I’ve been pounding the table on Meta Platforms (META) for years, writing several articles about why it’s a screaming buy. Following the stock’s steep sell-off last month as tariff-driven fears overwhelmed the market, I took advantage of the situation and continued adding to my long META position.

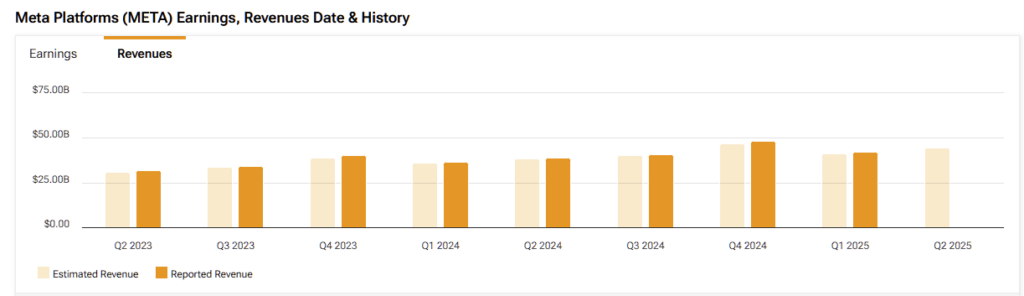

Buying the dip was a great idea, as the social media giant’s Q1 earnings blew the doors off expectations last week, forcing analysts to scramble and reprice the stock. Yet, the core story hasn’t changed: Meta’s growth is relentless, and its shares are ultra cheap compared to recent quarters.

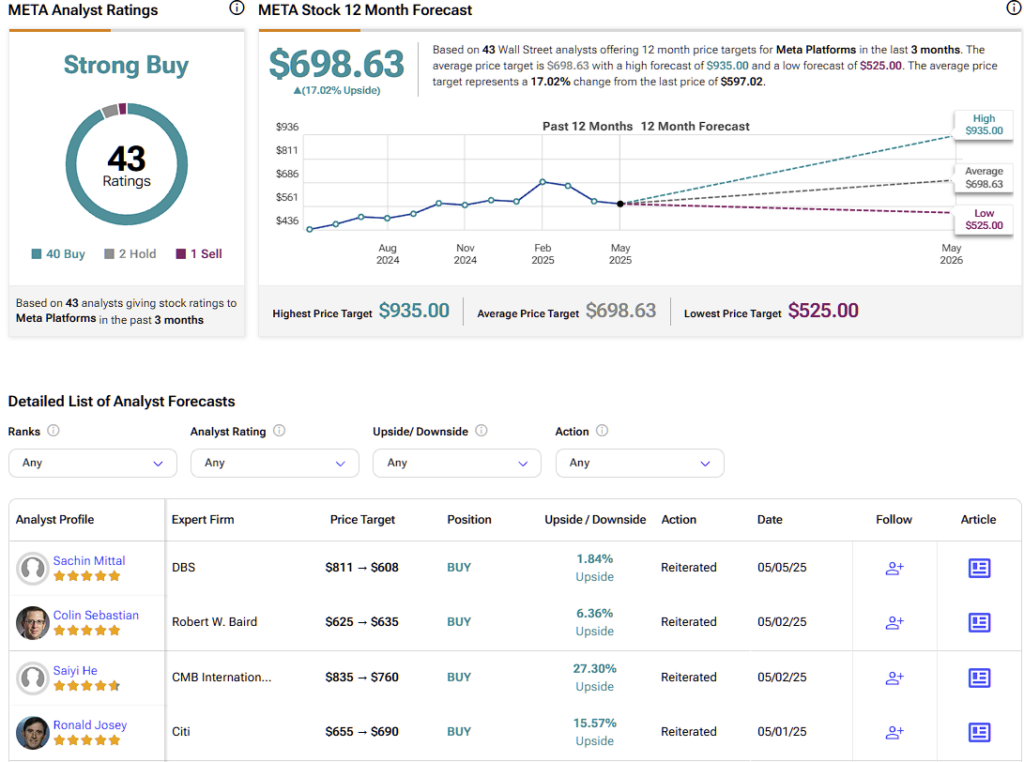

Earlier today, DBS analyst Sachin Mittal maintained his bullish stance on META reiterating a Buy rating with a lowered price target of $608 per share. In a research note, Mittal said that Meta Platforms’ strong financial performance and strategic initiatives are the reasons for sustained upside, with AI being the single largest driver of current revenues and future expectations. Importantly, Mittal pointed that “successful monetization efforts, particularly with its Reels feature, which has seen a substantial increase in user engagement and monetization.”

