Brand Excellence from Impactful Products

V. F. Corporation (VFC) is the quintessential American retail business. Founded in 1889, it is one of the world’s largest apparel, footwear, and accessories retailers. I am very bullish on this stock and have been for a long time.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Its shoes and clothes are casual but never frumpy, lively but not overheated, practical but stylish (to borrow an expression from Harvey Steiman).

Management is aware of its brands’ status as “cultural touchstones,” enticing generations of consumers to VFC’s former and current (*) iconic brand names: Reading Gloves and Mittens, Vanity Fair Silks, Lee and Wrangler Jeans, *JanSport, Red Kap, *Eastpak, *Icebreaker, Nautica, *Kipling, *Napapijri, Eagle Creek, Splendid, Ella Moss, *The North Face, *Vans, *Timberland, *Smartwool, *Altra, *Supreme, *Dickies. The company vision is, “Lifestyles. Not labels.”

Moreover, other companies talk about “Sustainability.” Showing its ability to be more forward-thinking, VFC produced a “Modern Slavery Statement.” The statement’s guidelines also apply to suppliers and distributors.

See V.F. Corporation’s Website Traffic Signal on TipRanks >>

Walking into Profits

With a market cap climbing close to $28B, VFC stock experienced steady but choppy growth. Shares are up 30.2% over the past five years but are down ~4% over the past 12 months. In October ’21, shares bottomed to $65.34. The stock topped $90 on May 4th. The short interest today is 2.75%. (See VFC stock charts on TipRanks)

The dividend cash amount payment has been reliable but fluctuating. Between the close of 2016 and September 2021, the cash amount paid paced to-and-fro between $0.42 to a high in ’18 of $0.51. $0.49 was the last payout. The yield is 2.65%.

Currently, VFC holds a Smart Score of eight. Seemingly, it deserves the TipRanks Outperform rating. Additionally, Investor sentiment is very positive. ROE is 26.99% for the trailing 12 months.

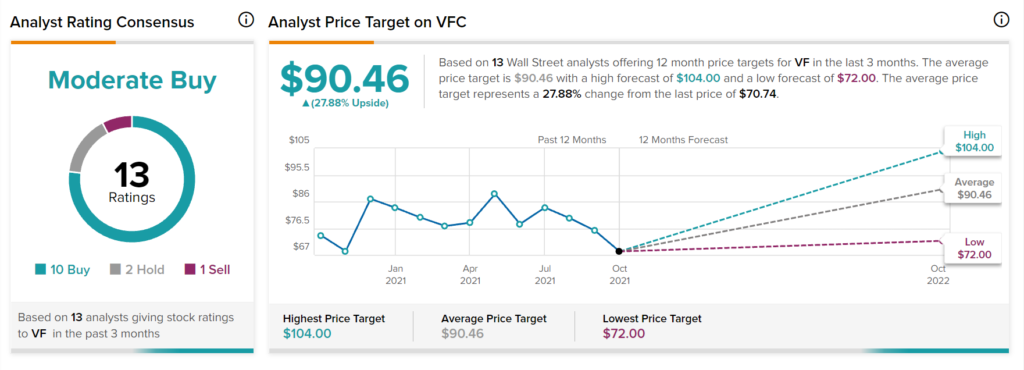

The average VFC price target is $90.46 per share, implying 27.9% upside. Ten analysts are bullish, two are neutral, and one is bearish. The high price forecast is $104, while the low is $72. After releasing current financials, the price dropped to near $68 per share. The stock gets a TipRanks Moderate Buy recommendation at the present time.

I believe the stock is at a value of around $70. Insiders began accumulating shares in the last three months, when the shares dipped to about $66, following the Q4 estimated earnings miss; however, adjusted earnings of $0.27 per share were actually 169% higher than the prior-year quarter. Revenue was also reported up by 23%, though down for FY’21 by 12%.

