Ridesharing has become a highly lucrative fintech niche occupied by two big names: Uber Technologies (UBER) and Lyft (LYFT). However, a third innovator is lining up on the grid as a fierce competitor: DiDi Global (DIDIY). But can this Chinese disruptor take pole position? Not only is ride-sharing firmly entrenched as a massive market both in the U.S. and internationally but the industry is also projected to continue growing rapidly in the years ahead. Fortune Business Insights projects that the worldwide ride-share market will increase from $123 billion in 2024 to a mind-boggling $480 billion by 2032–a scorching 18.5% compound annual growth rate (CAGR).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With this type of scintillating potential long-term growth, it’s no surprise that investors are clamoring for shares of industry leader Uber. The ridesharing bellwether has gained 33.3% this year alone, only in February. So, which of these ride-sharing stocks is the best option for investors right now?

Let’s buckle up and find out…

Uber Technologies (NYSE:UBER) | Ridesharing Bellwether Keeps Chugging Along

With a market cap of $170.2 billion and near-ubiquitous name recognition in the U.S. and many of the other markets in which it operates, Uber is the oversized gorilla in the ride-share room. The stock has performed well under the leadership of CEO Dara Khosrowshahi, who has won over investors by placing a strong emphasis on boosting profitability in recent years. The company lost $4.64 per share as recently as FY2022, then became profitable, earning $0.93 per share in 2023 before ramping earnings to $4.71 in FY2024. Despite the volatility, Uber is growing.

Uber is an excellent company with strong leadership and earnings that should continue to grow over time. Analysts project Uber’s earnings per share to grow to $2.43 in 2025 and rise to $3.33 in 2026. Uber’s valuation also looks reasonably attractive based on these 2026 projections, trading for 24.5x earnings estimates.

The potentially touchy issue with Uber is that the market has already given it a reasonably lofty multiple based on its strong performance. After its red-hot start to the year, the stock trades for 33.5x the consensus 2025 earnings estimates. While this isn’t necessarily an eye-watering valuation, it is well above the market average, with the S&P 500 (SPX) trading for 25.7x earnings.

Is Uber a Buy, Sell, or Hold?

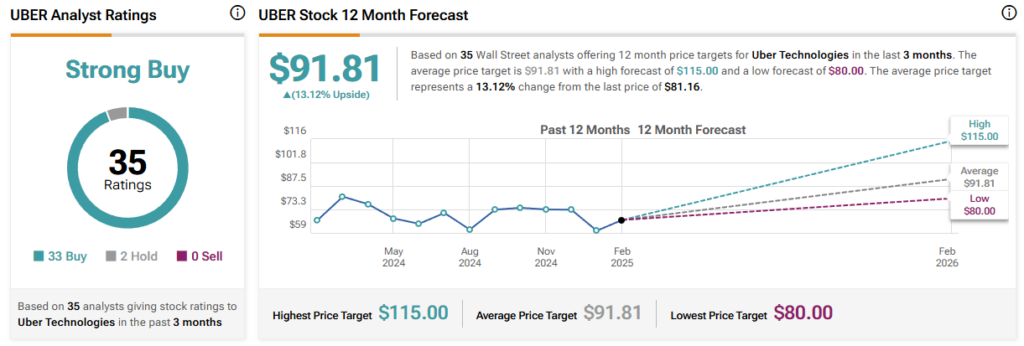

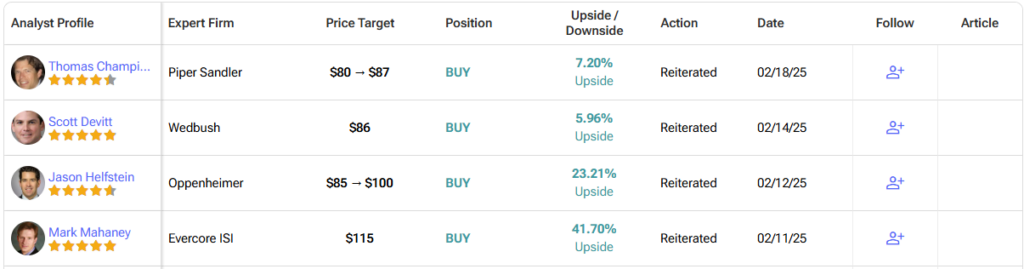

Turning to Wall Street, UBER earns a Hold consensus rating based on 33 Buy, two Hold, and zero Sell ratings assigned in the past three months. The average analyst UBER stock price target of $91.81 per share implies a 13% upside potential from current levels.

