The American consumer’s financial situation isn’t at its best. According to the U.S. Federal Reserve’s latest data, Americans now owe a record $1.14 trillion in credit card debt as of the second quarter, a $27 billion increase from the start of the year. With this in mind, I’m using the TipRanks Stock Comparison Tool to evaluate which major credit card stock might outperform. I currently hold a Buy position on Visa (V) and American Express (AXP), and a Hold rating on Mastercard (MA). If I had to choose one credit card stock, it would be American Express.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Visa (V)

My bullish view of Visa is based on its leading market share in transaction volumes, particularly in credit and debit transactions. Beyond that, Visa’s business model is built on stable, largely recurring revenue, and supported by a global network of cardholders and merchants.

However, rising consumer debt does not directly benefit Visa, as the company earns most of its revenue from transaction fees and does not assume credit risk. Visa’s performance depends more on its overall transaction volume rather than consumer debt levels.

Regardless, Visa remains an excellent long-term defensive investment. Over the past five years, the company has grown revenues at a compound annual growth rate (CAGR) of 9.4%, while diluted earnings per share (EPS) has grown by 18.6% during the last 12 months. Analysts expect Visa to report annual revenue growth of 9.6% this year, which is in line with its historic performance, and EPS is projected to increase by 13.1%.

Is Visa a Buy?

I consider Visa a Buy despite its Q3 results falling slightly short of forecasts, with revenues of $8.9 billion versus $8.92 billion expected. The stock dipped to multi-year lows but quickly rebounded to highs after the Fed signaled that interest rate cuts are coming, which could boost consumer spending and benefit Visa’s stock.

While I’m optimistic about Visa, it’s important to note that the stock isn’t cheap. It’s not overly expensive either. V stock currently trades at a forward P/E ratio of 29.3 times, which is above the industry average, but still around 6% below its five-year average.

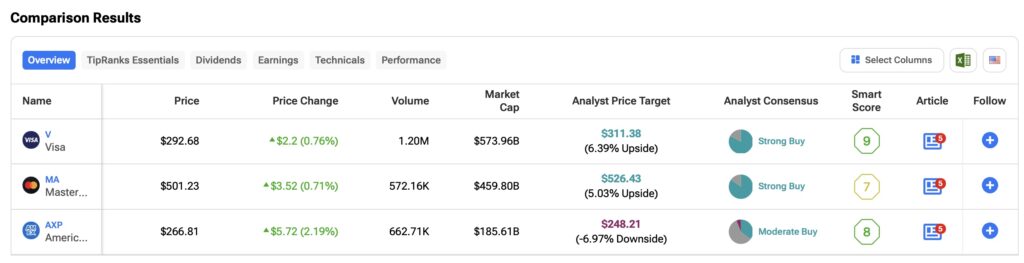

Looking at Wall Street consensus, 17 out of 21 analysts rate Visa a Strong Buy, with an average price target of $315.42 implying potential upside of 7.93%.

Mastercard (M)

I hold a neutral position on Mastercard. While the company dominates the global payments network, excluding China, its stock trades at a premium valuation despite minimal differences in its business model compared to Visa.

Mastercard currently trades at a forward P/E ratio of 34.7 times, which is nearly triple the industry average but approximately 7% below its own average over the past five years. This premium is partly justified by MA stock’s strong topline growth compared to Visa, with a 10.9% CAGR in revenue over the last five years and a 22.6% increase in EPS in the past 12 months.

Like Visa, Mastercard is unlikely to benefit from high consumer debt levels as its revenue mainly comes from transaction fees. Even so, analysts project Mastercard’s EPS to rise by 16.8% this year, with topline growth expected at 11.3%.

Is Mastercard a Buy, Sell, or Hold?

Although I currently rate Mastercard a Hold due to its valuation, the company delivered strong results in Q2 2024. It exceeded both top and bottom line expectations, with revenues of $6.96 billion compared to the $6.85 billion forecast, reflecting an 11% year-over-year increase.

As recent results were slightly better than Visa’s, Mastercard’s stock has been trading inline with V stock. Both stocks should benefit from a lower interest rates moving forward. Additionally, the Wall Street consensus for Mastercard is overwhelmingly positive, with 22 out of 26 analysts recommending a Buy, resulting in a Strong Buy consensus rating. The average price target of $526.43 suggests potential upside of 5.30% from the current share price.

American Express (AXP)

I am most bullish on American Express. Given the increase in consumer debt, Amex, as the company is commonly known, is likely to outperform both Visa and Mastercard. This is because American Express serves as both a credit card issuer and a payments network, directly benefiting from rising interest income on outstanding balances. As a result, Amex has been outperforming its credit card rivals this year.

Although Amex’s revenue CAGR over the last five years of 8.6% is lower than Visa’s and Mastercard’s, it has been more profitable, with diluted EPS growing by 36.2% over the last 12 months—almost double the growth rate of Visa.

Moreover, Amex trades at the lowest valuation among the three, with a forward P/E ratio of 19.7 times. Despite this discount, the stock has appreciated nearly 40% in 2024, currently trading 7.5% above its average over the past five years.

Is AXP Stock a Buy?

I see American Express as a Buy because its business model is well-positioned to benefit from increased consumer debt and the stock has a more attractive valuation. Although Amex’s second-quarter results were solid, there were minor concerns about high-end consumer spending and a slight miss on topline estimates.

Nevertheless, the market responded positively, given that credit quality remained stable, which is significant since about 23% of Amex’s revenue is tied to credit quality. The company’s bottom line should continue to grow robustly.

Wall Street’s consensus view on AXP stock is less optimistic than either V or MA. Of 17 analysts, only six are bullish, and one is bearish, resulting in a Moderate Buy consensus rating. The average price target is $248.21, indicating potential downside of 5.47%.

Conclusion:

In the current environment, where consumer debt is surging, American Express is positioned to outperform Visa and Mastercard. This is because Amex’s revenues are closely tied to interest and fees. In contrast, Visa and Mastercard derive a larger portion of their revenues from transaction volumes. While all three companies have promising futures, I believe American Express and Visa warrant a Buy rating due to their growth potential and valuations. Conversely, Mastercard deserves a Hold rating.