Whether it’s Coca-Cola (NYSE:KO), Hershey (NYSE:HSY), Colgate-Palmolive (NYSE:CL), or Philip Morris (NYSE:PM), consumer staples stocks are reporting strong earnings, and they look like steady, reliable performers for the long haul during a time of market volatility.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Vanguard Consumer Staples ETF (NYSEARCA:VDC) is a major consumer staples ETF that allows investors to gain diversified exposure to a broad range of these steady-eddy blue-chip stocks.

I’m bullish on VDC based on the reliable revenue and earnings of its holdings, the persistent demand for the products these holdings sell, and the ETF’s strong performance amid a volatile market. I’m also bullish on VDC based on its low fee, long dividend history, and the strong Smart Scores its top holdings boast.

What Is the VDC ETF’s Strategy?

VDC was launched by index fund pioneer Vanguard more than 20 years ago, in January 2004. In that time, the fund has grown to $6.5 billion in assets under management (AUM). According to Vanguard, VDC “seeks to track the performance of a benchmark index that measures the investment return of stocks in the consumer staples sector.”

VDC’s underlying index “includes stocks of companies that provide direct-to-consumer products that, based on consumer spending habits, are considered nondiscretionary.”

We’ll get into what types of stocks this encompasses in the section below.

VDC’s Top Holdings are Holding Up

VDC owns 105 stocks, and its top 10 holdings account for 60.7% of the fund. Below, you’ll find an overview of VDC’s top 10 holdings from TipRanks’ holdings tool.

As you can see, VDC owns a group of high-profile, blue-chip U.S. consumer staples stocks.

The fund owns the makers of everyday household staples like detergents, deodorants, soaps, shampoos, and more, like Procter & Gamble (NYSE:PG) and Colgate-Palmolive. These companies may not sound like the most exciting in the world, but they sell products that people need every day and are loath to cut from their budgets. This puts them in a strong position no matter how the economic tides ebb and flow from one day to the next.

Colgate recently shook off inflation and economic uncertainty to report strong 9.8% organic sales growth for the first quarter and increased pricing of 8.5%, encapsulating the strength these consumer staples stalwarts have in this environment. Colgate also used the strong start to the year as an opportunity to increase revenue guidance for the year.

Meanwhile, VDC has positions in soft drink giants like Coca-Cola and Pepsi (NASDAQ:PEP), which sell the sodas and other drinks that many people consume on a daily basis, regardless of how the macro economy is doing or where interest rates stand.

Like Colgate, Coca-Cola recently reported earnings and overcame any macroeconomic challenges, beating on both revenue and earnings. Coca-Cola says that it expects to grow organic revenue by an impressive 8-9% this year, along with comparable currency-neutral EPS growth of 11% to 13%.

Tobacco stocks like Philip Morris and Altria (NYSE:MO) are in a similarly strong position, as tobacco users buy their products on a routine, habitual basis and are unlikely to eschew this habit just because the economy is slow. Inflation and the uncertain economy aren’t hurting demand for Philip Morris’ red-hot nicotine pouch product Zyn, which saw shipment volume increase by an incredible 79.7% year-over-year during its first quarter of the year.

Big box retailers like Costco (NASDAQ:COST) and Walmart (NYSE:WMT) are competitive in any type of economic environment, thanks to their low-cost offerings.

Lastly, Mondelez (NASDAQ:MDLZ), the maker of popular snacks like Oreos and Chips Ahoy! is the type of company many consumers will buy products from as an affordable pick-me-up when they may not be able to afford other luxuries in a down economy.

Other notable VDC holdings from beyond the top 10 include Hershey, Keurig Dr Pepper (NYSE:KDP), Monster Beverage (NASDAQ:MNST), and Celsius Holdings (NASDAQ:CELH). Hershey just reported impressive first-quarter earnings in which it brushed off rising cocoa prices to beat estimates. Its earnings grew 3.7% year-over-year, and revenue increased 8.7%.

