What to do in the current market environment? We just saw the inflation numbers for July, and the results only feed into the current uncertainties. The annualized rate, 3.2%, marked the first time in over 12 months that the year-over-year rate ticked upwards, but analysts had expected a 3.3% rate. The inflation data only underscores beliefs that the Federal Reserve is not through with rate hikes, even if it has paused for the time being. More worrisome still is the persistence of high prices; while the rate of increase has slowed, consumer prices are still up approximately 16% over the past two years.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

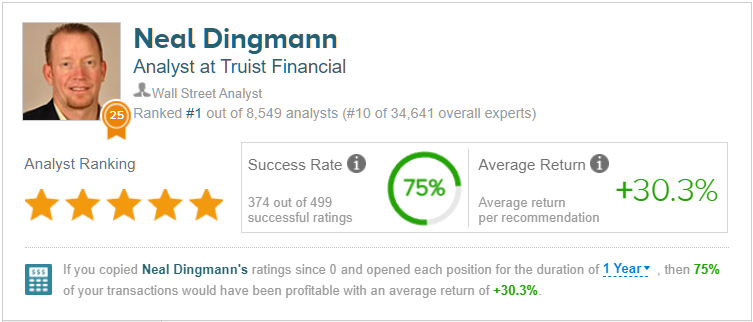

In these conditions, investors want to be sure they’ll find the best stocks to ensure a return, but how to choose? One sure way is to follow the best of the Wall Street analysts. These are the pros, the experts in the field of stock analysis, with reputations built on success, measurable in the results posted by the stocks they recommend. And the best of them is Neal Dingmann, of Truist Securities, who holds the #1 ranking out of more than 8,500 analysts rated by TipRanks.

Dingmann’s high rating is supported by his solid – and prolonged – successes at choosing stocks. The top analyst has made 499 stock calls in the past year, and 75% of those have turned a profit. More importantly, an investor following Dingmann’s advice over that period would have seen a return of nearly 30%. It’s a record that puts Dingmann head and shoulders above his peers.

So, for investors seeking a market win in a tough economic environment, Dingmann may just be the right person to follow. We’ve gotten started on that, pulling up the details on 3 of Dingmann’s recent picks. Here they are, along with the analyst’s comments.

Crescent Energy Company (CRGY)

The first ‘Dingmann pick’ on our list is Crescent Energy, a differentiated oil and gas production firm with a portfolio of assets in the ‘lower 48,’ primarily in Texas. The company produces both oil and natural gas products, and recently closed an accretive expansion of its rich Eagle Ford position, in one of Texas’ most productive energy regions.

Crescent is a well-capitalized firm, with $2.64 billion in market cap and $62 million in cash and other liquid assets as of June 30. The company is successfully carrying $1.4 billion in long-term debt, and was able to fund its Western Eagle Ford acquisition move to the tune of $600 million earlier this year.

Crescent reported its 2Q23 numbers earlier this month, which showed that production averaged 139 Mboe/d during the period, for a modest 1.5% quarter-over-quarter increase. The total top line came to $492.3 million, a 45.8% decline compared to the prior-year period – but more than $19.5 million above the estimates. At the bottom line the GAAP earnings, of 11 cents per share, missed the forecast by a penny.

Despite the drop in revenue and the disappointing GAAP earnings, Crescent generated strong cash flows. The company saw cash from operations reach $183 million in Q2, and realized a free cash flow of $46 million. The company’s cash flows allowed it to maintain its dividend at 12 cents per common share. This payment, last declared on August 9 for a September 6 payout, annualizes to 48 cents and gives a yield of 3.5%.

For Dingmann, this leads to an upbeat outlook. The 5-star analyst is confident that Crescent can continue to generate cash, and writes, “Crescent highlighted continued well productivity and operational efficiencies that have resulted in the company being able to notably decrease upcoming capital spend while still maintaining stable production, resulting in improved FCF. CRGY continues to benefit from its legacy Uinta and Eagle Ford assets along with its recent acquisition of operatorship and incremental working interest in its existing Western Eagle Ford assets. We forecast solid continued FCF and shareholder returns with notable future CO2/CCUS upside from its western CO2 pipeline, storage and other assets.”