Sustained Excellence Fuels Revenue Surge

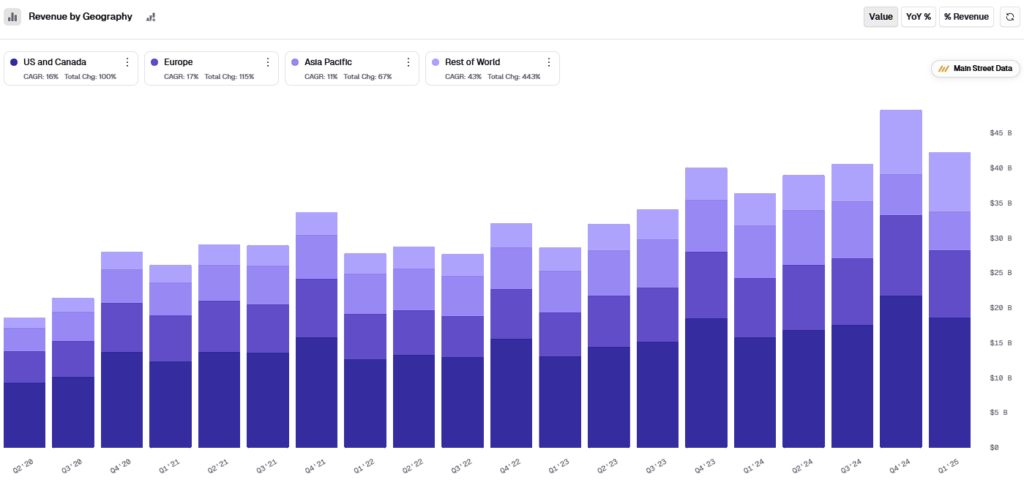

Meta’s Q1 was a masterclass in execution, with revenue surpassing $42.3 billion, up 16% year-over-year, smashing estimates by nearly $1 billion. The company’s Family Daily Active People (DAP) climbed to 3.43 billion, a 6% jump, reflecting sticky user engagement across Facebook, Instagram, and WhatsApp. This, paired with AI-driven content recommendations, boosted ad impressions by 5%, while average ad prices rose 10%.

Management credited AI tools like the Advantage+ suite for sharpening ad targeting, supporting higher returns for advertisers, and fueling engagement. For context, Instagram Reels alone saw 20% year-over-year growth. Meta AI, now with nearly 1 billion monthly active users, is weaving personalized experiences that keep users hooked, directly lifting these metrics.

It would seem Meta’s heavy investment in AI infrastructure and models like Llama is the company’s “secret sauce”, since they optimize everything from content curation to ad delivery. CFO Susan Li noted on the earnings call that these tools are “unlocking new levels of efficiency and engagement,” particularly in short-form video and messaging. So the game has shifted from just growing the user base to employing more intelligent systems, making every interaction more valuable, and, in turn, pushing revenue to new heights.

