The software sector has been catching plenty of attention lately from investors and analysts alike, and for good reason. The industry is huge, expected to generate more than $700 billion in revenues this year alone, and anticipated to rise at an estimated CAGR of 5% over the next 5 years. While stock indexes only paint with broad strokes, the NASDAQ composite – which is weighted heavily toward tech and software – is up 20% so far this year.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The prospect of further gains in tech stocks, particularly in the software segment, has top analyst Shrenik Kothari, of Baird, pounding the table to recommend two software companies for investors’ perusal. Kothari sees this sector as a growth opportunity, although he is quick to point out that each company will follow its own idiosyncratic path towards further growth and profits.

We’ve opened up the TipRanks databanks to follow these picks of Kothari’s, to find out just what exactly draws a 5-star analyst to make his recommendations. Here are the details, and the analyst’s comments.

GitLab (GTLB)

We’ll start with an open-source software company, GitLab, a leader in the field of DevSecOps. This sounds like a mouthful, but boils down to a simple, specialized platform that customers can use to optimize their own software development for speed, security, and efficiency. The open-source nature of GitLab’s platform means that users – the coders and developers building their own software systems – as well as the general public can make additions to the code, putting in improvements or tweaks as they see fit. In addition, GitLab’s platform, like all open-source software, is available free of charge. This combination of free access and the ability to edit as needed has made GitLab a popular choice in the DevSecOps field.

Companies need to make money, though, and GitLab operates on the so-called freemium model. That is, all users can access GitLab’s platform and products at a basic level. Users who require higher levels of functionality, or who wish to add higher-level upgrades, can do so through paid subscriptions. It’s a sound business model that has brought the company some 30 million total users – a total that includes a million or more active license users with paid subscriptions. In addition, the company has more than 3,300 active users making regular contributions to the open-source code.

By the numbers, GitLab has built itself into a successful software firm. The company has been all-remote since its founding in 2011 and currently counts more than 1,800 employees in over 60 countries around the world. The company brought in more than $579 million in total revenues during its fiscal year 2024, which ended on this past January 31. The company has seen consistent quarter-over-quarter revenue gains for a while now.

In its last reported quarter, covering fiscal 1Q25 (April quarter), GitLab reported a top line of $169.2 million, up more than 33% year-over-year and beating the forecast by over $3 million. The company’s bottom line, the non-GAAP EPS figure, came to 3 cents per share, a sharp turnaround from the 6-cent loss reported in the prior-year quarter and beating the estimates by 7 cents per share. The company will report its FQ2 results today (September 3) after the close.

Digital security has become more essential than ever, and GitLab’s ability to make security features integral to software systems from their initial development has become a strong asset for the company. This underlies analyst Kothari’s take on the stock, as he writes, “As cyber threats become more sophisticated and frequent, the need for robust security integration within the software development process has never been more critical. GitLab’s focus on DevSecOps, embedding security into its CI/CD pipelines, addresses these concerns head-on, making it a preferred choice for enterprises prioritizing cybersecurity… With its high-value Ultimate tier gaining traction, GitLab still has substantial room for expansion. Ultimate’s success in the federal sector, particularly with military and local government agencies, highlights its potential to penetrate deeper into commercial and international markets. The rising demand for enhanced security and compliance features makes Ultimate an attractive offering, ensuring ongoing growth.”

The analyst, who is rated among the top 2% of his peers by TipRanks, goes on to predict a solid future for this software company: “GitLab is not just about growing fast; it’s also getting better at turning a profit. The company’s shift from multi-year to annual contracts has helped smooth out revenue recognition and improve margins. Additionally, the strategic push toward its high-value Ultimate tier, where security capabilities are paramount, has resulted in higher average revenue per user.”

These comments back up Kothari’s Outperform (i.e. Buy) rating on the stock, while his $59 price target implies a potential gain of 24.4% on the one-year horizon. (To watch Kothari’s track record, click here)

