Global media companies Warner Bros. Discovery (WBD) and Paramount Global (PARA) are scheduled to report their quarterly results on November 7 and 8, respectively. Using the TipRanks Stock Comparison Tool, a closer look suggests both stocks have a neutral outlook. However, if I had to choose one as the better buy ahead of earnings, I’d lean toward Paramount Global, given its better fundamentals and relatively stronger track record in meeting earnings expectations.

Let’s dive deep.

Warner Bros. Discovery

I have a neutral outlook on Warner Bros. Discovery as an investment, primarily because the company remains weighed down by substantial debt from its merger with Discovery and faces ongoing challenges in reducing this debt.

Currently, WBD has $41.4 billion in gross debt, translating to a net debt-to-earnings leverage ratio of 4x. Despite generating a solid $7.47 billion in cash flow last year, there is skepticism about the company’s ability to meet its leverage target of 2.5x to 3x by the end of 2024. The major concern is that Warner Bros. Discovery is not yet profitable, with analysts forecasting profitability sometime in 2025.

In the streaming market, WBD competes with HBO Max and Discovery+, providing a blend of premium and reality television content. The company’s path to profitability is closely tied to its direct-to-consumer (DTC) strategy, which includes the Max platform. While the segment is still posting a slight loss this year, it has seen global growth with 103.3 million subscribers.

While DTC subscriber numbers in the U.S. and Canada are falling, recent price hikes for Max are expected to offset the lower average revenue per user (ARPU), which is approximately $8—approximately half of Netflix’s (NFLX). Achieving profitability may take some time, but Warner Bros. Discovery’s valuation appears appealing, with an EV/EBITDA of 7.9x, nearly 27% lower than the industry average.

Is WBD a Buy, Ahead of Its Earnings?

I prefer to remain cautious about Warner Bros. Discovery given its conservative Q3 2024 earnings outlook, with revenue projected at $9.79 billion. This moderation likely stems from significant debt obligations, potentially limiting cash flow and challenging profitability. In the past three months, nine out of ten analysts have revised earnings down, and seventeen out of nineteen have lowered revenue projections, underscoring increasing skepticism around WBD’s performance.

It’s important to note that WBD has beaten EPS and revenue estimates in only two of the last ten quarters. If it fails to meet conservative Q3 expectations, this could signal worsening liquidity issues and harm the company’s financial stability. Conversely, exceeding these expectations might offer short-term support for the stock despite the overall bearish sentiment. However, I believe taking that risk isn’t worthwhile.