Risks VFC and the Industry Face

Nonetheless, VFC faces risks. For one, there are rumblings that future VFC sales will suffer the baleful consequences of labor shortages, factory shutdowns in China, Malaysia, and Vietnam, material shortages, and port congestion. Higher freight costs will soften sales or slice away at future earnings for the entire shoe and clothing industry.

Last April, industry analysts sounded alarms about shortages of the natural rubber Vans uses to make vulcanized rubber shoes. That’s due to flooding and leaf disease ravaged rubber trees last year. Tire producers and others are hoarding supplies, driving up prices. If it’s not one thing, it’s another, in these turbulent times.

Additionally, inflation may erode dollar value but after COVID-19, consumers are spending: Deloitte estimates spending will grow 8.1% in ’21. In fact, product shortages are partially attributable to consumer purchasing madness. In August ’21, spending on shoes and clothes was 3.4% higher than in 2019, before COVID.

Exceeding Expectations

Outdoor wear has been particularly strong for VFC over the past year. For example, the North Face logo is everywhere. Additionally, on October 11, ’21, sales of Van’s slip-on white shoes are reported to have grown 7.800% following their feature on the Squid Game. Online searches popped 97%.

The positives translated into strong Q2 financials, as reported on October 22, ’21. Revenue jumped 23% to $3.2 billion. Vans brand revenue was up 8% for the quarter, and the Outdoor lines increased 31%. Additionally, the work segment +18% includes a 21% pop for Dickies. In overseas sales, revenue from European operations was +19% and in China revenue was +9%. Lastly, digital revenue +24% and without factoring revenue from acquisitions, digital revenue was +54% quarter-over-quarter. EPS from operations increased 66% to $1.11.

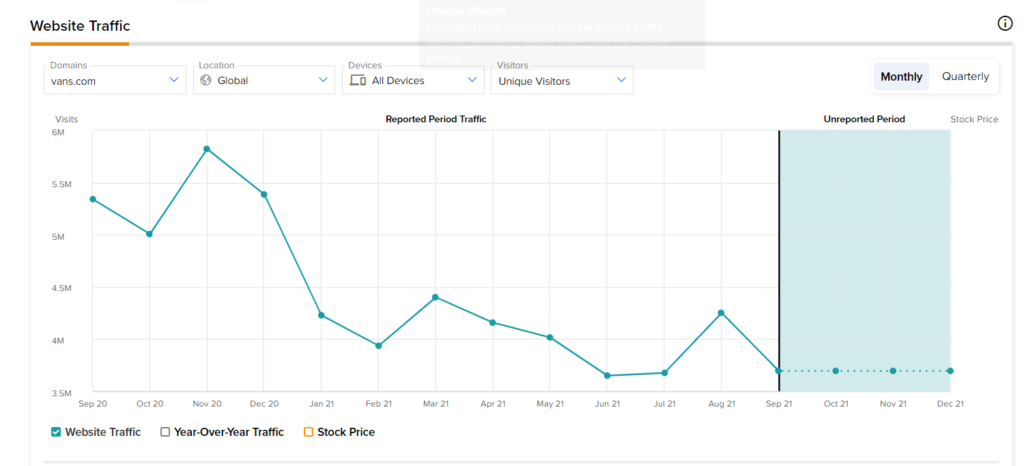

The company forecasts FY 2022 revenue will be ~$12 billion, which will be 30% growth. According to TipRanks’ Website Traffic Tool, when looking at one of the brand’s websites, Vans.com, total unique visitors on all devices are down 21.20% from the same period last year. This figure can help predict the current quarter’s earnings.

It must be frustrating for management and shareholders to see that despite financials showing the strength of the brands and administration that makes me smile, the stock has fallen, because the numbers do not meet the expectations of armchair analysts. Even the gross margin increased 290 basis points to 53.7% during the stressful times of COVID variants appearing on the scene.

Investors might want to consider any drop in share price below $70 as a stock buying opportunity.

Disclosure: At the time of publication, Harold Goldmeier did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.