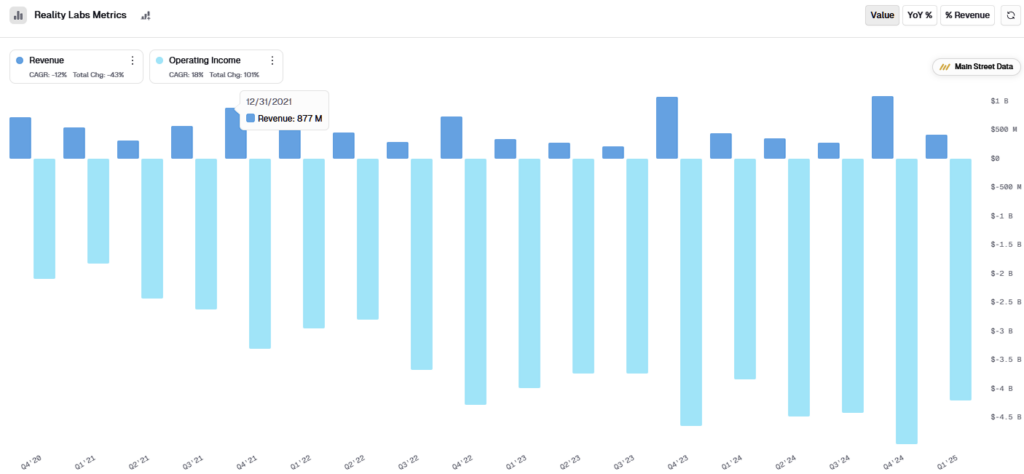

Profitability Soars Despite Reality Labs Drag

In the meantime, Meta’s profitability is firing on all cylinders, even as Reality Labs bleeds cash. The company’s operating margin expanded to 41%, up from 38% last year, driven by economies of scale and ruthless cost discipline. Management highlighted reduced legal expenses and streamlined operations in the Family of Apps segment as key factors. Despite Reality Labs posting a $4.21 billion operating loss, the core ad business’s strength, with $21.77 billion in operating income, more than offset it, showcasing Meta’s ability to fund moonshots while staying profitable.

The revenue surge and margin expansion combined translated into a 35% surge in net income to $16.64 billion and a 37% jump in EPS to $6.43, trouncing Wall Street’s $5.25 forecast. This trend should only pick up from here, as AI-driven ad delivery and workforce optimizations have proven notable margin boosters. It’s genuinely perplexing that Wall Street has yet to receive the signal.

Surging Profits Highlight a Bargain Basement Valuation

Where Meta’s investment case gets particularly intriguing is that for FY2025, Wall Street’s EPS estimate of $25.47, which implies just 6.7% growth, is laughably low. In Q1 alone, the company posted a 37% EPS surge, mocking consensus estimates. In the meantime, there are no signs of a slowdown, with management’s outlook oozing confidence, as they see Q2 revenue of $42.5-$45.5 billion and AI tailwinds accelerating ad growth. Conservatively, I peg 2025 EPS at $29-$30, supported by sustained ad momentum and margin expansion.

In any case, even when we employ Wall Street’s depressed $25.47 estimate for the year, the stock trades at just 23x forward earnings, which is clearly a bargain for a company that’s grown EPS at a 35%+ CAGR over the past decade, and as we saw in Q1, it continues to do so at the same pace.

So it’s fair to say that, even if our EPS estimate was as depressed as Wall Street’s, the stock’s valuation is absurdly low given Meta’s AI-fueled trajectory. Supercharged by tools like Advantage+ (now a $20 billion run-rate juggernaut), its ad business is flourishing above and beyond its peers. As analysts wake up to Meta’s pole position in the AI race (i.e., smarter ads, stickier platforms, and brand new monetization streams), a valuation expansion toward a P/E in the low 30s isn’t a stretch. That could easily drive 30-40% upside from here, so I still view Meta as a screaming buy.

Is META a Good Stock to Buy Now?

Despite their rather conservative estimates, analysts remain pretty bullish on the stock. Over the past three months, Meta Platforms has gathered 40 Buy, two Hold, and just one Sell rating, forming a Strong Buy consensus on Wall Street. Today, META stock has an average price target of $698.63 per share, implying a 17% upside potential from current price levels.

The Metaverse Keeps Scaling Up

Meta Platforms is firing on all fronts, with its first quarter proving its growth engine is long-lasting and can adapt to changing market conditions. The stock’s 23x forward earnings is a gift for a company scaling profits at this pace, particularly with AI turbocharging its ad machine. As Wall Street catches up to Meta’s AI-driven dominance, a valuation rerating could send shares soaring. Thus, this appears to be a rare chance for investors to own a tech titan at a discount.