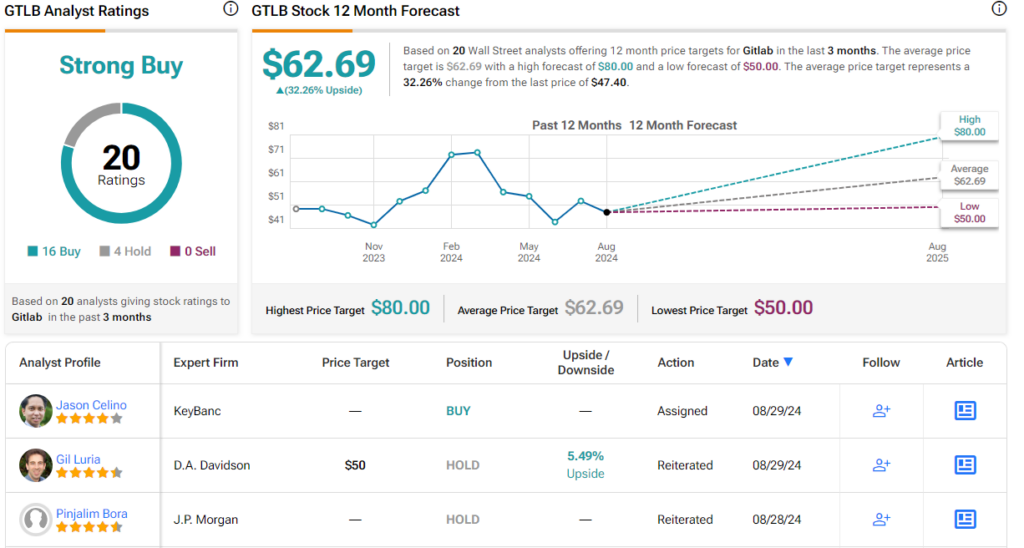

GitLab has earned a Strong Buy consensus rating from the Street’s analysts, based on 20 recent reviews that include 16 Buys to 4 Holds. The shares are priced at $47.40 and their $62.69 average price target is even more bullish than Kothari’s, suggesting an upside of 32% in the next 12 months. (See GitLab stock forecast)

JFrog (FROG)

Next up on our list is JFrog, a software firm working in DevOps and providing its users with a clean, efficient pathway to make regular, invisible software edits. The company’s goal with the platform is to make the workflow, from developers to users, secure and free of unnecessary hassles. JFrog’s DevOps tools are compatible with all major software technologies, and in an added convenience for all users, the platform enables a fully automated DevOps pipeline.

JFrog was founded in 2008, and today boasts millions of users and more than 7,000 paying customers worldwide – a total that includes a majority of the Fortune 100 firms. The company’s platform is popular with users and customers, as shown by its numbers on repeat customers. In the most recent earnings release, covering 2Q24, JFrog noted that it had 928 customers with annual recurring revenue (ARR) greater than $100,000, and that of that total 42 customers had ARR of $1 million or more. These figures represent solid increases from the numbers reported in the prior-year period (813 and 24 respectively).

That was the good news. However, investors were not fully pleased with the headline numbers of JFrog’s Q2 results, as shown by the 27% dive the stock took after the release. While the bottom line, of 15 cents per share in non-GAAP measures, was a penny better than expected, the company’s $103 million in revenue was down 22% year-over-year and missed the forecast by $600,000. The real hit, however, came due to management’s forward guidance. JFrog published Q3 revenue guidance in the range of $105 million to $106 million, well below the hoped-for $107.9 million. The full-year revenue guidance, with a midpoint of $423 million, also underwhelmed when compared to the estimated $428.4 million.

For analyst Kothari, the key point here is not JFrog’s recent miss, but rather the company’s move toward larger customers – a move that was reflected in the high-value ARR numbers. Kothari writes of the software firm, “JFrog’s strategic shift towards targeting larger enterprise customers represents a significant growth lever. By moving upmarket, the company aims to increase its average deal size and secure multi-year contracts, thereby enhancing revenue predictability. This transition is supported by the introduction of advanced features tailored to enterprise needs, such as robust security integrations and enhanced scalability options… The increasing adoption of JFrog’s Enterprise+ plan reflects the company’s success in catering to the needs of large-scale enterprises. Enterprise+ offers enhanced security, scalability, and support features that are critical for organizations with complex and demanding software release requirements.”

Looking ahead, Kothari rates FROG shares as Outperform (i.e. Buy) with a $32 price target that implies the stock will appreciate by 15% in the coming year.

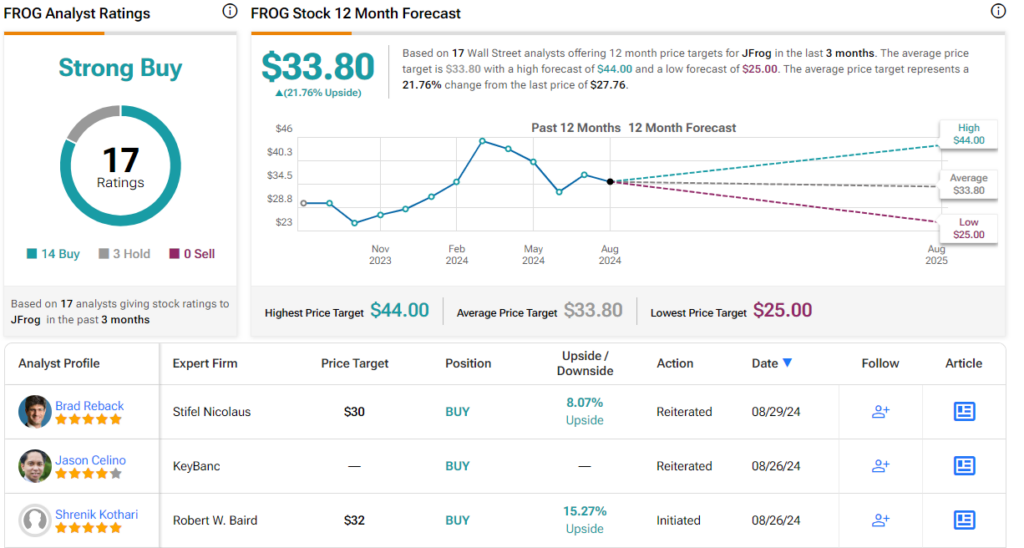

Overall, JFrog’s stock has a Strong Buy consensus rating based on 17 reviews with a breakdown of 14 Buys to 3 Holds. The stock’s $27.76 trading price and $33.80 average target price together point to a one-year upside potential of 22%. (See JFrog’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.