Mounting inflation and share price volatility have put dividend stocks on almost every investor’s radar in recent months – so we’ve highlighted two British dividend-payers who could be a good long-term choice for your portfolio.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

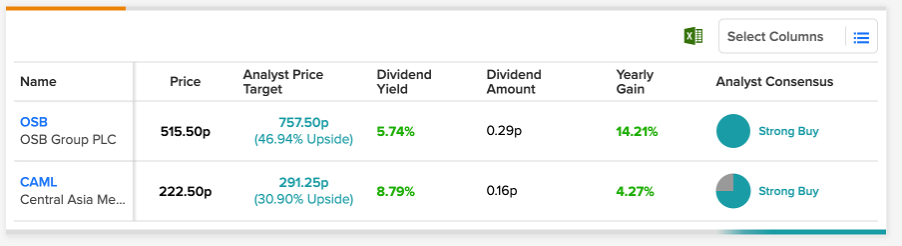

We have shortlisted mortgage lender OSB Group (GB:OSB) and metal producer Central Asia Metals (GB:CAML) that have dividend yields higher than their respective sector average.

Here, we have also used the TipRanks Stock Screener tool to list and screen stocks with higher dividend yields combined with analyst ratings.

Let’s see the stocks in detail.

OSB Group

OSB Group is a financial services company focused on mortgage lending to sub-segments of the market. The company also has retail saving operations through Kent Reliance and Charter Savings Bank.

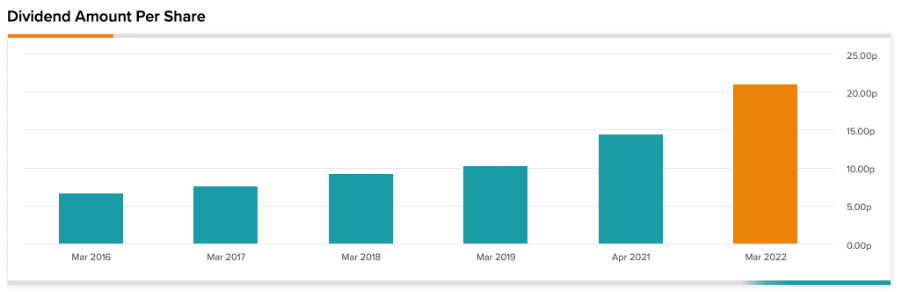

The company has consistently increased its dividend over the last few years. As per the company’s dividend policy, its interim dividend should be one-third of the previous year’s total dividend. In line with this policy, the company announced an interim dividend of 8.7p per share during its first half results for 2022.

The company’s strong financial and operational performance helped it maintain a stable return for its shareholders. In the first half of 2022, it posted a record pre-tax profit of £294 million, which increased by 16% from the previous year. The net interest margin increased to 302 bps from 268 bps in the last year, driven by base rate hikes by the central bank.

Talking about the outlook, the company is optimistic about its lending business as it expects a growth of around 10% in its net loan book, based on a strong pipeline of loan applications.

OSB share price forecast

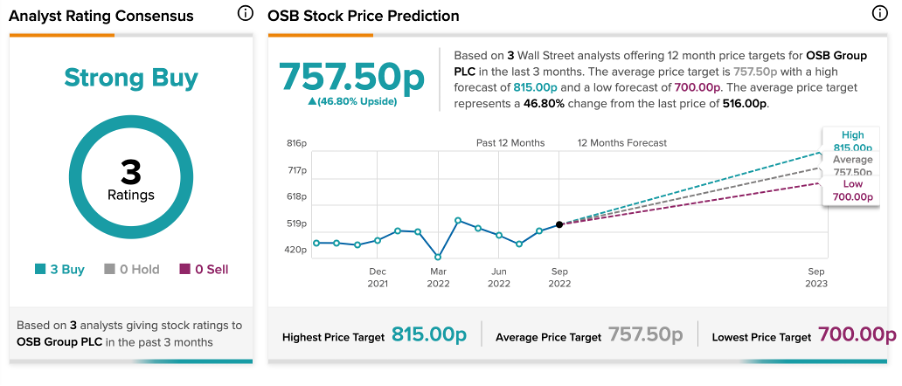

According to TipRanks’ analyst consensus, OSB Group stock has a Strong Buy rating based on three Buy recommendations.

The average price target is 757.5p, which is 46.8% higher than the current price. The stock price has a high forecast of 815p and a low forecast of 700p.

Central Asia Metals

Central Asia Metals is a metal exploration company with operations in Kazakhstan and North Macedonia. The company mainly deals in copper, zinc, and lead.

The company has benefited from the rising metal prices in 2022 and as a result, the company posted a 60% increase in its first-half profits of $67 million.

It has seen consistent production growth and is confident of its future numbers as well. Therefore in its interim results for 2022, the company raised its guidance numbers for production. Copper production is raised to 14,000 tonnes, and Sasa zinc and Sasa copper will touch around 50,000 tonnes this year.

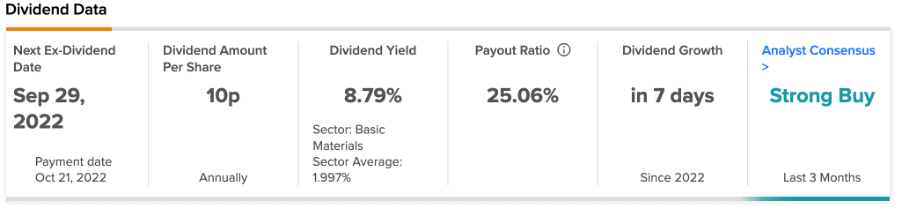

The company has an attractive dividend yield of 8.79% as compared to the sector average of 1.99%. During its results, the company increased its dividends by 25% to 10p per share, which was 40% of free cash flow. The analyst expects full-year dividends could touch 20p per share along with high profits forecasts.

Is Central Asia Metals’ stock a Buy?

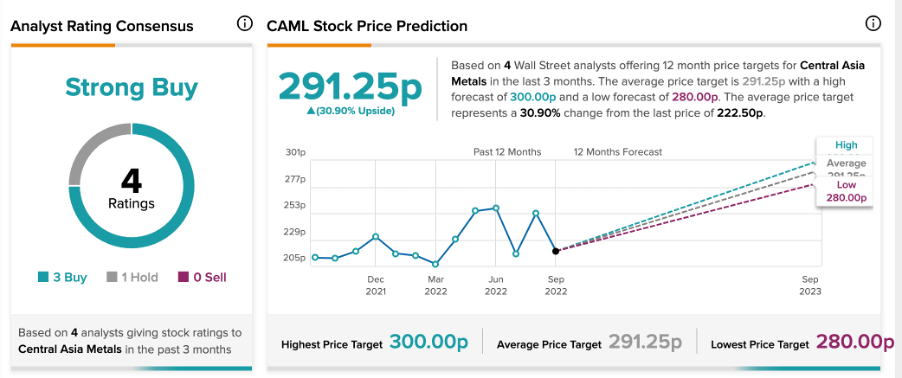

According to TipRanks, CAML has a Strong Buy rating, based on three Buy and one Hold recommendations.

The CAML share price forecast is 291.25p, which has an upside potential of 31%.

Conclusion

Both companies have brighter results ahead of them thanks to strong business growth. This will lead to higher returns for the shareholders.

Investors looking for a good addition to their portfolios for passive income growth can consider these two stocks.