There are as many investment strategies as there are investors – some will follow growth stocks, others prefer value stocks, while still others look for dividend returns. Some investors take an aggressive approach, and others prefer to hold shares passively for the long term. All are viable strategies. But whichever one you follow, the real key to success is populating your portfolio with the right stocks.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

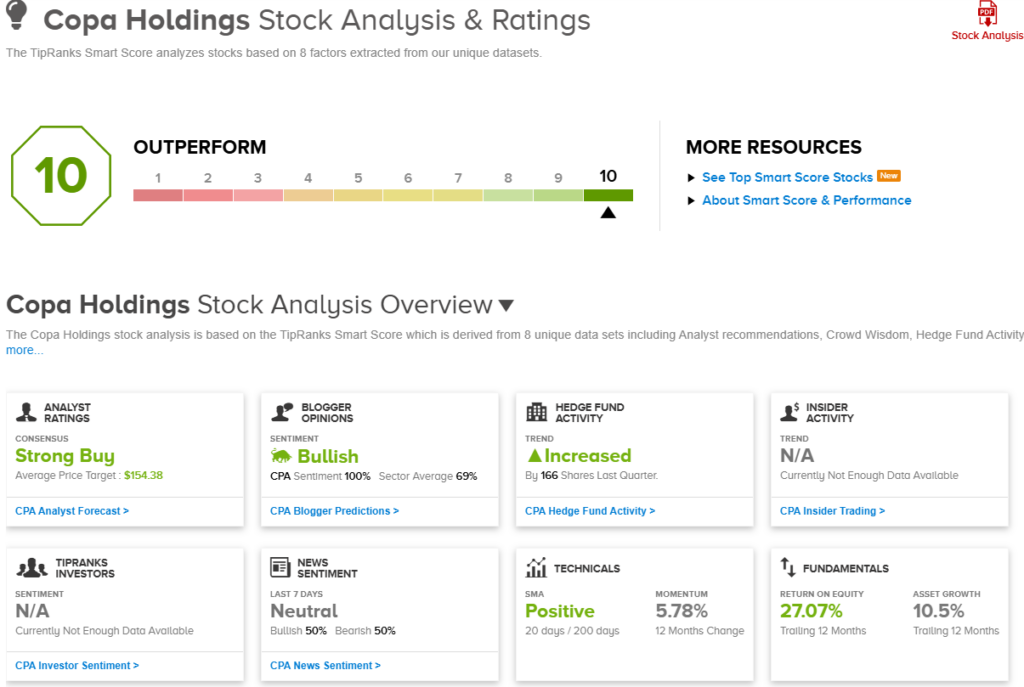

This is where the Smart Score comes in. The Smart Score is a data collection and collation tool, developed by TipRanks and powered by AI, using natural language algorithms to gather all of the markets’ data and use it to rate every stock against a set of factors that are known to predict future outperformance. The result is distilled down to a simple score, on a scale of 1 to 10, with the ‘Perfect 10s’ being stocks that deserve a closer look.

Using the TipRanks database, we’ve found a couple of these ‘Perfect 10s’ that have caught Wall Street’s eye. So, let’s take a closer look at these two high-scoring stocks and find out why the Street’s analysts are recommending them.

Boot Barn Holdings (BOOT)

The first ‘Perfect 10’ stock we’ll look at, Boot Barn Holdings, lives in the world of retail. Boot Barn is a lifestyle company, catering to customers seeking out apparel, footwear, and accessories with a Western theme – the American West, that is, with a cowboy flavor. The company is best known for its cowboy boots, workwear, and cold weather gear; the boots, especially, are considered high-end. Boot Barn has expanded its product lines, however, and offers a more fashion-oriented lineup of Western wear, with shirts, jackets, jeans, and other apparel for men, women, and kids.

Since its 1978 founding, Boot Barn has become the largest Western-themed lifestyle retailer in the US market. The company has a market cap of $4.2 billion and operates a network of 441 stores across 46 states, as well as an extensive e-commerce side with three separate websites: bootbarn.com, sheplers.com, and countryoutfitter.com.

At the end of January, the company released its financial results for fiscal 3Q25, which covered the quarter ending on December 28, 2024. In that quarter, Boot Barn expanded its network by opening 13 new stores and saw an 8.2% year-over-year increase in retail store same-store sales – along with an 11.1% y/y increase in e-commerce same-store sales. The overall year-over-year same-store sales increase for the quarter came to 8.6%. On the headline numbers, Boot Barn reported $608.17 million in revenue, in line with forecasts and up 17% year-over-year, while the company’s EPS, at $2.43, was 2 cents better than expected.