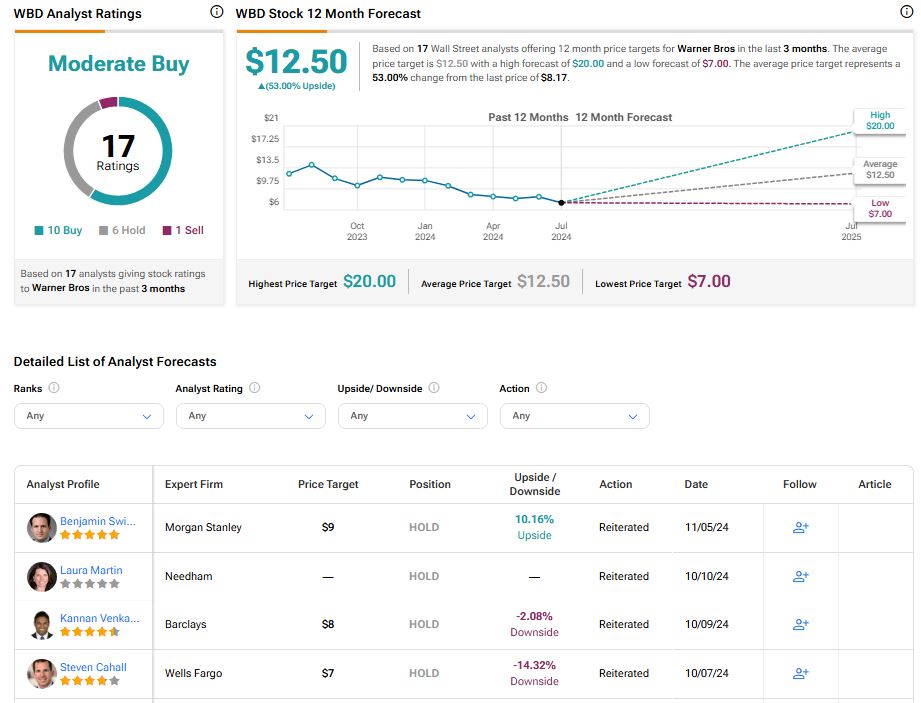

According to TipRanks, WBD stock holds a Moderate Buy rating based on 17 analyst reviews: ten recommend a Buy, six suggest a Hold, and one advises a Sell. The average price target is $12.50, implying an upside potential of 53%.

Paramount Global

Like Warner Bros. Discovery, I also have a neutral outlook on Paramount Global, a key player in streaming with Paramount+ and well-known brands like CBS, Paramount Pictures, Showtime, Nickelodeon, and MTV. My concerns stem from the company’s recent turmoil, particularly its takeover drama involving competing bids from Edgar Bronfman Jr., the former CEO of Warner Music Group, and Skydance Media.

However, Bronfman withdrew his bid in late August, leaving Skydance as the leading contender. This news disappointed investors who favored Bronfman’s offer, contributing to the stock’s poor performance this year. Skydance intends to invest $6 billion for up to 400 million new non-voting Class B shares at $15 each, allowing Paramount shareholders to choose between cash or new stock at this price. While this represents a nearly 36% premium to the current stock price of around $11, market skepticism remains about the deal’s final terms and feasibility due to the existing price gap.

In contrast to Warner Bros. Discovery, Paramount appears to be in a stronger financial position for future operations, with $2.3 billion in cash and equivalents against $14.5 billion in long-term debt, resulting in a current ratio of 1.3. This is promising given the company’s struggle for profitability. Analysts project EPS growth at a CAGR of 38.97% over the next three to five years. However, Paramount has historically lagged behind its peers in top-line growth, posting a negative 3.1% five-year quarterly sales CAGR compared to 29.4% for Warner Bros. Discovery and 15.7% for Netflix.

Is PARA a Buy, Ahead of Its Earnings?

I rate Paramount Global stock as a Hold ahead of its earnings report, even though management’s Q2 guidance suggests that Paramount+ is on track to achieve domestic profitability by 2025. This outlook comes amid anticipated losses in Q3 and Q4 due to content expenses. Similar to Warner Bros. Discovery, analysts have revised both top and bottom line estimates downward. Fifteen out of seventeen analysts have adjusted their EPS estimates to a range of $0.24, while all nineteen analysts have lowered revenue estimates to a consensus of $6.97 billion.

However, Paramount has a slightly more favorable history of exceeding estimates compared to Warner Bros. Discovery. In the last ten quarters, Paramount has beaten EPS estimates in seven instances, though it has only surpassed revenue estimates in three.

According to Jason Bazinet of Citigroup (C), Paramount’s investment thesis hinges not just on net additions or profits but also on how much consumers are willing to pay for an hour of streaming. This perspective is vital in determining whether these platforms are considered true substitutes for linear pay-TV. In Q2, Direct-to-Consumer advertising grew by 16%, driven by increased viewing hours on Paramount+ and Pluto TV, alongside higher CPMs. Sustaining this trend could positively influence the stock.

At TipRanks, the Wall Street consensus for Paramount Global is a Hold, with six out of 13 analysts offering a neutral recommendation, four adopting a bearish stance, and only three taking a bullish view. The average price target is $12.67, indicating a potential upside of 16.56%.

Conclusion

While I hold a neutral outlook on both Warner Bros. Discovery and Paramount Global, I see WBD struggling with high debt levels and consistently missing top- and bottom-line expectations. Paramount Global, meanwhile, faces governance challenges that make its outlook speculative. That said, based on fundamentals, I find Paramount Global to have a more de-risked balance sheet and a clearer path to profitability growth.

Although Q3 estimates are conservative for both, Paramount Global’s better track record of beating earnings expectations and clearer guidance on Paramount+ profitability gives it a slight advantage over WBD, making it the preferable buy ahead of earnings.