Penny stocks generally refer to stocks that trade at less than $5 a share. While penny stocks continue to be a risky bet, they are still popular among investors. Such penny stocks trading at low share prices can translate to huge gains for retail investors in terms of percentage returns.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While some penny stocks trade over the counter (OTC), others are listed on the stock exchange.

Using the TipRanks penny stock screener, we have identified some of the top penny stocks.

Lantronix (NASDAQ: LTRX)

Lantronix is a provider of software as a service (SaaS) globally, as well as engineering services, and also provides hardware for Edge Computing, the Internet of Things (IoT), and Remote Environment Management (REM).

LTRX is expected to announce its Fiscal Q2 results on February 10. The company delivered mixed first-quarter results. Lantronix’s revenues jumped 61.6% to $27.7 million, driven by higher revenues when it comes to its IoT and REM businesses.

However, losses widened from $0.302 million in the same period last year to $2.28 million in the third quarter. The reason for the widening losses was rising costs “related to the acquisition of the TN Companies and share-based compensation.”

Lantronix acquired TN (Transition Networks) Companies last year for around $32 million.

Considering the strong demand for LTRX’s products and services, Lantronix remained confident that barring supply chain constraints, it could very well achieve full-year revenue and non-GAAP EPS at the high-end of its guidance range.

Needham analyst Ryan Koontz applauded the management’s “impressive execution on supply chain for a smaller hardware-centric company.” The analyst was upbeat about the positive demand for LTRX’s products, boosted by the investment in industrial applications of IoT and saw a “turnaround story” that can achieve maximal performance from the assets it has purchased.

Koontz also expects that the company’s acquisition of Transition Networks will be immediately accretive.

As a result, the analyst remained bullish with a Buy rating and a price target of $13 (98.8% upside) on the stock. What’s more, LTRX stock analysis shows a score of 9 out of 10, indicating that this stock is highly likely to outperform the market. This Smart Score is based on 8 unique parameters including Analyst recommendations, TipRanks Investors, and Bloggers’ sentiment regarding the stock and insider activity.

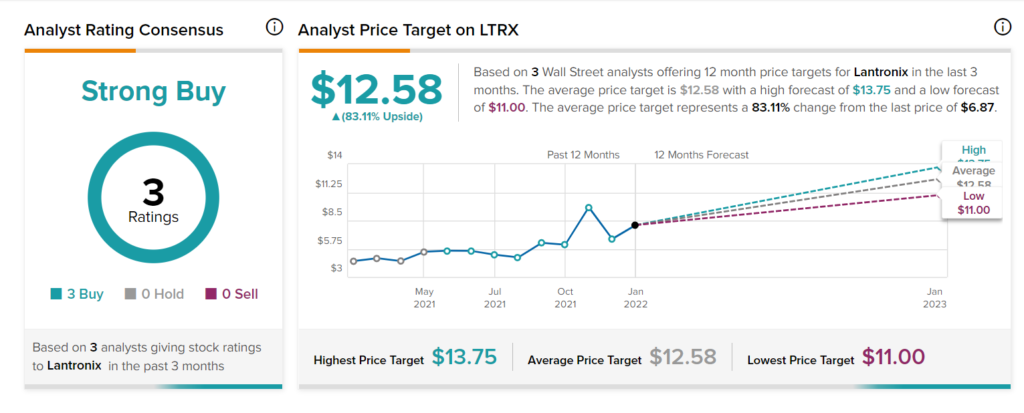

Besides for Koontz, two other analysts are also upbeat about the stock with a Strong Buy consensus rating. The average Lantronix stock prediction of $12.58 implies upside potential of approximately 92.4% to current levels for this stock.

Compass Therapeutics (NASDAQ: CMPX)

Shares of Compass Therapeutics have tanked by approximately 36% in the past month, even as the U.S. Food and Drug Administration (FDA) gave approval to the company’s Investigational New Drug (IND) Application for a Phase 2 study of CTX-009 in the U.S. and Korea.

Compass Therapeutics was founded in 2014 and has its headquarters in Boston, Massachusetts. It is a clinical-stage, oncology-focused biopharmaceutical company that is in the process of developing “proprietary antibody-based therapeutics to treat multiple human diseases.”

Compass’s lead product candidates are CTX-009 (a.k.a. ABL001), an investigational antibody that blocks both DLL4 (Delta-like ligand 4/Notch) and VEGF-A (vascular endothelial growth factor A) signaling pathways, which are critical to “angiogenesis and tumor vascularization.”

Tumor angiogenesis is the growth of new blood vessels needed by tumors to grow.

The company’s other two product candidates include CTX-471 and CTX-8371. CMPX acquired worldwide rights for CTX-009 through the acquisition of Trigr Therapeutics last year.

Following the Phase-2 study approval for CTX-009, H.C. Wainwright analyst Michael King said that this approval reinforced “our enthusiasm for the stock and reflects the management’s strong focus on execution.”

Moreover, the analyst pointed out an encouraging result in a Phase 2 study conducted in South Korea for CTX-009, which was initiated in the first quarter of last year. In this study, CTX-009 was being studied in combination with paclitaxel in patients with advanced biliary tract cancers (cholangiocarcinoma).

According to King, this study has already indicated 5 partial responses (PRs) among the first 17 patients, indicating a preliminary overall response rate (ORR) of 29%. As a result, the analyst stated that Compass intends “to convert the Phase 2a study into a pivotal Phase 2/3 study in 2Q 2022 with topline readout anticipated in 3Q 2023, which we believe could be a major inflexion point for the stock.”

The analyst reiterated a Buy and a price target of $11 on the stock.

Compass Therapeutics has a Strong Buy consensus rating, based on 6 unanimous Buys. The average CMPX stock prediction of $9.50 implies upside potential of approximately 408% to current levels for this stock, making it one of the best penny stocks to watch.

Moreover, CMPX stock analysis indicates a score of 9 out of 10, indicating that this stock is highly likely to outperform the market.

Minerva Surgical (NASDAQ: UTRS)

Our third stock on this list is Minerva Surgical. Minerva Surgical is a medical device company that has a product line of minimally invasive medical devices that address abnormal uterine bleeding (AUB).

AUB can occur due to both structural and non-structural causes.

Before May 2020, the company used to sell only one product, the Minerva ES Endometrial Ablation System (Minerva ES), which targeted AUB due to a non-structural cause. But after acquiring certain assets of Boston Scientific Corporation (BSX), Minerva’s portfolio has expanded to intra-uterine health products.

According to SVB Leerink analyst Danielle Antalffy, while Minerva initially targeted only the endometrial ablation segment of the AUB market that was worth $240 million, with the expansion of its product portfolio, it is now targeting the entire $600 million AUB market.

In the analyst’s words, Minerva is “poised for near term share gains given its full product portfolio, cross-selling opportunities, and strong clinical evidence.”

Antalffy believes that UTRS has a sustainable growth trajectory when it comes to its products and anticipates that sales will reach $100 million. The analyst backed up this belief by adding that the company was expanding its sales force and working to increase patient awareness through its direct-to-consumer channel.

As a result, the analyst is bullish on the stock with a Buy rating and a price target of $8 on the stock.

The rest of the analysts on the Street are also optimistic on the stock, with a Strong Buy based on a unanimous 4 Buys. The average UTRS stock prediction of $15.33 implies upside potential of approximately 259.9% to current levels for this stock.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.