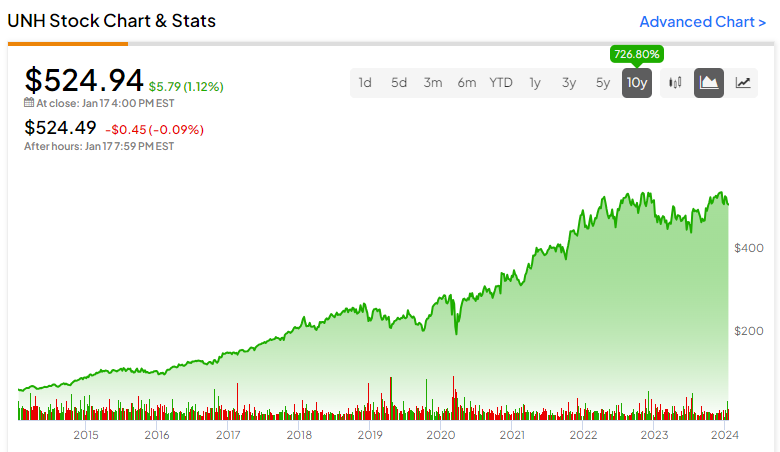

Healthcare insurance company UnitedHealth Group (NYSE:UNH) is a U.S. healthcare giant that offers health benefit plans and services, care delivery and management, wellness programs, and pharmacy care services. It has also been one of the most reliable blue-chip stocks for investors over the years, with 10-year returns of over 700%, helping it reach a market cap of $485 billion. However, shares have been stagnant since April 2022, possibly leading investors to wonder whether there’s still upside potential left.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

We believe there’s still double-digit upside to be had due to the stock’s superb qualities, reasonable valuation, and growth potential. Therefore, we’re bullish on the stock.

What Makes UNH Stock So Special?

For such a large stock to register such large gains over the years, it has to have some sort of special sauce, and that’s exactly what UNH has due to its size. In Fiscal 2023, UNH reported revenue of $371.6 billion. This makes it the largest health insurance company in the world, giving it a huge competitive edge — one that’s likely to last for the foreseeable future.

Being the largest health insurance company in the world comes with the perk of consistent profitability, at least when combined with a solid management team. For instance, UNH has seen its diluted earnings per share (EPS) grow every year for at least the past 10 years. Over this period, its EPS has grown at a compound annual growth rate (CAGR) of 15.8%, an exceptional growth rate for a company of this size.

More recently, its EPS in Q4 2023 grew by 15.4% to $6.16 per share, showing that the company is maintaining this growth rate. On top of this, its return on equity has hovered around 24-27% since December 2017, showing high profitability and predictability. For context, an ROE of over 10-15% is generally considered good. With all this in mind, it makes sense as to why UNH stock has performed so well in the past.

UnitedHealth’s Optimistic Growth Outlook

In its Q4 conference call, UnitedHealth’s management expressed confidence in achieving its “long-term 13% to 16% adjusted earnings per share growth rate” for this year and 2025. Since UNH has proven itself as a company that investors can trust (especially since it essentially always beats EPS estimates), we think the firm will be able to at least meet the 13% target for the next two years.

The firm’s growth strategy includes expanding value-based care, growing its Medicare Advantage business by 450,000-550,000 consumers this year, leveraging AI technologies for efficiency and better service, and optimizing resource use and operational efficiency (i.e., the planned sale of its business in Brazil).

Why There’s Still Upside Potential

Given UnitedHealth’s reasonable valuation, along with its future EPS growth rate, which is forecast to be in the low-double-digit range, the stock is likely to rise by the same amount (per year) in the next few years. That’s because its next-12-month P/E ratio of 18.8x is close to its five-year average of 19.7x. Therefore, it’s reasonable to assume that UNH will maintain its current multiple.

Put simply, if earnings grow by around 13% per year for the next two years and the stock maintains a similar valuation multiple, then the stock will also rise by around 13% per year (in a perfect world). Coincidentally (or maybe it’s not a coincidence), analysts also expect around 13% upside potential in the next 12 months, as explained below.

Is UNH Stock a Buy, According to Analysts?

On TipRanks, UNH comes in as a Strong Buy based on 15 Buys, one Hold, and one Sell assigned in the past three months. The average UNH stock price target of $593.13 implies 12.99% upside potential.

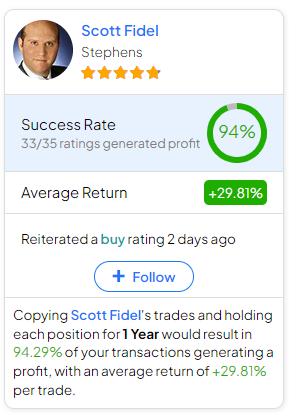

If you’re wondering which analyst you should follow if you want to buy and sell UNH stock, the most accurate analyst covering the stock (on a one-year timeframe) is Scott Fidel of Stephens, with an average return of 29.81% per rating and a 94% success rate. Click on the image below to learn more.

The Takeaway

UnitedHealth is a healthcare leader that has proven itself over the years with large returns and steady earnings growth while maintaining a reasonable valuation. Looking ahead, this earnings growth is expected to continue, positioning the stock to deliver double-digit annualized returns over the next couple of years.