These numbers were generally considered good, but shares in BOOT have been on the backfoot since. That has been put down to heightened expectations and the fact the midpoint of the FQ4 profit forecast missed the estimates.

However, Bank of America analyst Christopher Nardone senses an opportunity in the selloff. Nardone is upbeat on the stock’s long-term potential, noting particularly that Boot Barn continues to expand its store footprint. He writes, “We maintain our Buy rating and think the recent pullback offers a particularly attractive opportunity to own one of the more compelling growth stories in retail… Following the 3Q print, we were encouraged by the strength of the QTD comp update of 8.3%, which includes softer sales during the last week in Jan due to the snowstorms in the South. Our positive thesis revolves around confidence in the new store pipeline, a growing customer base in a market with limited competition, and the ability for op margin expansion in F26 despite tariffs.”

Looking ahead, the analyst adds, “We think BOOT will finish the fiscal year (March) strong and have confidence that the company can deliver another year of mid-teens sales growth in F26. We are confident in the new store pipeline and expect management will deliver on 15% store growth, which equates to 9% in non-comp growth.”

Along with his Buy rating on the stock, Nardone gives BOOT a price target of $195, pointing toward an upside of 46% in the year ahead. (To watch Nardone’s track record, click here)

Overall, Boot Barn shares have picked up 12 recent Wall Street reviews, and the 11-to-1 split, favoring Buy over Hold, adds up to a Strong Buy consensus rating. The stock is currently priced at $138, and its $190.09 average target price suggests a one-year upside potential of 42.5%. (See BOOT stock forecast)

Copa Holdings (CPA)

From retail, we’ll switch over to the airline industry for a look at our next ‘Perfect 10’ stock. Copa Holdings is an airline company, operating through two subsidiaries, Copa Airlines out of Panama City and Wingo, a leading low-cost air carrier in Colombia. Copa, the larger airline, benefits from its central position in Panama, and operates flights across Latin America, the Caribbean, South America, and into the United States. The airline offers direct flights to such major regional destinations as Miami, Bogota, Sao Paulo, New York, and even as far north as Boston. Wingo operates mainly within Colombia, but can also take travelers to the Greater Antilles, the Yucatan, and to Lima, Peru.

Earlier this month, Copa Holdings released its monthly traffic statistics for January of this year. The results showed solid year-over-year gains, reflecting growth in the company’s fleet and its position as a leading Latin American air carrier. Available seat miles, or ASM, a key industry metric, came in at 2,774.6, for a 22.1% y/y gain, while revenue passenger miles (RPM), another key metric, was up 23.6%. The final traffic metric, load factor, or the percent of available seats that are filled on average, was up year-over-year from 85.3% to 86.4%.

Copa finished 2024 with a fleet of 112 aircraft, all various models of the Boeing 737. That number includes two 737 MAX 8 aircraft which the company took delivery of during the fourth quarter of the year. More than half of Copa’s fleet, 67 aircraft, are Boeing 737-800s, while 37 planes are 737 MAX 9s. Operating a large fleet of mainly homogenous aircraft allows Copa to realize financial savings on both air- and ground crew training and aircraft maintenance.

Turning to the financial results, we find that Copa reported a miss on the top line in 4Q24, with revenues coming in at $877.1 million. This was down 4% year-over-year, and was $3.6 million below the forecast. However, the company’s non-GAAP EPS, at $3.99, beat the forecast by 24 cents per share.

The beat on earnings was the key point brought out by analyst Rogerio Araujo in his coverage of Copa for Bank of America. Araujo sees this stock as a sound value, and writes of it, “In our view, Copa’s earnings beat is evidence that the company may continue to operate at a higher margin level in the foreseeable future, with the main driver being the company’s efforts to reduce costs, which seems sustainable… We have a Buy rating on an attractive valuation level, with the stock trading at 4.5x Adjusted EV/EBITDA, significantly below the 8x historical average.”

That Buy rating is accompanied by a $185 price target that implies an upside of 89% on the one-year horizon. (To watch Araujo’s track record, click here)

All 8 of the analyst reviews on COPA are positive, giving the stock a unanimous Strong Buy consensus rating. The shares have a trading price of $97.88 and an average target price of $154.38, together indicating room for a gain of 58% in the year ahead. (See CPA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.