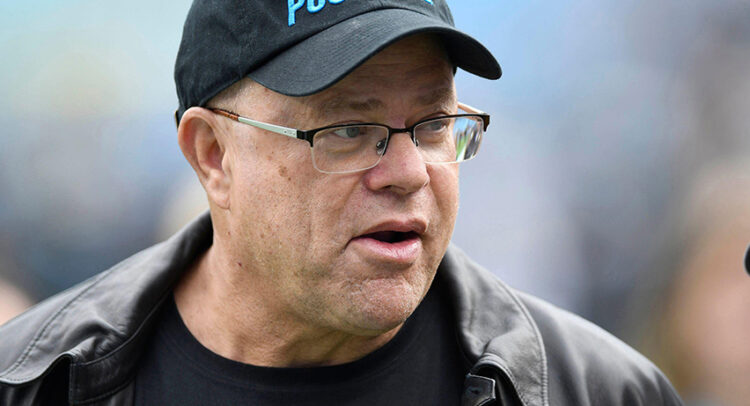

More than 15 years ago, hedge fund manager David Tepper pulled in a $7 billion profit by backing Bank of America and Citigroup in the midst of the great financial crisis. His investment in those banks ran counter to the common wisdom at the time – but it perfectly encapsulated his contrarian approach to investing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tepper, who founded hedge fund Appaloosa Management in 1993 and has a personal fortune north of $21 billion, has always held to two main principles: seek out value, and don’t worry about the common wisdom. Market sentiment plays no role in his investment strategy; he seeks out shares that are undervalued and ignored by the mass of investors – but that also offer sound fundamentals and the prospect of a turnaround.

This strategy has led Tepper to buy big into unexpected stocks in the past – and more recently, he has stuck to his contrarian guns. A look at his most recent filings, covering 2Q25, shows that UnitedHealth (NYSE:UNH) and Intel (NASDAQ:INTC) have both attracted his attention, even as the companies faced massive headwinds.

We’ve opened up the TipRanks database to get a feel for both of these stocks – to see how the Street thinks about them, and to get an idea of why Tepper is buying in so heavily.

UnitedHealth Group

We’ll start in the health insurance industry, with UnitedHealth. This firm, with its market cap of $278 billion and its customer base numbering 148 million strong globally, is the largest operator in the US health coverage space. UnitedHealth has been in the business since 1974, and took on its current name in 1978. The company employs over 400,000 people, in everything from administrative functions to direct care staff.

UnitedHealth’s business is split between two main areas of operation, the insurance side and the direct care side. On the insurance side, the company offers a wide range of affordably priced health benefit and insurance plans. These policies include offerings for individuals and for employer benefit packages. UnitedHealth is also a major player in the Medicare and retirement sector, and offers packages for community and state benefit plans.

Turning to the direct care side, we look at Optum, UnitedHealth’s provider segment. Under this aegis, the company provides direct-care health services for a variety of audiences, in a patient-centered manner. The company prioritizes high-quality, community-based care services, and includes mental health services in its packages. The company’s Optum Insight branch works with providers, payers, and government agencies, as well as life-sciences companies, to develop service plans and payment options that simplify the administrative and financial ends. The company also provides pharmacy services, under Optum RX, for affordable medication options.

The US healthcare sector is a huge business, and UnitedHealth has in recent years been expanding its revenue share. In 2023, the company generated a top line of $371.6 billion; this increased to $400.3 billion last year, and for the 12 months including 2H24 and 1H25, UnitedHealth saw a total of $422.8 billion in revenue.

Despite these gains, UNH has seen share price drop sharply this year – the year-to-date decline is currently 38.5%. The company has faced serious headwinds since the spring, when its 1Q25 report included a downward revision to the full-year 2025 revenue guidance, which was then followed by the company completely taking its guide off the table. The share price suffered another blow when the company confirmed that its Medicare billing practices have come under scrutiny from the Department of Justice. The company’s statement included confirmation that UNH is now complying with both civil and criminal investigations.

Normally, that type of admission from a major company would make big-name investors think twice, but this is exactly the sort of situation that gets Tepper’s attention. Tepper is a contrarian, and he focuses on stocks that are suffering a price decline but retain sound fundamentals.

With this in mind, in Q2, Tepper increased his UNH stake significantly, buying 2,275,000 shares. Tepper’s stake in UnitedHealth now totals 2.45 million shares, worth approximately $753 million.

