The Vanguard High Dividend Yield Index ETF (NYSEARCA:VYM) is one of the largest and most popular dividend ETFs in the market today, with $54.4 billion in assets under management (AUM). With a dividend yield of 3.0%, the ETF’s name may sound like a bit of a misnomer, but this is still a sound investment choice for income and generalist investors alike. I’m bullish on this Vanguard ETF based on its above-average yield, solid long-term performance, ample diversification, portfolio of highly rated dividend stocks, and ultra-low fee.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Plus, if the market retreats or investors rotate out of high-risk growth stocks into more stable, defensive dividend stocks, VYM looks like a good place to be.

What Is the VYM ETF’s Strategy?

According to Vanguard, VYM “seeks to track the performance of the FTSE High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields.”

VYM’s Holdings

With 556 holdings, VYM offers investors plenty of diversification. Plus, its top 10 holdings account for a very manageable 23.7% of assets, meaning there is very little concentration risk to worry about here.

Below, you can check out an overview of VYM’s top 10 holdings using TipRanks’ holdings tool.

As you can see, the fund owns plenty of the well known, tried and true dividend stocks like ExxonMobil (NYSE:XOM), Procter & Gamble (NYSE:PG), and Johnson & Johnson (NYSE:JNJ).

But its top holdings also include some holdings that aren’t immediately associated with dividend investing, like Broadcom (NASDAQ:AVGO), which is more often thought of as a growth stock. However, Broadcom is a dividend payer, and its combination of share price appreciation and dividends has led to incredible returns for its shareholders, so it’s a good thing that VYM doesn’t overlook lower-yielding stocks like Broadcom.

The fund is also well-diversified across sectors. Financials have the largest weighting (20.7%), followed by Industrials (12.6%), Health Care (11.7%), Consumer Staples (11.1%), Energy (10.6%), and Technology (10.1%), which all have fairly similar weightings.

Overall, I like VYM’s mix of traditional blue-chip dividend stocks with newer dividend stocks like Broadcom.

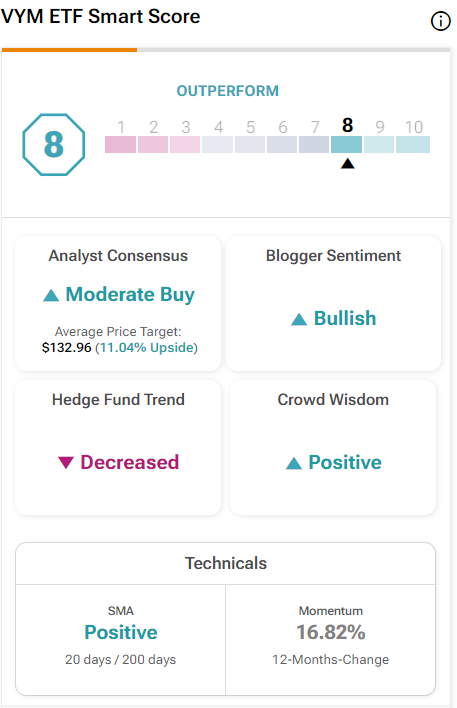

VYM’s top holdings also have a formidable collection of Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

An impressive nine out of VYM’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above. What’s more, Broadcom, ExxonMobil, Johnson & Johnson, Merck (NYSE:MRK), and Walmart (NYSE:WMT) all feature “Perfect 10” Smart Scores, meaning that half of VYM’s top 10 holdings earn this coveted rating.

VYM itself features an Outperform-equivalent ETF Smart Score of 8.

Evaluating VYM’s Performance

VYM has been a solid performer over the years. As of May 31, the fund has achieved an impressive 11.2% annualized return over a five-year period and a respectable 9.6% annualized return over a 10-year period.

It should be noted that these returns have lagged the S&P 500 (SPX). For comparison, the Vanguard S&P 500 ETF (NYSEARCA:VOO) has generated five- and 10-year annualized returns of 15.8% and 12.7%, respectively.

However, these double-digit (and near double-digit) annualized returns are still strong and have allowed VYM’s investors to compound significant gains over the long term. For example, an investor who put $100,000 into VYM 10 years ago would have $244,820 today.

