Utility stocks have long attracted investors for several reasons. They provide essential services – we can’t get along in the modern world without running water, reliable electricity, or safe supplies of natural gas. These necessities give the companies that provide them a secure and often predictable business foundation.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

In addition, most utility firms operate in tightly regulated markets and effectively hold monopolies within their regions. For investors, that means a key determinant of performance isn’t the going rate for services, but rather the company’s relationship with its regulatory authority. Maintain that relationship on solid footing, and the firm will remain well-positioned to appeal to investors.

Wells Fargo’s Shar Pourreza, who is rated by TipRanks in the top 2% of Wall Street’s analysts, has been giving this sector a long, hard look as 2025 winds toward its close, and he sees utility stocks as sound options for the remainder of the year.

“We continue to see the sector as discounted vs. its emerging growth attributes/opportunities, including data centers, reshoring, electrification of the system, and other economically driven load growth opportunities. In short, this is one of the strongest backdrops we have seen in the sector, which is not only leveraged to perpetual infrastructure needs, but is now further buoyed by one of the healthiest load growth environments we have seen in more than 20 years of covering this space… The defensive characteristics for the group merely create a floor, limiting downside, but the perfect storm of tailwinds creates materially higher upside opportunities,” the 5-star analyst opined.

With that bullish setup in mind, Pourreza isn’t just speaking in general terms – he pinpoints two utility stocks as his ‘best ideas’ for the rest of the year. But do his top picks align with the broader Wall Street consensus? We turned to the TipRanks database to find out. Let’s dive in.

Sempra Energy (SRE)

The first energy stock we’ll look at here, Sempra Energy, is an electric and natural gas utility operating in California and Texas. The San Diego-based company was founded in 1998 and today is one of the largest utility-scale energy networks in North America, with approximately 40 million customers. Sempra has some 20,000 employees and boasted nearly $100 billion in total assets at the end of last year.

Sempra has three main operating divisions: Sempra California, Sempra Texas, and Sempra Infrastructure. In the first, the company’s two utilities, SD&E and SoCalGas, serve some 25 million customers in the southern and central parts of the state, providing electricity and natural gas. The company takes a proactive stance on grid resiliency, understanding that power supplies must be reliable. In addition, Sempra is a leader in bringing renewable energy sources into the distribution network.

Looking at Sempra Texas, we find that the company operates through Oncor Electric Delivery Company. Oncor, headquartered in Dallas, is a regulated electric transmission and distribution company, with more than 143,000 miles of total electric lines in commission. Oncor is one of the largest transmission and distribution companies operating in Texas and serves some 13 million customers across 120 counties.

The Sempra Infrastructure division has a more global focus and includes a portfolio of liquefied natural gas (LNG) assets with approximately 40 million tons capacity per year under construction on the Pacific and Gulf coasts. This division focuses on bringing LNG into the North American utility network and includes more than 4,500 miles of natural gas transport and distribution pipelines. The division’s other work involves operating cross-border projects between the US and Mexico. These include solar and wind power projects, as well as battery storage.

In September of this year, Sempra announced several strategic actions designed to advance the company’s corporate strategy and to bring cash reserves into its coffers. At the center of these actions is the sale of 45% of Sempra Infrastructure Partners to the global investment firm KKR for $10 billion in cash. The deal is expected to close in the middle of next year, with the full cash balance to be paid seven years after the closing.

Turning to the company’s financial results, we find that Sempra’s last report, covering 2Q25, showed revenue of $3 billion. This figure was relatively flat year-over-year but missed the forecast by nearly $124 million. At the bottom line, Sempra’s non-GAAP EPS of 89 cents was also the same as the prior-year quarter – and it beat the forecast by 4 cents per share.

Pourreza, in his comments on Sempra, notes the company’s potential earnings strengths and its bullish catalysts in the making.

“Best Idea Regulated Utility… We would be buyers ahead of a key reset in February, especially given current valuation levels, with 7-9% EPS growth unlikely to step back down to 6-8% (i.e., the long-term EPS trajectory is to exceed prior 6-8% guidance),” Pourreza said. “We are very bullish on the outlook for Oncor, especially on the heels of key legislative initiatives that passed, have very little concerns around the CA utilities and believe the recent deal with KKR was banner, as it not only supports growth (still with 25% exposure with SIP) and the balance sheet, but it mitigates risk, which all investors were seeking, by deconsolidating SIP from SRE,”.

The analyst goes on to put an Overweight (i.e., Buy) rating on the shares, with a $115 price target that points toward a one-year upside potential of 24%. (To watch Pourreza’s track record, click here)

