The last two years have been very good for the stock markets – but that success is resting on a narrow base. It’s no secret that the mega-cap tech names have led the gains, especially the ‘Magnificent 7’ giants, and investors are starting to look for other healthy names to broaden their portfolios. And lately, that search is leading investors toward dividend stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The outlook for dividends is promising. Corporate earnings saw solid growth in 2024, and expectations for 2025 remain strong, setting the stage for a favorable dividend environment. As Goldman Sachs senior strategist Ben Snider puts it, “From a macro perspective, the main driver of dividends historically is earnings growth.” In line with this, Goldman projects a 7% overall increase in dividend payouts this year.

With this in mind, we turned to TipRanks’ database and found two reliable dividend stocks offering a solid 7% forward yield – plus, they’ve recently earned upbeat reviews from analysts. Let’s take a closer look at what makes them compelling buys.

MPLX LP (MPLX)

We’ll start in the energy industry, where MPLX is an important midstream player. The company has been in business since 2012, when it spun off from Marathon Petroleum to operate the parent firm’s midstream hydrocarbon transport assets as an independent entity. Today, MPLX controls and operates a diverse network of assets in the hydrocarbon industry; these include pipelines for both crude oil and refined products, light-product terminals, storage caverns and refinery tanks, crude oil and natural gas gathering systems, pipelines associated with these gathering systems, and processing and fractionation facilities for natural gas and natural gas liquids. The company even owns an inland marine business, transporting oil and gas products on North America’s major river systems, plus the docks, loading racks, and associated piping needed to load and operate the river barges.

MPLX has grown to a multi-billion giant of the midstream sector, with a market cap of $54.5 billion and annual revenues of $11.9 billion in 2024. While the company has its hands in most parts of the energy transport niche, it is particularly well known for selling a variety of important natural gas liquid products, including butane, ethane, isobutane, natural gasoline, and propane.

Turning to the company’s recent results, we find that MPLX generated $3.06 billion in revenue, a figure that was up 3% year-over-year although it came in just under analyst expectations, missing by $10 million. At the bottom line, the $1.07 EPS beat the forecast by 2 cents per share.

Of note to dividend investors, the company on January 22 declared a common share quarterly dividend payment of $0.9565. This payment, the second at this rate, is scheduled for payment on February 14. The annualized rate of the payment, $3.826, gives a forward yield of 7.2%. The company has not missed a quarterly dividend payment and has a history of making regular increases to the dividend.

Justin Jenkins, in his write-up on MPLX for Raymond James, notes the company’s diverse network of assets as a key advantage, saying, “The unique diversification of MPLX’s crude/products and gas/NGLs businesses is not lost on us, and we note that both segments present tailwinds in the current environment that don’t seem to be well reflected in valuation, even with strong recent performance. Relative to consensus, we are more optimistic on MPLX’s multi-year earnings trajectory, especially in light of recent NGL logistics projects, as well as inflation escalators on the core business.”

Adding to that, Jenkins reflects on the potentialities of this company’s dividend and value profile: “In turn, faster distribution growth (potentially supplemented by additional organic growth, bolt-on M&A, dropdowns) provides possible catalysts in 2025+ as financial flexibility remains favorable. Trading at ~9.5x 2027E EV/EBITDA, we see MPLX as currently in line or even at a modest discount to large-cap midstream peers in the ~8-11x range.”

All in all, Jenkins rates MPLX shares as Outperform (i.e., Buy), backing that up with a $60 price target that suggests a one-year upside potential of 13%. With the dividend yield and potential upside taken together, the one-year return on this stock could exceed 20%. (To watch Jenkins’ track record, click here)

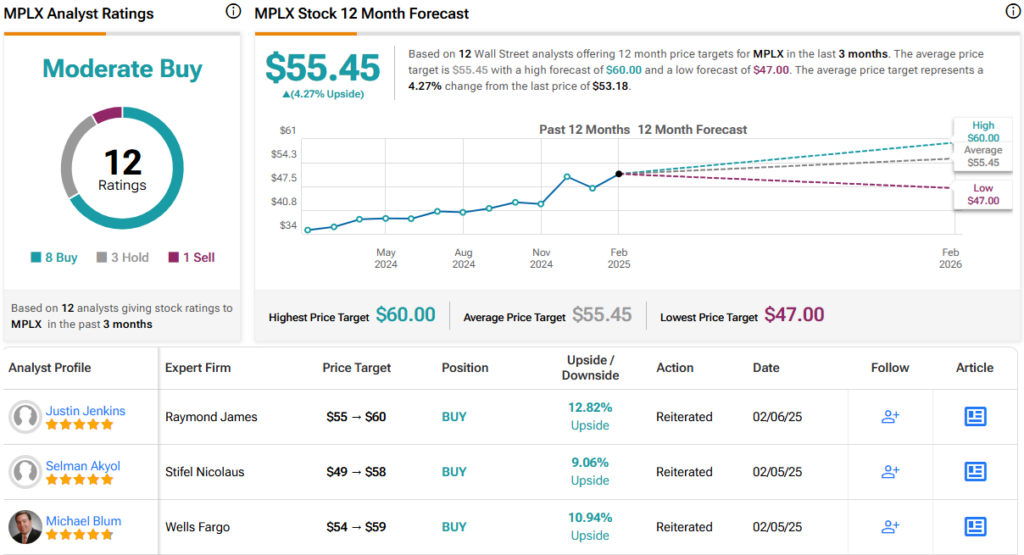

There are 12 recent analyst reviews on record for MPLX, and these split to 8 Buys, 3 Holds, and 1 Sell for a Moderate Buy consensus rating. The stock is priced at $53.18, and its $55.45 average price target implies a modest gain of 4% in the next 12 months. (See MPLX stock forecast)

