Shares of Unity Software (NYSE: U) declined 17.4% on Wednesday to close at $32.82 after the gaming software development company announced the acquisition of Ironsource (NYSE: IS) in an all-stock deal. This deal values Ironsource at approximately $4.4 billion, at a 74% premium to the 30-day average exchange ratio.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This transaction was positively viewed by William Blair analyst Dylan Becker and he retained his Buy rating on the stock.

Becker elaborated further on his bullish thesis in his research report.

Platform Synergy Between Unity and Ironsource

The analyst is of the opinion that “this transaction makes strategic sense for both entities as they look to scale their platform solutions.”

Ironsource’s platform enables mobile content creators to transform their apps into a scalable, successful business.

Becker stated that Unity intended to “embed ironSource’s platform of tools into [its] Operate business to bolster its solution suite and drive future cross-sell opportunities through further emphasizing the tethering of Creation and Operation solutions across the development community.”

Unity’s Operate Solutions offers app developers a set of solutions to grow and monetize their end-user base, while its Create Solutions provides a comprehensive portfolio of software solutions for developers to create 2D and 3D content.

John Riccitiello, CEO of Unity commented on the transaction, “The combination of Unity and ironSource better supports creators of all sizes by giving them all the tools they need to create and grow successful apps in gaming and other consumer-facing verticals like e-commerce. This is a step further toward realizing our vision of a fully integrated platform that helps creators in every step of their RT3D journey.”

Moreover, Becker pointed out that the “long-term confidence and opportunity” ahead in the gaming and non-gaming space was indicated by the backing of this transaction from both Silver Lake and Sequoia.

Silver Lake and Sequoia are two of the largest shareholders in Unity and have committed to investing $1 billion in total in Unity in the form of convertible notes that will be issued at the closing of the transaction.

The transaction is expected to close in the fourth quarter of this year.

Financial Synergy from the Transaction

After the closing of this all-stock transaction, Unity will own around 73.5% and Ironsource will own approximately 26.5% of the combined entity.

This merger is projected to be “highly accretive” and the combined company is expected to generate a “run rate of $1 billion in Adjusted EBITDA by the end of 2024, and $300 million in annual EBITDA synergies by year three.”

Unity also announced a stock buyback program of up to $2.5 billion effective upon the closing of the transaction.

Analyst Becker believes that this buyback gives the “management future optionality to opportunistically offset some of the dilution attributable to the expected transaction.”

Becker’s Concluding Thoughts on Unity’s Acquisition

The analyst concluded that this acquisition is likely to “greatly accelerate the company’s profitability roadmap.” Becker anticipates that Unity’s pro-forma multiple on its profitability target in 2024 is likely to be in the “mid-to-high teens” as the company’s EBITDA grows in excess of 30%.

Summing it up, Becker stated, “Overall, we believe that the company has a long runway for durable growth ahead as real-time 3D content becomes more prevalent with the announced business combination providing an accelerated product roadmap to capitalize on the steady momentum across the company’s Create segment and further contributing to the company’s widening data moat.”

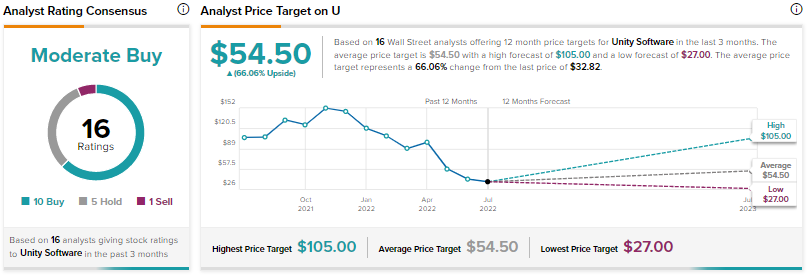

Wall Street analysts are cautiously optimistic about Unity Software with a Moderate Buy consensus rating based on 10 Buys, five Holds, and one Sell. The average Unity Software price target of $54.50 implies an upside potential of 66.1% at current levels.

Bottom Line

It appears that Unity is all set on the long runway for growth with this acquisition. Even Hedge Funds are positive about the stock as indicated by the TipRanks Hedge Fund activity tool. This tool indicates that hedge funds have increased their holdings of Unity stock by 1.1 million shares in the last quarter.