Coinbase (COIN), one of the largest cryptocurrency exchange platforms in the United States, will release its fourth-quarter earnings on February 24.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Being an online trading platform, the majority of Coinbase’s revenues come from the fees it charges for trading cryptocurrencies. As a result, more monthly users could equate to increased trading activity on the platform, which could provide a boost to transaction, subscription, and services revenues for Coinbase.

We used TipRanks’ new Website Traffic tool to look into Coinbase’s monthly user statistics and get a better sense of the company’s current state ahead of the Q4 print.

Website Visits Reflect Upward Trend

We discovered from the tool that the total estimated visits to the Coinbase website remained robust in Q4. Notably, there was an estimated 49.8% quarter-over-quarter rise in total global visits to the coinbase.com website.

Further, TipRanks’ new website tool showed that the year-over-year increase in visits to the coinbase.com website was stupendous, rising 112.3% to 421.7 million.

Therefore, Coinbase could witness robust growth in both its Monthly Transacting User (MTU) and Trading Volume metrics in the to-be-reported fourth quarter.

Wall Street’s Take

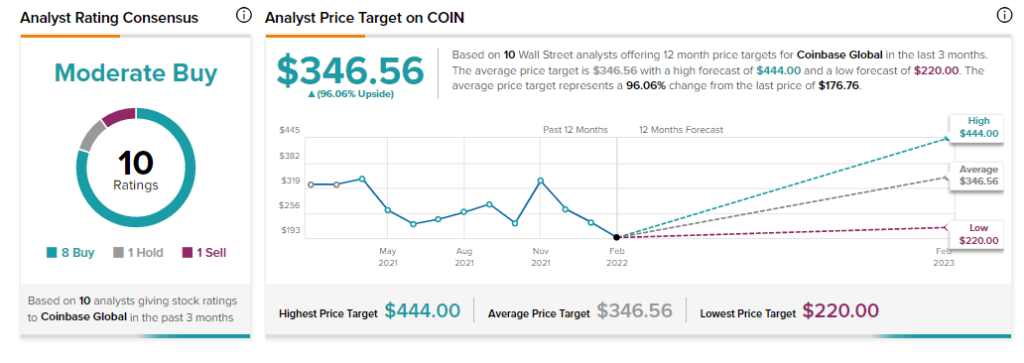

On TipRanks, Coinbase stock commands a Moderate Buy consensus rating based on 8 Buys, 1 Hold, and 1 Sell. As for price targets, the average COIN stock price forecast of $346.56 implies almost 96.1% upside potential from the current levels.

Conclusion

To summarize, website visit numbers for Coinbase appear to be very impressive for Q4, with estimated visits reflecting a growing number of users utilizing Coinbase’s infrastructure, products, and services.

Together with the recent volatility in the crypto market, monthly user stats could be a major contributor to strong net revenues in Q4 and might be the catalyst needed to ignite a recovery in COIN’s share price.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure