non-combustible products.

IMB is late to the smoke-free market but has its strategy in place for sustainable growth. Do not forget that it is the most attractive income stock right now.