Led by a resurgent tech sector, growth stocks are back in a big way in 2023, and the popular Vanguard Growth ETF (NYSEARCA:VUG) is up 31.7% year-to-date. So, what is VUG, and could it be a fit for your portfolio?

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

What Does the VUG ETF Do?

VUG is the growth ETF from the fund and ETF giant Vanguard, and it’s a popular one, growing to almost $90 billion in assets under management (AUM) since its inception in 2004. In fact, VUG is the 11th-largest ETF in the world by AUM, and if you remove two bond funds from the equation, it comes in at number nine. The ETF seeks to track the results of the CRSP US Large Cap Growth Index.

VUG’s Portfolio

VUG is fairly diversified, with 241 holdings, although note that its top 10 holdings account for over 50% of assets. In fact, the top two holdings, Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT), combine to account for over 25% of the fund. Below, you can get an overview of VUG’s top holdings using TipRanks’ holdings tool.

As a growth ETF, VUG’s top holdings are dominated by the large-cap tech stocks that have propelled the market higher this year, including the aforementioned Apple and Microsoft, plus Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and Tesla (NASDAQ:TSLA).

However, VUG isn’t limited to mega-cap tech. Beyond these names, healthcare giant Eli Lilly (NYSE:LLY) and payment networks Visa (NYSE:V) and Mastercard (NASDAQ:MA) also occupy spots within the top 10. Other notable holdings include more blue chip, large-cap growth stocks like Meta Platforms (NASDAQ:META), Thermo Fisher Scientific (NYSE:TMO), Home Depot (NYSE:HD), Costco (NASDAQ:COST), and McDonald’s (NYSE:MCD).

VUG’s top 10 holdings feature a solid collection of Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A Smart Score of 8 or higher is equivalent to an Outperform rating. As you can see in the table above, six out of VUG’s top 10 holdings feature Smart Scores of 8 or better.

VUG itself features an impressive ETF Smart Score of 8.

Is VUG Stock a Buy, According to Analysts?

Turning to Wall Street, VUG has a Moderate Buy consensus rating, as 66.9% of analyst ratings are Buys, 29.7% are Holds, and 3.4% are Sells. At $298.07, the average VUG stock price target implies 6.9% upside potential.

A Star Performer

VUG is up 31.7% year-to-date, as mentioned earlier, and 24% over the past year, but it has been providing strong returns for its investors for a lot longer than that. Over the past three years, VUG has returned 11.8% on an annualized basis. Over the past five years, VUG has provided even better total returns of 13.2% on an annualized basis.

Zooming all the way out to 10 years, VUG has returned a stellar 13.9% on an annualized basis. Going all the way back to its inception in 2004, VUG’s total annualized return is impressively still in the double digits at 10.2%. Double-digit annualized returns over a long-term time horizon like this are a great way to build long-term wealth.

Furthermore, VUG is one of the rare ETFs that can say it has “beaten the market” over an extended time frame. Let’s use its Vanguard counterpart, the Vanguard S&P 500 ETF (NYSEARCA:VOO), as a stand-in for the broader market and the S&P 500 specifically.

Over a three-year time horizon, VOO’s annualized total return of 12.8% beats VUG’s 11.8%. However, when the time frame is extended to five years, VUG has the edge with a 13.2% return to VOO’s 11% return. Going out 10 years, VUG’s 13.9% annualized return also beats VOO’s 11.9% return.

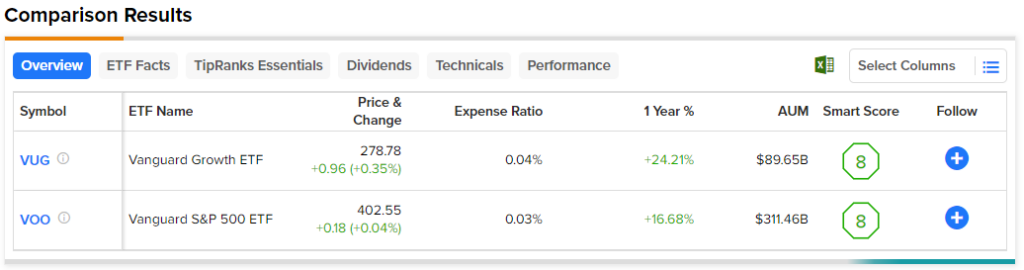

Below, you can check out a comparison of VUG and VOO created using TipRanks’ ETF Comparison Tool, which allows investors to compare up to 20 ETFs at a time across a variety of customizable factors.

VOO’s long-term double-digit annualized returns are stellar, so this sets a high bar for beating the market, but VUG is an ETF that can make this claim.

Minimal Fees

Despite this excellent long-term track record, VUG isn’t charging investors an arm and a leg for this performance. The ETF’s expense ratio of just 0.04% is very investor-friendly. This means that an investor putting $10,000 into VUG would pay just a negligible $4 in fees in year one of investing in the fund. After three years, this same investor would pay just $10 in fees, and after 10 years, their total in fees paid would be just $39.

You can essentially gain exposure to hundreds of the market’s top growth stocks for 10 years for less than the price of a dinner for two at most restaurants nowadays, which is a good deal in my book. Minimal fees like this can help investors to preserve the principal of their investment portfolios and make a big difference over the long term, as high fees can really add up over time.

Investor Takeaway

Note that VUG is also a dividend payer. While its current dividend yield of just 0.6% isn’t much to write home about in and of itself, it all adds up to help add to total returns over time. Furthermore, VUG has a proud history as a dividend payer, having made dividend payments to its holders for 18 years in a row going back to its inception in 2004.

With a very attractive expense ratio, a strong portfolio, and an excellent long-term track record, VUG is the type of ETF that investors can feel confident about making a cornerstone of their portfolios for the long term. Since VUG is up considerably this year, it’s likely that there will be pullbacks at some point. Still, this ETF has proven itself as a long-term winner, so investors can consider utilizing these pullbacks to dollar-cost average into a position over time to lower their cost basis.