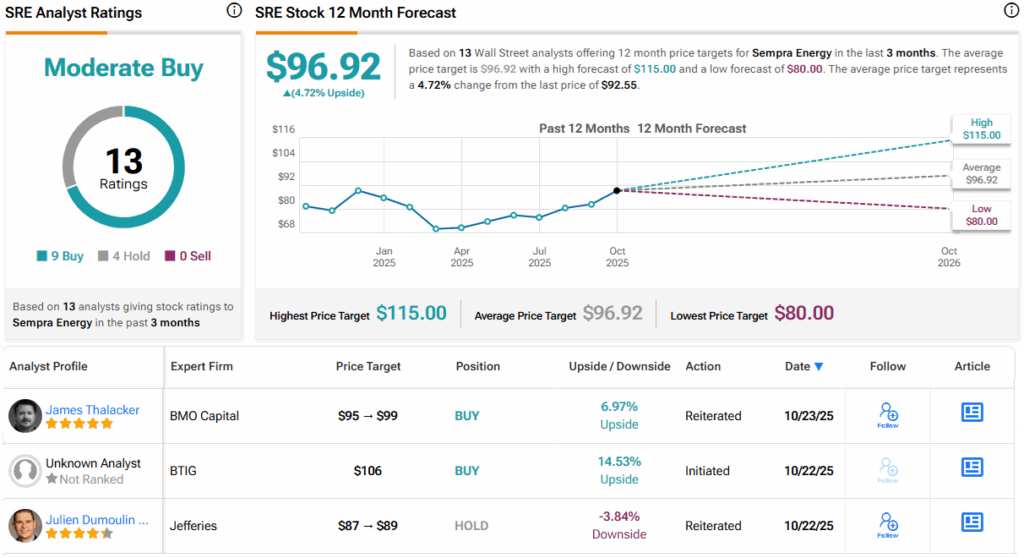

The Moderate Buy consensus rating on Sempra is based on 13 recent analyst recommendations that include 9 Buys and 4 Holds. The shares are currently priced at $92.55, and their $96.92 average target price implies a 5% gain in the coming year. (See SRE stock forecast)

Constellation Energy Corporation (CEG)

The next stock we’ll look at is a leader in the US carbon-free power market. Constellation Energy is well-known for its portfolio of electric power generation assets, which includes nuclear, wind, solar, and hydroelectric sources, as well as natural gas sources. The company has been an independent operator since 1999, and from its Baltimore headquarters it oversees a network that extends to 48 states, the District of Columbia, Canada, and the UK.

At its core, Constellation is an electricity provider, with more than 32,400 megawatts of capacity – of which some 90% is carbon-free. The company is the nation’s largest operator of nuclear power plants, and is closely involved in the restart operations of the Crane Clean Energy Center, the Three Mile Island facility formerly known as Unit 1. As of this past September, Constellation is ahead of schedule on the facility restart, which is now targeted for 2027.

In addition to its nuclear work, Constellation is expanding through strategic acquisitions. In January of this year, the company announced its intent to acquire the Texas-based power utility Calpine. The transaction, valued at approximately $16.4 billion and to be conducted in cash and stock, was approved by regulatory authorities in July of this year. The deal is expected to close by year’s end, and to be immediately accretive in terms of revenue.

In another strategic move, Constellation is looking to co-locate its power generation facilities with data centers. This move piggybacks on the hardware aspect of the AI boom; data centers are notorious for their high power consumption. One good example of this co-location strategy is the Crane project on Three Mile Island; that nuclear plant restart includes a 20-year power purchase agreement with Microsoft.

Constellation saw $6.1 billion in revenue during 2Q25, its last reported quarter. This total was up 11.5% from the prior year and beat expectations by $1.19 billion. The company’s earnings, reported as $1.91 per share in non-GAAP terms, were 8 cents per share ahead of the forecast.

According to Wells Fargo’s Shar Pourreza, Constellation’s strong fundamentals, disciplined expansion strategy, and multiple growth catalysts make it one of the most compelling utility plays in the market today.

“Best IPP [Independent Power Producer] idea on a number of near-term catalysts. Incremental DC announcement expected by YE25, constructive datapoints on Crane Clean Energy repowering and opportunities with Calpine acquisition closing (i.e. run rates, DC deals),” Pourreza said. “CEG is becoming the premier nuclear and gas operator in the US with clear tailwinds both new volumes of data center deals (i.e. availability of resources up for contractual arrangements) and the broader commodity upside on power prices in the US as load growth starts to chip at the gap between near term prices and long-term new build economics.”

To this end, Pourreza puts an Overweight (i.e., Buy) rating on CEG, and his $478 price target implies a gain for the next year of 24%.

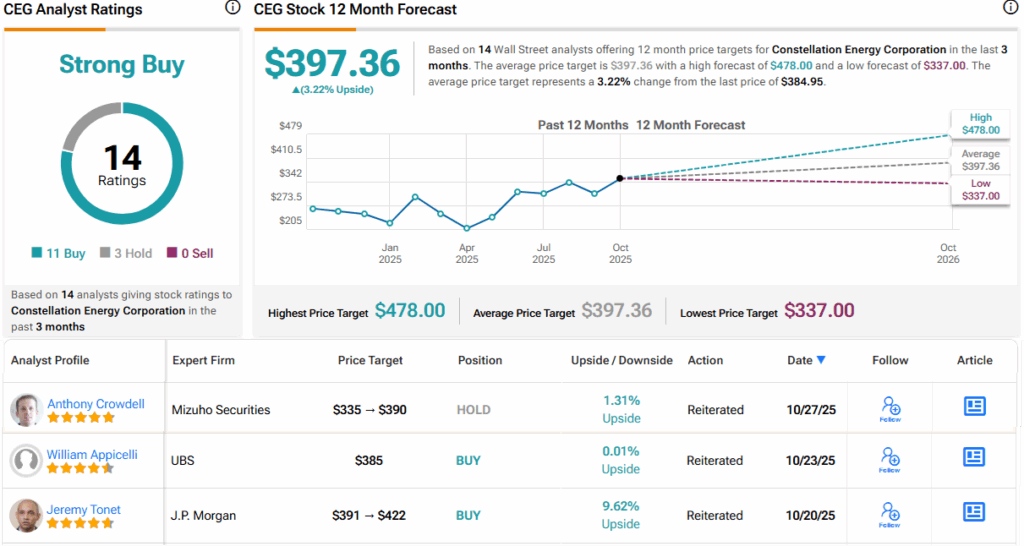

Overall, Constellation’s stock gets a Strong Buy consensus rating based on 14 reviews that break down to 11 Buys and 3 Holds. The shares are trading for $384.95 and their average target price of $397.36 offers modest 12-month upside of 3%. (See CEG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.