When we look at UnitedHealth’s last earnings release, for 2Q25, we find that the company had $111.6 billion in quarterly revenue, growing 13% year-over-year and meeting Street expectations. On earnings, UNH realized a non-GAAP EPS of $4.08, which missed the estimates by 37 cents per share. We should note that in the quarterly report, the company reinstated its 2025 revenue guide, calling for revenue between $445.5 billion and $448.0 billion.

Despite recent headwinds, looking ahead, Cantor analyst Sarah James thinks UnitedHealth presents strong potential for investors, although she maintains a careful stance. James writes, “We believe we are at a turning point for UNH, with ’25-27 EPS growth achievable & baking in appropriate risk. We believe guidance was intentionally set low for 2025 and 2026/2027 commentary to allow the company to return to earnings predictability and a beat-and-raise pattern. That said, we are also keeping our estimates conservative to respect the unpredictability of several end markets impacted by policy changes, the turnaround needed in multiple segments, and new cost trend commentary that seems to be more bearish than peers on multiple segments.”

Quantifying her take, James put an Overweight (i.e., Buy) rating on the stock, with a $440 price target that suggests a potential one-year upside of 43%. (To watch James’s track record, click here)

This health insurance giant has picked up 20 recent analyst reviews from the Street, and the breakdown of 17 Buys, 2 Holds, and 1 Sell gives the stock a Strong Buy consensus rating. That said, the stock is currently priced at $307.42 and its $314.95 average price target implies the shares will stay rangebound for the time being. (See UNH stock forecast)

Intel

Next on our list of Tepper picks is Intel, one of the best-known names in the world of semiconductor chips. While not in the same league as industry leader Nvidia, the company still boasts a respectable market cap of $108.5 billion and controls nearly 75% of the market share for PC microprocessor chips. The company built itself up on that niche and is the leading provider of x86 chips for desktop and laptop PCs; if you’ve bought a computer recently, there’s a strong chance that it has the blue-and-silver ‘Intel Inside’ sticker on it.

Intel provides us with a case study, however, in why a tech firm can’t stand still, even on a successful product line. The company was founded in 1968, and from the 90s into the mid-2010s, the company led the industry in annual revenue. Even today, with $53 billion in 12-month revenue through 2Q25, the company still ranks 5th globally and 3rd in the US among its peers. By market cap, however, Intel has fallen out of the top ten and ranks #17 globally. The firm’s decline has two roots: first, the AI boom prompted industry leaders to shift toward AI-capable chips, and Intel is conspicuous as a latecomer to that space; and second, competitor AMD, whose $272 billion market cap provides much deeper pockets, has been making a serious challenge to Intel in the desktop processor market.

We should note that Intel has been developing new products for the AI market, with chipsets designed for AI cloud and AI-capable PC systems. In a clear sign that management is looking to change focus, the company brought on former Cadence CEO Lip-Bu Tan earlier this year as the new CEO, with plans to meet the challenges presented in the chip market by the AI boom and by increased competition.

On another note, one that has generated controversy, Intel has also secured strong financial backing from the US government, which recently confirmed an enormous $11.1 billion investment in the company. While the cash infusion is undoubtedly welcome from Intel’s end, and is in line with the Trump Administration’s commitment to promoting US companies and to onshoring US high-tech manufacturing, the move might also bring politics into Intel’s business decision processes. The move gives the US government a 10% stake in Intel.

We should also note that Japan’s Softbank has bought heavily into Intel, with a $2 billion investment in the company.

These large governmental and institutional investments help to highlight the fact that Intel’s stock has not been attractive in recent years. Yes, the stock has gained this year, but the shares are still down over the long term, with a five-year drop of 50%.

And now we come to David Tepper. The contrarian billionaire bought 8 million shares of the chip maker during 2Q25. This stock acquisition marked a new position for Tepper, and his stake in the company is valued at $198.4 million.

5-star analyst Gus Richard, from Northland, covers Intel, and while he acknowledges that the company has a difficult path to reverse its fortunes, he believes that the path does exist. In his note on the stock, Richard writes, “Intel’s turnaround remains in doubt, but we believe INTC has a lot of technology and levers to execute its turnaround. Next year, INTC will be in the same zip code as TSMC, sharing similar process technology and, along with TSMC, will be a leader in advanced packaging. INTC can leverage these capabilities to become a SiP package foundry.”

Following from this, Richard rates INTC as Outperform (i.e., Buy). He complements that with a $28 price target that points toward a one-year share price gain of 13%. (To watch Richard’s track record, click here)

That’s definitely the bullish take. The 29 recent reviews on this stock include that single Buy along with 25 to Hold and 3 to Sell, for a Hold consensus rating. The shares have a trading price of $24.80, and the $22.17 average price target implies that the stock will slip 10.5% in the next 12 months. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.