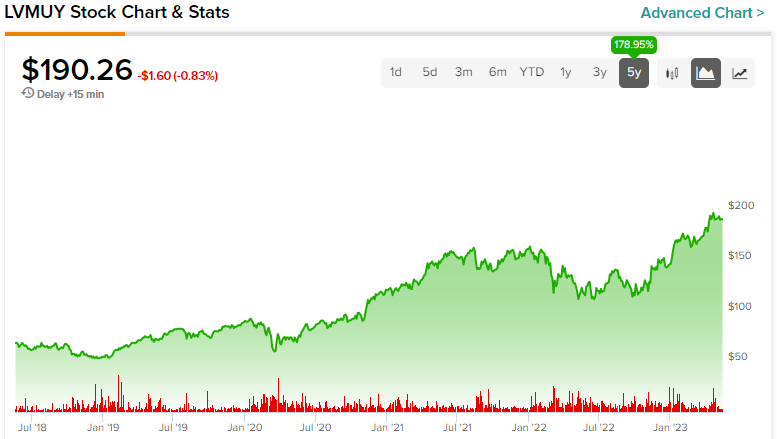

Fashionistas around the world love to sport Louis Vuitton! Is it the same with investors, too, when considering LVMH Moet Hennessy Louis Vuitton (GB:0HAU) (OTC:LVMUY) stock? One look at the stock’s chart, and you will be taken aback by the upward-sloping curve LVMH has almost always been on. Over the past five years, the U.S. listing of LVMH has returned nearly 179% to its shareholders. Year-to-date, the stock has already run up over 30%. So the answer is yes, LVMH is indeed a stock that looks immune to recessions/downturns. I am bullish on LVMH.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Being the proud owner of 75 luxury brands across five business segments, Louis Vuitton recently showed the world that the premium luxury space remains unfazed by any macro concerns. Three weeks ago, the stock achieved a milestone after becoming the first European company to reach a $500 billion market cap. Now, let’s take a look at the stock’s results and factors deciding its future course.

LVMH Delivered Blowout Q1 Earnings

Last month, LVMH reported upbeat Q1 numbers with an outstanding performance across all business segments despite a cloudy macroeconomic outlook and inflationary pressures. The outperformance was driven by a recovery in sales in the Asian region aided by the easing of lockdowns in China. It’s no wonder then that LVMH stock received upward price target revisions from several Wall Street analysts.

The owner of brands like Louis Vuitton, Dior, Moet, Hennessy, Bulgari, and U.S. jeweler Tiffany, reported robust organic sales growth of 17%. That was aided by growth across all regions except the U.S., where it was light at 8%. Specifically, Asia saw 14% growth during the quarter compared to a decline of 8% reported in the prior quarter. China continues to remain one of the most important regions, with high growth expectations.

Resilient Demand for Luxury Unabated by Recession

So, investors must be wondering if the current quarterly number is just a one-off surprise aided by a fierce return of Chinese consumers or if this going to be consistent in the forthcoming results. The answer is that it’s not just LVMH. There has been an upsurge in demand in the overall luxury segment.

Peers like Hermès International (GB:0HV2) (OTC:HESAF), best known for its coveted Birkin handbag, also reported strong double-digit sales growth. Further, even German luxury performance automaker Porsche reported upbeat Q1 results, with strong sales growth of 25.5%

Clearly unaffected by the economic challenges, the aficionados of luxury goods continue to indulge! As a result, luxury goods companies continue to see higher-than-expected growth in sales and profits.

It is not surprising that LVMH’s CEO, Bernard Arnault, just got richer. Recently, he became the world’s richest person, according to the Bloomberg Billionaires Index, surpassing Elon Musk of Tesla (NASDAQ:TSLA).

Notably, China, being one of the largest luxury markets, will continue to play an important role in spurring the demand for luxury goods across the globe. So far, LVMH has been a beneficiary of this and will continue to gain market share in the coming quarters with its attractive portfolio of brands. For instance, LVMH is planning to expand its presence in China by opening flagship Louis Vuitton stores in various cities.

Is LVMH Stock a Buy, According to Analysts?

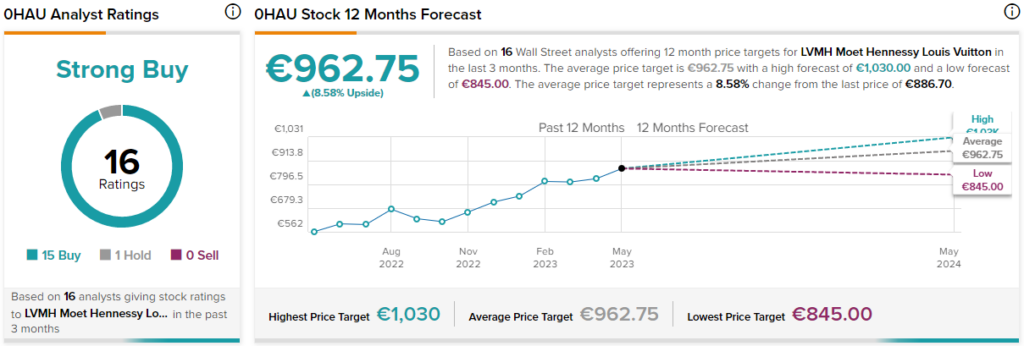

The Wall Street community is clearly optimistic about LVMH. As per TipRanks, the company commands a Strong Buy consensus rating based on 15 Buys and one Hold rating. LVMH’s average price target of €962.75 implies 8.6% upside potential from current levels.

Conclusion: Consider LVMH Stock

I believe LVMH can be a fruitful investment. Yes, the stock is seemingly trading at a premium P/E multiple of 31.9x. However, it is trading at much lower levels compared to a major peer like Hermes. For instance, Hermes is trading at essentially double LVMH’s valuation at a P/E of around 64x.

With a well-balanced geographic mix and some very sought-after brands under its radar, LVMH stock has done well across decades, never (or rarely) disappointing investors. That’s why it continues to make newer highs year after year.

Despite its premium valuation, I will buy the stock due to its solid, consistent track record over the years, sticky brand loyalty, and growth potential, aided by a rebound in Chinese demand.