Li Auto (LI) may not dominate headlines like Tesla, but perhaps it should. In 2024 alone, the company delivered over 500,000 vehicles, expanded its global R&D presence, and continued scaling China’s largest highway fast-charging network. Notably, Li Auto stands out in the sector for its profitability, strong balance sheet, and plans to launch two new models in 2025.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In an industry often defined by lofty valuations and high expectations, Li Auto’s disciplined execution and relatively modest valuation make it an attractive opportunity. While geopolitical and macroeconomic risks remain, I’m initiating a Buy rating based on its solid fundamentals and growth trajectory.

New Kid on the EV Block

I’m impressed by Li Auto’s operations and strategic direction. Primarily active in China, the company specializes in extended-range electric vehicles (EREVs), which combine battery-electric drivetrains with onboard generators. This hybrid approach helps alleviate range anxiety, one of the biggest concerns among EV buyers. Most of Li Auto’s lineup consists of family-oriented SUVs, with increasing emphasis on autonomous driving capabilities, advanced software integration, and driver assistance systems.

Building on its strong delivery performance, the company reported revenues of RMB 144.5 billion (approximately $20 billion). It now operates over 500 retail locations and employs more than 32,000 people, all part of an ambitious growth plan that will soon place it in direct competition with EV titans like Tesla (TSLA) and BYD (BYDDF). With the upcoming launch of its i6 and i8 models and the introduction of the AD Max v13 autonomous driving system, Li Auto is positioning itself for a potentially transformative year.

Beyond vehicle production, Li Auto is aggressively expanding its infrastructure. The company currently operates 1,420 highway fast-charging stations and aims to grow that number to 4,000 by year-end. Meanwhile, opening a new R&D center in Munich marks its first significant move into Europe, complemented by new sales hubs in Dubai and other international markets. While still in the early phases of global expansion, these steps reflect a promising and deliberate push toward building a truly international brand.

Financial Performance Revs Up Li Auto

Despite the company’s solid balance sheet and strong top-line performance, there are a few near-term challenges worth noting. In Q4 2024, net income declined 39% year-over-year, and gross margins slipped from 23.5% to 20.3%. Management attributed this margin pressure to the ongoing ramp-up in battery electric vehicle (BEV) production, a shifting product mix, and broader macroeconomic uncertainty. While these factors are part of the company’s long-term growth strategy, they may continue to weigh on profitability in the short term.

While near-term challenges remain, the company’s financial foundation is highly reassuring. With ¥112.8 billion in cash on hand—far outweighing its ¥2 billion in debt—Li Auto boasts a rock-solid balance sheet. Strong free cash flow supports continued investment in infrastructure expansion and R&D initiatives, giving management the flexibility to adapt in a fast-moving market. The absence of a dividend further enhances its capital flexibility, allowing for strategic reinvestment to fuel long-term growth.

Gauging LI Auto’s Value in an Uncertain Market

With a forward P/E of 26.6, Li Auto is reasonably valued relative to its peers. Unlike XPeng, NIO, and Rivian, which are still unprofitable, Li Auto trades at a more grounded multiple while maintaining profitability. Tesla, by contrast, commands a significantly higher multiple at around 60x forward earnings, but faces growing scrutiny, margin pressure, and slowing momentum in China. In this context, Li Auto’s valuation appears balanced, offering a compelling mix of growth and financial stability.

What is the Target Price for Li Auto?

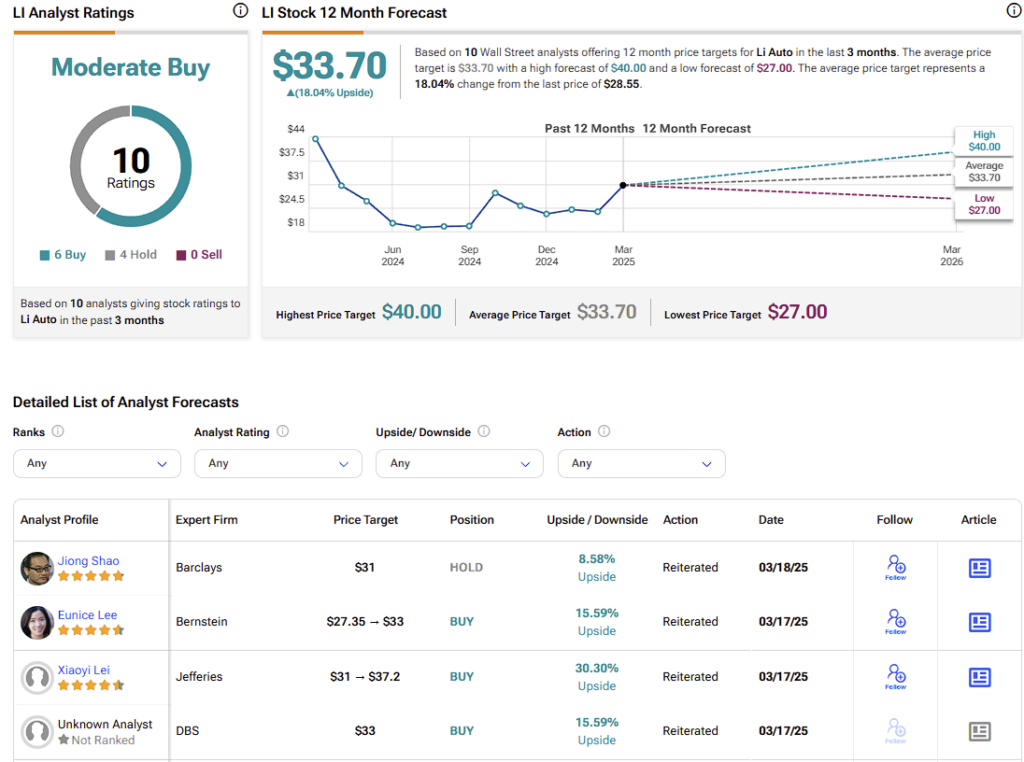

LI stock carries a Moderate Buy consensus rating on Wall Street based on six Buy, four Hold, and zero Sell ratings over the past three months. LI’s average stock price target of $33.70 implies approximately 18% upside potential over the next twelve months.

Several Price Catalysts in Play for Li Auto

In my view, a number of key risks and potential catalysts make Li Auto a stock to watch closely. Battery electric vehicle (BEV) adoption remains in its early stages, with demand still developing and far from guaranteed. If consumer uptake falls short, margins could come under pressure, especially if rivals use this uncertain period to close the gap on more established players.

As with any company deeply tied to China, there’s always the risk of unexpected government intervention, whether through regulatory shifts or trade policy. While such disruption seems unlikely in the near term, given the strategic importance of the EV sector to China’s economy, the broader geopolitical landscape remains a concern. Recent global tariff disputes, both international and domestic, could create economic headwinds for the industry.

That said, Li Auto also has several promising catalysts. If it successfully scales its BEV offerings, it could unlock a powerful new revenue stream and validate its long-term strategy. Progress in international expansion and the monetization of its software and autonomous driving platforms could further bolster the company’s growth trajectory. For investors willing to navigate the risks, meaningful upside may be ahead.

Underrated EV Contender No More

The electric vehicle sector is set to remain one of the market’s most dynamic—and volatile—corners, as companies straddle the line between traditional automotive fundamentals and high-growth, software-driven potential. While Li Auto faces short-term challenges and broader macroeconomic uncertainty, its robust balance sheet, promising product lineup, and potentially attractive valuation make it a compelling prospect for forward-looking investors. Given these factors, I’m initiating a buy rating on the stock and will closely monitor the key catalysts in the coming quarters.