OneMain Holdings (OMF)

From the energy sector, we’ll shift gears and move over to the financial sector. OneMain is a financial services company, whose main focus is providing consumer loan services to a sub-prime customer base. The company, which traces its roots back to 1912, is a leader in the nonprime consumer credit market, and is known for making responsible credit accessible to its customers. The company operates mainly through its online presence, but it also maintains a network of 1,300 physical locations in 44 states.

OneMain’s loan business is substantial; in the recently reported fourth quarter of 2024, the company listed managed receivables totaling $24.7 billion. This category includes loan services for wholesale loan partners as well as third-party origination auto finance loans. The managed receivables were up 11% year-over-year. The company’s consumer loan originations came to $3.5 billion in the quarter, for 16% year-over-year growth. OneMain’s interest income in Q4 was listed as $1.3 billion and made up the bulk of the total revenues. Interest income was up 11% from the prior-year period.

At the top and bottom lines in the quarter, OneMain reported $1.5 billion in total revenue and $1.16 per share in non-GAAP earnings. The revenue total was up 9% year-over-year and beat the forecast by $320 million; the earnings figure was a penny better than had been expected.

Turning to the dividend, we find that OneMain declared a $1.04 common share quarterly payment in its Q4 report. This payment, which annualizes to $4.16 per share, is scheduled to be paid on February 20 and gives an attractive forward yield of 7.3%.

This stock has caught the attention of JMP’s David Scharf, an analyst who ranks in the top 3% of Wall Street stock experts. Scharf had this to say following the company’s Q4 earnings: “At a high level, 4Q was uneventful with the top line, volumes, credit metrics, and expenses coming in in-line to slightly better than expectations. The initial 2025 guidance, however, has a more conservative origination volumes and revenue growth outlook relative to our current forecast, while credit and Opex expectations are in line.”

Looking ahead, the 5-star analyst also notes the strong dividend and the stock’s overall position, adding, “With a 7% dividend yield, conservative initial ’25 guidance, in our view, modest valuation at 8x 2025E EPS given the cautious outlook for the year, and significant funding advantages compared to major competitors, we like the positioning of the stock.”

Scharf rates OMF shares as Outperform (i.e., Buy) and adds a $65 price target that points toward an upside of 14.5% on the one-year horizon. Add in the dividend yield, and the total one-year return could exceed 21%. (To watch Scharf’s track record, click here)

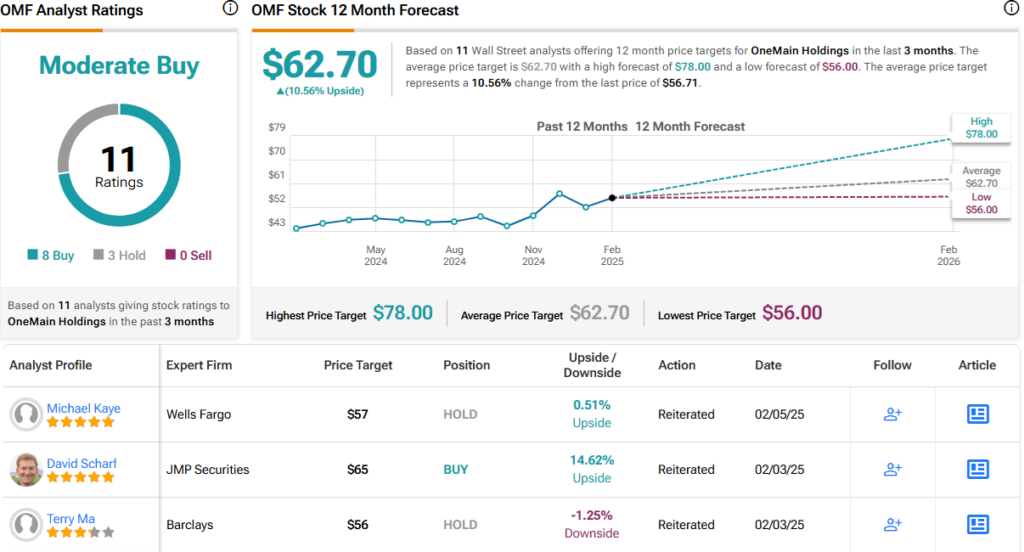

The 11 recent analyst reviews here include 8 to Buy and 3 to Hold, giving OneMain its Moderate Buy consensus rating. The stock is selling for $56.71 right now, and its $62.70 average price target implies it will gain 10.5% in the year ahead. (See OMF stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.