As these results show, top consumer staples stocks like these have strong brands and persistent demand to succeed during a challenging macroeconomic environment.

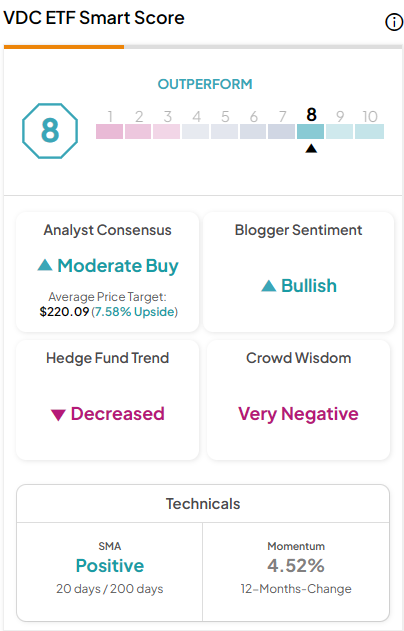

In addition to these resilient business models and strong demand, another thing that VDC’s top holdings have in common is their strong Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Eight out of VDC’s top 10 holdings have Outperform-equivalent Smart Scores of 8 or above, and VDC itself has an Outperform-equivalent ETF Smart Score of 8 out of 10.

Long Dividend History

Whether it’s Pepsi and Coca-Cola or Altria and Philip Morris, many of VDC’s top holdings are lauded for their long dividend histories, so it’s no surprise that VDC is a dividend payer.

VDC currently yields 2.5%. While it’s not a huge dividend yield, it trumps that of the S&P 500 (SPX), which yields 1.4%. Plus, VDC has a reliable track record as a dividend payer, having made dividend payments to its holders for 18 years in a row.

Affordable Expense Ratio

Like many of its Vanguard peers, it features a modest expense ratio of just 0.10% (a 0.09% management fee plus 0.01% in other expenses). This means that an investor in the fund will pay just $10 in fees on an investment of $10,000 annually.

Over time, investing in low-cost funds like this can save investors a considerable amount of money. Assuming the fund returns 5% per year going forward and maintains its current expense ratio, the investor putting $10,000 into the fund will pay just $128 in fees over a 10-year time frame.

How does this help investors to save? Let’s compare VDC to another consumer staples ETF with a higher expense ratio, the iShares U.S. Consumer Staples ETF (NYSEARCA:IYK), which has $1.3 billion in AUM and charges an expense ratio of 0.40%. An investor putting $10,000 into IYK will pay $40 in fees annually, and assuming the same parameters as above, this investor will pay a much higher $505 in fees over a 10-year time horizon, illustrating the considerable savings offered by a low-cost fund like VDC.

Below, you can check out a comparison of VDC and IYK using TipRanks’ ETF Comparison Tool, which allows users to compare up to 20 ETFs at a time based on a variety of inputs.

Is VDC Stock a Buy, According to Analysts?

Turning to Wall Street, VDC earns a Moderate Buy consensus rating based on 56 Buys, 43 Holds, and six Sell ratings assigned in the past three months. The average VDC stock price target of $220.16 implies 8.8% upside potential.

The Takeaway: A Sound Choice

I’m bullish on consumer staples and VDC in particular. The economy goes through ups and downs, and the stock market ebbs and flows, but consumers always need the basics that consumer staples companies sell, whether it’s their favorite soft drink from Coca-Cola or Pepsi or toothpaste from Colgate-Palmolive. It may not be the sexiest sector, but these companies have strong and consistent earnings and revenue.

Throughout earnings season, we’ve seen companies like Coca-Cola, Hershey, Philip Morris, Colgate-Palmolive, and other consumer staples names prove this.

I’m also bullish on VDC, specifically because of its holdings’ strong Smart Scores, low expense ratio, and attractive dividend.