Media streaming company Roku’s (NASDAQ:ROKU) impressive third-quarter performance has fueled its stock price, driving it up by 149% year-to-date, outperforming the S&P 500’s (SPX) gain of 22%. Roku’s revenue growth has begun to pick up again. Furthermore, the advertising market’s recovery could be beneficial to Roku in the short term. However, I believe it could take a few more years for Roku to be profitable, which is why I’m currently bearish on ROKU stock.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Roku’s Q3 Performance Fueled Its Stock Price Performance

Roku is a television streaming platform whose affordability, ease of use, and vast content library have made it a household name. In its recent third quarter, active accounts grew to 75.8 million globally compared to 65.4 million in the prior-year quarter. Plus, global streaming hours on the platform increased by 22% year-over-year in Q3.

What sets Roku apart is its ecosystem, which includes both hardware and software elements. Roku’s hardware includes a range of streaming devices that fall under its Devices segment. Thanks to its new Roku-branded televisions, Devices revenue jumped 33% year-over-year to $125.2 million in Q3.

Meanwhile, the Platform segment revenue, generated from content distribution and video advertising, also increased by 18% to $786.8 million from the prior-year quarter.

Roku’s stock price performance this year can be attributed to its strong revenue growth, which came in at 20% year-over-year, reaching $912 million, surpassing the consensus estimate of $857 million.

Profitability is Still a Long Shot

While revenue growth has been impressive, it has not been sufficient to propel the company to profitability. However, Roku is making progress, reporting a positive adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of $43.4 million for the first time in the quarter.

In an 8-K filing in September, Roku announced that it was undertaking some drastic cost-cutting strategies this year. The goal is to bring down its “year-over-year operating expense growth rate by consolidating its office space utilization, performing a strategic review of its content portfolio, reducing outside services expenses, and slowing its year-over-year headcount expense growth rate through a workforce reduction and limiting new hires, among other measures.”

Strong revenue growth and cost reductions contributed to a positive EBITDA in the third quarter, according to the company. Furthermore, Roku expects the rebound in video ads to continue in Q4, predicting $955 million in revenue for the quarter. Management also stated, “We will continue to operate our business with discipline to defend margins, with a focus on driving positive free cash flow over time.”

Meanwhile, analysts foresee Q4 revenue to be around $966 million, and Roku’s full-year 2023 revenue is expected to increase by 9.8% year-over-year to $3.43 billion.

The competition in the streaming space is heating up. Roku’s ability to be profitable in the coming years will be determined by how well it maintains and grows its user base while effectively reducing costs and monetizing its platform.

Is ROKU Stock a Buy, According to Analysts?

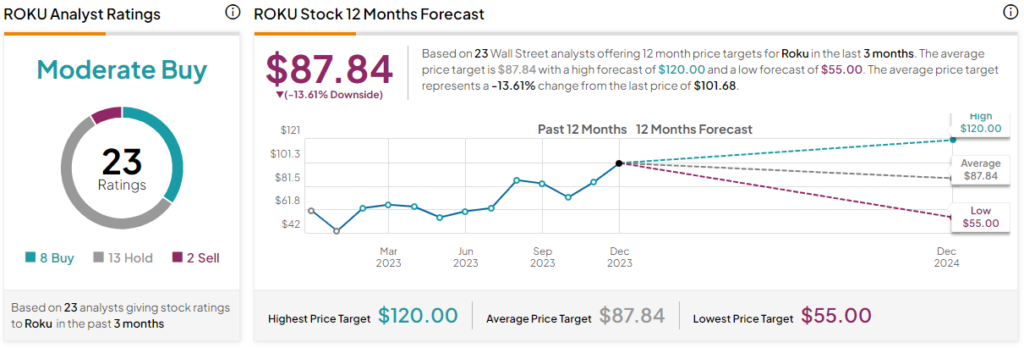

Overall, ROKU stock has earned a Moderate Buy consensus rating on TipRanks based on analyst ratings. Recently, Wedbush analyst Alicia Reese raised ROKU stock’s price target, citing the possibility that the company’s initiatives will result in higher revenue growth and consistent earnings in the long run. The analyst has a Buy rating on the stock.

Meanwhile, Citi analyst Jason Bazinet maintained his Hold rating on the stock, stating that while Roku’s financial metrics may improve, the company’s long-term outlook remains uncertain.

Out of the 23 analysts covering the stock, eight rate it a Buy, 13 rate it a Hold, and two rate the stock a Sell. ROKU has soared following its third-quarter results, surpassing its average price target of $87.84.

ROKU’s high target price of $120, on the other hand, indicates upside potential of 18% in the next 12 months.

Since Roku is not profitable, it can be valued only based on its sales. Based on its estimated revenue growth of 11.8% to $3.84 billion in 2024, Roku is priced at a reasonable forward price-to-sales (P/S) ratio of 3.8, lower than its historical average of 10.8. Roku is also valued cheaper than its bigger competitors in the industry, Netflix (NASDAQ:NFLX) and Apple (NASADAQ:AAPL), which have forward P/S ratios of 5.2 and 7.1, respectively.

The Bottom Line on Roku

Despite the ongoing increase in streaming demand, it has notably declined from the peak levels experienced during the pandemic, as people are spending less time at home. While Roku is reasonably valued for a growth stock, it may be a few years before the company sees green in its bottom line. Until it is profitable, I will be steering clear of Roku.