The tightening of monetary policy, cost inflation, and supply-chain bottlenecks have eroded corporate revenues and margins over the past few quarters, making investment decisions tougher. Under such circumstances, a proper study of the investment strategies and choices of well-versed investors, like U.S. politicians, could lessen the pain for prospective investors. Notably, some renowned U.S. politicians bought shares of three high market cap companies in August. These companies include The Procter & Gamble Company (NYSE:PG), AbbVie Inc. (NYSE:ABBV), and Starbucks Corporation (NASDAQ:SBUX).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While shares of Procter & Gamble slipped 1.9% in the past month, AbbVie and Starbucks declined 3.3% and 1.8%, respectively. Meanwhile, in the past month, the S&P 500 fell 2.6%, the NYSE decreased 1.5%, and the NASDAQ lost 3.8%.

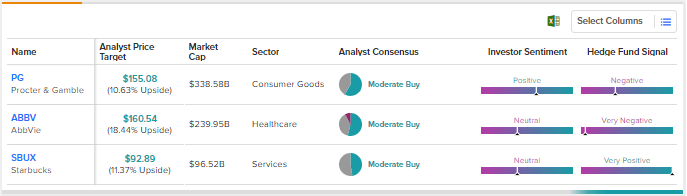

A consolidated chart providing Wall Street’s take on the companies mentioned above has been designed using TipRanks’ Stock Comparison tool for a better understanding of prospective investors.

The Procter & Gamble Company (NYSE:PG)

The consumer goods company deals in products related to health care, beauty, family care, home care, and baby care. Shares of this $338.6-billion company were purchased by Democrat Debbie Dingell once in August. The Representative from Michigan bought seven to 104 shares of The Procter & Gamble Company for approximately $1,000 to $15,000.

In July 2022, the company’s Chairman of the Board, President, and CEO, Jon Moeller, said, “We remain committed to our integrated strategies of superiority, productivity, constructive disruption, and an agile and accountable organization structure. They remain the right strategies to step forward into the near-term challenges we are facing and continue to deliver balanced growth and value creation.”

Is PG Stock a Buy or Sell?

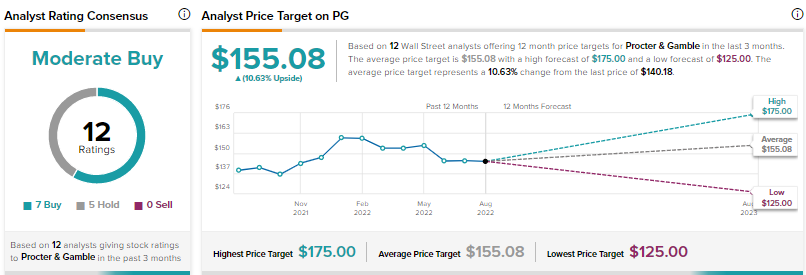

TipRanks’ analysts have a Moderate Buy consensus rating on PG stock, which is based on seven Buys and five Holds. PG’s average price forecast is $155.08, representing 10.63% upside potential from the current level.

Meanwhile, retail investors are optimistic about the prospects of Procter & Gamble. The number of retail portfolios with investments in PG stock increased 0.9% in the past month. The investments of Top TipRanks Portfolios have grown 1.8% in the same period.

AbbVie Inc. (NYSE:ABBV)

AbbVie is a $240-billion biopharmaceutical company, which specializes in eye care, neurology, women’s health, immunology, and other fields. The U.S. Congressman from Pennsylvania, Dwight Evans, purchased eight to 109 shares of ABBV in August. The Democrat’s Buy trade is valued within the $1,000-$15,000 range.

In July, AbbVie’s Chairman and CEO, Richard A. Gonzalez, said, “The momentum of our business, combined with advances across our pipeline continue to support AbbVie’s promising long-term outlook.”

What Is ABBV’s Price Target?

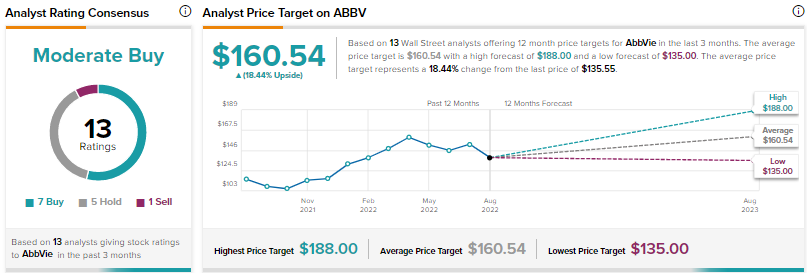

On TipRanks, ABBV’s price target is $160.54, representing an upside of 18.44% from the current level. The highest price target is $188, and the lowest is $135.

Also, the company carries a Moderate Buy consensus rating based on seven Buys, five Holds, and one Sell rating. Despite the cautiously optimistic tone of analysts, retail investors increased their exposure to ABBV stock by 0.3% in the past 30 days. Further, the number of top portfolios holding ABBV stock is up 1.5%.

Starbucks Corporation (NASDAQ:SBUX)

The $96.5-billion company is known for its beverages, especially coffee, breakfast sandwiches, pastries, ground coffee, roasted beans, and other food products. Shares of the company were purchased by Republican John Curtis in August. Notably, the Representative from Utah bought 12 to 170 SBUX shares for $1,000 to $15,000.

In August, the company’s interim CEO, said, “We have a clear line-of-sight on what we need to do to reinvent the company, elevate our partner and customer experiences and drive accelerated, profitable growth all around the world.”

What Is the Price Target for SBUX Stock?

SBUX’s average price target of $92.89 reflects 11.37% upside potential from the current level. The highest price target is $110 and the lowest is $84.

On TipRanks, as many as nine analysts have assigned a Buy rating to SBUX stock, and 10 analysts have rated the stock a Hold. Talking about retail investors, the number of portfolios with exposure to SBUX stock increased 0.7% in the past month. The same for top portfolios grew 0.4%.

Concluding Remarks

It is worth mentioning that economic activities in the U.S. have weakened. The country’s GDP fell 1.6% in the first quarter of 2022 and 0.6% in the second quarter. Also, the U.S. economy is forecast to grow 2.3% in 2022 and 1% in 2023 versus 5.7% in 2021, according to the International Monetary Fund.

Amid economic uncertainties caused by multiple factors, including those mentioned above, we believe that investors will be keen to learn from the trading activities of U.S. politicians and other experienced investors and institutions. It appears that the long-term prospects of Procter & Gamble, AbbVie, and Starbucks are solid. In the near-term, prevalent headwinds might be concerning as evident from analysts’ cautiously optimistic tone on these stocks.

Read full Disclosure