Looking forward, Dingmann rates the shares as a Buy, and his $20 price target indicates confidence in a 49% upside for the next 12 months. (To watch Dingmann’s track record, click here)

The Street’s top analyst is bullish, on average, more so than the consensus. Crescent has 4 recent analyst reviews, with a 3 to 1 breakdown favoring Buys over Sells, for a Moderate Buy consensus rating. The shares are trading for $13.4 and their $16.50 average price target points toward a 23% gain in the year ahead. (See CRGY stock forecast)

Earthstone Energy (ESTE)

Next up is Earthstone Energy, one of the mid-sized exploration and production firms operating in the Texas-New Mexico border area. The company, with a market cap of $2.25 billion, focuses on upstream operations in the Midland and Delaware Basins, two of the rich hydrocarbon production formations that put the Texas oil patch back on the world map in the last two decades. The company’s program is based on the acquisition of oil and gas properties featuring both current production and future development opportunities.

Some key points in Earthstone’s strategy include maintaining free cash flow generation, improving operating margins through streamlining efficiencies, and pursuing value-accretive acquisitions and mergers. Expanding acreage positions and drilling inventory, while blocking acreage to allow for longer horizontal drilling, are fundamental to the company’s operating procedures.

The company has been busy on the acquisition front over the past few years with the most recent acquisition being that of Novo Oil & Gas Holdings in the Delaware Basin. The $1 billion purchase (for two-thirds of its assets) closed on August 15 and was funded by a combination of cash and borrowing.

Turning to the company’s recent results, we find that Earthstone beat the forecasts in its 2Q23 report. The company’s revenue came in at $370 million, down 21% y/y but $19.8 million better than had been anticipated. Bottom line earnings, an EPS of 53 cents by non-GAAP measures, also beat the forecast, by 3 cents. Earthstone generated $41.9 million in free cash flow for the quarter, down significantly from the $163.9 million generated in 2Q22.

For top analyst Dingmann, the key here is Earthstone’s acquisition activities. The company has expanded its portfolio recently, and the new assets are adding substantial value. Dingman says of the firm, “Earthstone has completely reshaped the company the past several quarters not only with its materially larger size/scale, but also adding some of the highest return assets in the portfolio that have already seen notable operating efficiencies… ESTE continues to trade at a very low valuation we believe largely due to the private equity overhang.”

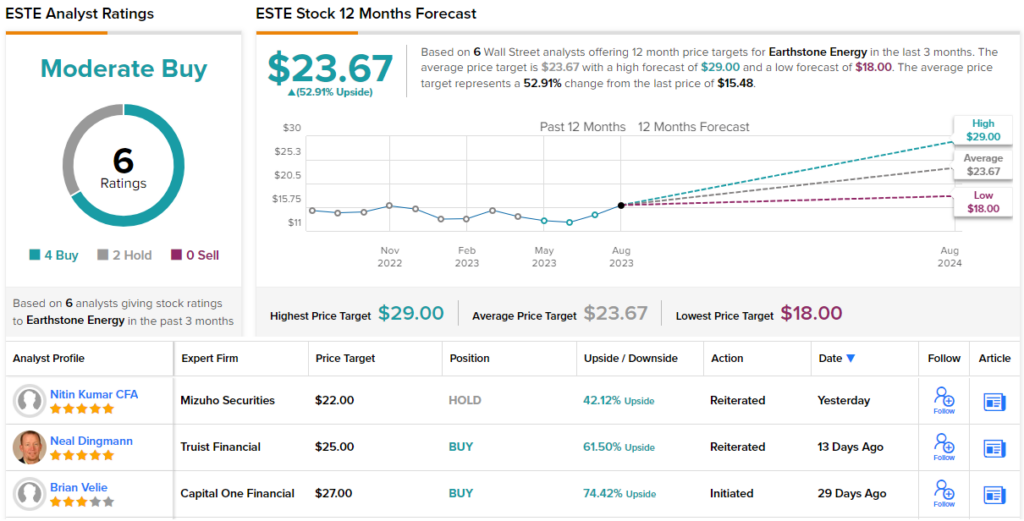

These comments support Dingmann’s Buy rating on Earthstone, while his $25 price target implies a one-year upside potential of 61%.

