Meme stocks have been gaining momentum for some time now. Outdoor grill company Weber Inc. (NYSE: WEBR), which went public in August 2021, offers accessories, gas grills, and consumables. It has no company-specific news, but investors are jumping over WEBR stock, as it has a very high short interest of 58%, according to MarketWatch.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The stock jumped more than 10% at the close on Wednesday and further rose 5.1% in pre-market trading at the last check, in anticipation of a short-squeeze in the stock by investors.

Website Visit Data Reflects an Uptrend

Using the website traffic tool, an uptrend was identified. In the last three months, total visits on weber.com showed an increasing trend, on a global basis, representing a significant jump of 42.2%, 32.03%, and 16.52% in March, April, and May, respectively, on a sequential basis.

The rise in website visits could be due to various factors, including the rising popularity of the company’s products and a subsequent increase in customer demand.

Wall Street’s Take

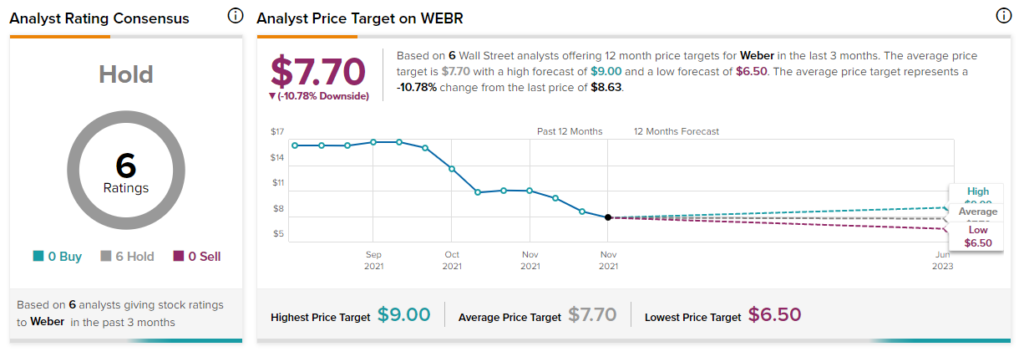

Overall, the stock has a Hold consensus rating based on six unanimous Holds. That’s after a 27.48% slide in Weber’s share price over the past six months. The average Weber price target of $7.70 implies 10.78% downside potential to current levels.

Weber gets a 5 out of 10 on TipRanks’ Smart Score ranking, which indicates that the stock is likely to perform in line with market averages.

Bottom Line

With a diversified product portfolio and a strong outlook for the year, Weber is gaining popularity. Nevertheless, a cautious approach toward investing and vigilance on website trends as seen in TipRanks’ Website Traffic Tool could guide to a prudent investment decision.