Sometimes in life, you need to go big or go home. The Vanguard Mega Cap Growth ETF (NYSEARCA:MGK) brings this winner-take-all attitude to the market by investing in the market’s largest growth stocks. This strategy is simple yet effective. Why is investing in mega-cap stocks a winning strategy? Stocks that are winners often keep winning, and you don’t grow to a market cap in the hundreds of billions of dollars without being an exceptionally strong company for a long period of time.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What is the MGK ETF’s Strategy?

MGK is a passively-managed ETF that “seeks to track the performance of the CRSP US Mega Cap Growth Index,” according to Vanguard. Its goal is to provide “a convenient way to get diversified exposure to the largest growth stocks in the U.S. market.” The ETF launched in 2007 and has grown to $13.7 billion in assets under management (AUM).

Monster Gains

While the strategy of investing in the U.S.’s largest growth stocks may sound like a simple one, investing doesn’t need to be complicated, and MGK has generated monster returns for its holders over the years. The mega-cap ETF has returned 18.6% over the past year. As of the end of July, over the past three years, MGK generated an admirable annualized total return of 12.0%.

Zooming further out, its five-year annualized total return stands at a fantastic 15.6%, and its 10-year annualized total return came out to an equally impressive 15.5%. Since the fund’s inception in 2007, it has delivered annualized total returns of 12.1%.

On a cumulative basis, this means that MGK holders have enjoyed blockbuster total returns of 106.1% and 323.3% over the past five and 10 years, respectively.

These results surpass the solid returns that the broader market has posted over the same time frames. For example, the Vanguard S&P 500 ETF (NYSEARCA:VOO), which simply invests in the S&P 500 (SPX), has returned 12.9% over the past year. Its three-year annualized total return of 13.7% beats MGK, but its five- and 10-year annualized returns of 12.2% and 12.6%, respectively, while excellent, can’t compete with MGK’s superior returns over the same time frame.

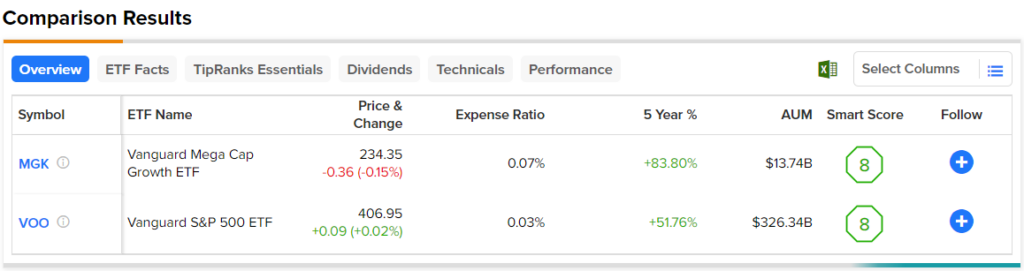

Below, you can check out a comparison of MGK and VOO using TipRanks’ ETF Comparison Tool, which enables users to compare up to 20 ETFs at a time across a variety of factors.

Big-Time Holdings

Given its mega-cap focus, it’s unsurprising that MGK’s holdings are comprised of household names that everyday investors are familiar with. The ETF has 98 holdings, and its top 10 make up 60.9% of the fund. You can check out the chart below for an overview of MGK’s top 10 holdings.

As you might guess (because it’s the world’s most valuable company by market cap) Apple (NASDAQ:AAPL) is the fund’s largest holding, with a weighting of 15.9%, followed by Microsoft (NASDAQ:MSFT), which weighs in at 13.5%. Other top 10 holdings include the tech behemoths Amazon (NASDAQ:AMZN), both classes of Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) stock, Nvidia (NASDAQ:NVDA), Tesla (NASDAQ:TSLA), and Meta Platforms (NASDAQ:META) that comprise the market’s so-called “magnificent seven.”

While these tech mega-caps reign supreme at the top of MGK (the technology sector accounts for 56.3% of the fund’s holdings, according to Vanguard), the fund has plenty more to offer beyond big tech. Pharmaceutical giant Eli Lilly (NYSE:LLY) and global payment network Visa (NYSE:V) occupy the final two spots of the top 10.

Just outside the top 10, you’ll find other blue chip, large-cap names representing a wide variety of industries, such as Home Depot (NYSE:HD), McDonald’s (NYSE:MCD), Costco (NASDAQ:COST), Mastercard (NYSE:MA), and Thermo Fisher Scientific (NYSE:TMO).

These are some of the market’s largest stocks, and they also enjoy strong Smart Scores across the board. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors.

A score of 8 or above is equivalent to an Outperform rating. Seven of MGK’s top 10 holdings, and all five of its five largest positions, have Outperform-equivalent Smart Scores of 8 or above, further indicating that this is a strong collection of holdings.

MGK itself features an Outperform-equivalent ETF Smart Score of 8.

What is the Price Target for MGK?

Turning to Wall Street, MGK earns a Moderate Buy consensus rating based on 87 Buys, 10 Holds, and one Sell rating assigned in the past three months. The average MGK stock price target of $275.53 implies 14.2% upside potential.

Reasonable Expense Ratio

Thankfully for investors, one area where MGK doesn’t go big is when it comes to expenses. Vanguard pioneered the idea of low-cost index investing through mutual funds and later expanded this philosophy into the world of ETFs. As such, MGK has a reasonable expense ratio of just 0.07%.

This means that an investor who puts $10,000 into MGK today will pay just $7 in fees during their first year of investing. Assuming the expense ratio remains at 0.07% and the fund gains 5% per year going forward, over the course of a decade, this same investor would pay just $90 in fees. By investing in low-cost ETFs like this, investors can preserve more of their principal over time and avoid having large chunks of their gains eaten up by fees and expenses.

Does the MGK ETF Pay a Dividend?

With a dividend yield of just 0.5%, dividends are another area where MGK doesn’t go big, but in reality, income is not one of the fund’s primary objectives. On the plus side, MGK offers good longevity in this department, with 14 consecutive years of dividend payments under its belt.

The Takeaway

The market’s largest stocks by market value didn’t get to where they are by being slouches — they are winners for a reason. That’s why it’s probably not a bad idea to invest in these long-term winners, and MGK offers investors a simple, low-cost, and convenient way to gain exposure to all of them in one vehicle. The ETF’s stellar returns over the long term are a testament to the effectiveness of its investment strategy, meaning that MGK continues to be an attractive long-term investment opportunity.