Plus, much of the broader market’s outperformance over the last few years can be attributed to the phenomenal performances of just a handful of large-cap tech stocks (the much-discussed Magnificent 7).

For example, technology stocks have a 30.6% weighting within VOO versus just a 10.1% weighting within VYM. If growth stocks and technology stocks pull back or investors rotate into more defensive sectors, the gap between VYM and the broader market would likely narrow significantly, given the fund’s focus on dividend stocks and its skew towards large-cap value stocks.

Note that VYM’s holdings are also a bit cheaper than the broader market. As of May 31, VYM’s portfolio traded at 18.5 times earnings, while the S&P 500 currently trades at 24 times earnings.

Above-Average Dividend

As the name clearly implies, VYM is a dividend payer, and it currently yields 3.0%. While the yield may sound a bit underwhelming, given the phrase “high yield” in the fund’s name, it’s still double the yield offered by the S&P 500 (SPX). Plus, VYM has a strong track record as a dividend ETF, having paid dividends for 17 consecutive years since its 2006 inception and grown this dividend for the past 13 years.

Ultra-Low Expense Ratio

VYM’s expense ratio is just 0.06%, making the fund a great bargain for investors. This 0.06% expense ratio means that an investor putting $10,000 into the fund will pay just $6 in fees annually, a very reasonable sum.

Investing in low-cost ETFs like VYM really helps protect investors’ nest eggs over time. For example, assuming that the fund returns 5% per year going forward for the next decade and maintains this current expense ratio, the aforementioned investor putting $10,000 into VYM would pay just $77 in fees over 10 years.

Is VYM Stock a Buy, According to Analysts?

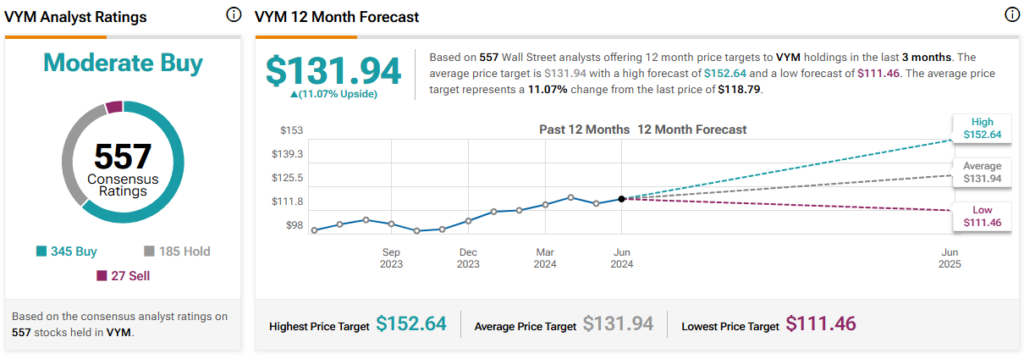

Turning to Wall Street, VYM earns a Moderate Buy consensus rating based on 345 Buys, 185 Holds, and 27 Sell ratings assigned in the past three months. The average VYM stock price target of $131.94 implies 11.1% upside potential from current levels.

Investor Takeaway

I’m bullish on VYM as a solid choice for income investors and generalist investors alike to include as part of their balanced portfolios.

While the fund’s yield isn’t as high as the name would perhaps imply, and while its returns have slightly underperformed the broader market, it has still produced near double-digit annualized returns over the past decade, creating significant wealth for its holders, and its yield is double that of the S&P 500.

I also like that the fund includes strong dividend growth stocks like Broadcom that offer a nice mix of performance and yield as opposed to simply focusing on stocks with the highest yields, regardless of performance. Additionally, VYM’s top holdings are rated highly by TipRanks’ Smart Score system.

Plus, it’s hard to go wrong with VYM’s extremely favorable expense ratio, which keeps more money in the pockets of its investors.

Overall, VYM is a well-rounded ETF that offers a decent yield, solid performance, significant diversification, and low fees, making it a worthy holding for investors. Lastly, if the market, or growth stocks in particular, pull back, VYM and its rock-solid portfolio of dividend stocks look like a good place to be, in my view.