Lyft (NASDAQ:LYFT) | Small Yet Nimble Comeback Specialist

Like Uber, Lyft became a public company in 2019 but has not achieved the same success as its larger rival. The company’s market cap is just under $6 billion, a fraction of Uber’s. While shares of Uber are up 94.5% over the past five years, shares of Lyft are down 71.3% over the same time frame.

However, Lyft seems to be turning things around with a stronger focus on profitability. The company recently reported strong full-year 2024 earnings and achieved full-year GAAP profitability for the first time while generating record cash flow. It also gained traction with customers as it achieved all-time highs in total rides and total riders.

The company still has a long way to go if it wants to get to Uber’s size and scale, but it can still be a successful opportunity for investors. That’s because Lyft shares are comparatively cheap, trading at a significant discount to those of its largest competitor and the broader market. In fact, Lyft stock trades 13x the consensus 2025 earnings estimate, meaning that the S&P 500 is roughly twice as expensive as Lyft, and Uber is about 2.5 times more expensive.

Additionally, the company is expected to increase earnings per share to $1.40 in fiscal 2026, meaning it trades at just a paltry 10x these forward estimates, an even more attractive multiple.

I’m bullish on Lyft based on its improving results, newfound profitability, and markedly cheap valuation compared to Uber and the broader market. This leaves it with significant room for upside if it can continue to execute and build on its record 2024 results.

Is Lyft a Good Stock to Buy?

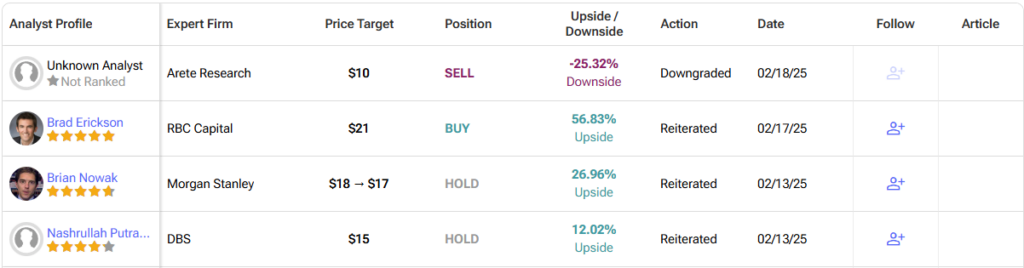

On Wall Street, LYFT has a consensus rating of Hold based on seven Buy, 23 Hold, and one Sell rating in the past three months. The average analyst LYFT stock price target of $17.21 per share implies a ~29% upside potential from current levels.

Didi Global (OTC: DIDIY) | Off the Beaten Track Chinese Disruptor

The rideshare market isn’t solely the domain of Uber and Lyft; a noteworthy peer is disrupting the traditional Uber/Lyft development model. Didi Global is China’s largest rideshare provider, but operating in markets outside of China in Asia and Latin America too. With a market cap of $24 billion, Didi is much smaller than Uber but is also almost four times the size of Lyft. Didi also ranks between Uber and Lyft in valuation, trading at 17.8x forward earnings estimates.

While U.S. readers are more likely to be familiar with Uber and Lyft than Didi, many investors may recall that Didi briefly traded in the U.S. The company generated some fanfare with a 2021 IPO on the NYSE that raised $4.4 billion and valued the company at a whopping $73 billion. One year later, the company delisted its American Depositary Shares (ADSs) from the exchange following pressure from China’s regulators surrounding their desire to delay the company’s IPO based on alleged cybersecurity and privacy concerns and now trades over the counter (OTC) in the U.S.

At the time, many market commentators saw it as more of a punishment for going public in the U.S. instead of in China. Chinese regulators fined the company $1.2 billion and are currently facing a lawsuit saying it defrauded investors by concealing information. Some observers expect DiDi to be listed in Hong Kong soon, but nothing has been officially confirmed or announced thus far.

While these issues may not be entirely DiDi’s fault and may indeed be in the rearview mirror, the stock remains difficult to access, and liquidity is a sizeable concern. Other opportunities in the space are more compelling.

Lyft Stock Takes Pole Position on the Rideshare Track

Uber is an outstanding stock and the market leader in rideshare, but with a $170 billion market cap and a price-to-earnings multiple north of 30, it may not have as much room to run as Lyft or even DiDi Global.

Meanwhile, Lyft is cheaper than Uber and DiDi and lacks the warts DiDi comes with. I’m bullish on Lyft based on its attractive valuation, newfound profitability, and recent record results, making it the most compelling opportunity for investors in the ride-sharing space right now.