Once again, we’re look at a stock with a Moderate Buy consensus rating. Earthstone shares have 6 recent analyst reviews, including 4 to Buy and 2 to Hold; the stock’s $23.67 average price target suggests a 53% increase from the current trading price of $15.48. (See Earthstone stock forecast)

Riley Exploration Permian (REPX)

Last on our Dingmann-backed list is Riley Exploration, an independent hydrocarbon exploration and production company working in the Permian Basin of West Texas, the same general region that supports Earthstone above. Riley’s operations are growth-oriented, and focused on the oil and natural gas resources of the region. The company engages in extensive acquisition and development moves in addition to its regular exploration and production activities.

Riley’s operations are focused on several proven productive areas of the larger basin. These include the Northwest Shelf of the Wasson Field complex in Texas, and the Yeso Trend of Eddy County, New Mexico. Over the past century, these areas have produced over 3 billion barrels of oil from a combination of drilling methods; currently, Riley is working from the shallow carbonates of the area, using horizontal drilling and other completion techniques to access difficult-to-reach portions of the reservoir.

These activities brough Riley a total of $99.9 million in 2Q23 revenues, a solid result when compared to the $88.4 million revenue realized in 2Q22 – and beating the Street’s forecast by $9.1 million. Riley’s earnings came to $33 million by GAAP measures, amounting to EPS of $1.65, coming in 13 cents below the estimates.

Operating cash flow for the company’s second quarter was listed as $56 million, of which $3 million was free cash flow. Riley declared a dividend for Q2 of 34 cents per common share, which was paid out on August 3. The annualized dividend payment of $1.36 yields 3.9%.

In a recent notes on Riley, Neal Dingmann points out that the company is able to generate cash flows without spending excess capital. He writes, “Riley is enjoying the fruits of its legacy and external operations by likely continuing to realize solid FCF this quarter and going forward, despite minimal 4Q23 capital spend. The company continues to see the benefits of having a larger, more diverse asset base as the New Mexico field was shut-in in early 3Q23 and a restart remains TBD due to downstream operational disruptions though we forecast minimal impact on 2023 and likely no impact on 2024 production.”

Continuing his comments, Dingmann adds, “We anticipate solid continued operations to be driven by the same notable legacy assets along with more potential accretive deals once leverage goes below 1x likely early next year.”

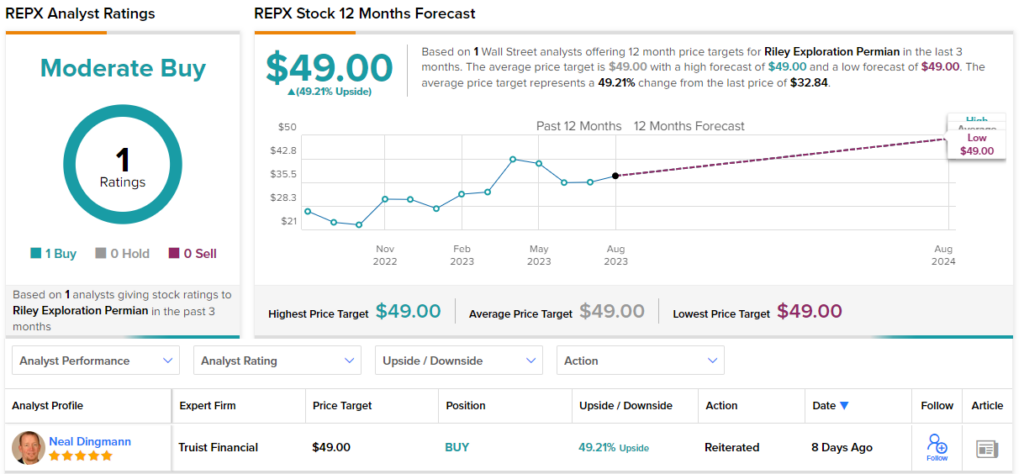

Dingmann’s is the only review currently on file for Riley, whose stock is trading for $32.84. Dingmann’s Buy rating on the shares comes with a $49 price target that suggests a 49% upside on the one-year horizon. (See REPX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.