A great preacher once said, “What has been is what will be, and what has been done is what will be done, and there is nothing new under the sun;” words of high poetry to stir the soul – and to let us ponder just how what has been can inform us of what is to come.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This works in the financial markets as well as it does from the pulpit, although any good financial advisor will tell you that past performance will not guarantee future results. That same advisor will also tell you that knowing how a stock has performed is essential for figuring out where it might go next. Growth stocks with solid histories of outperforming the broader market are always a good bet.

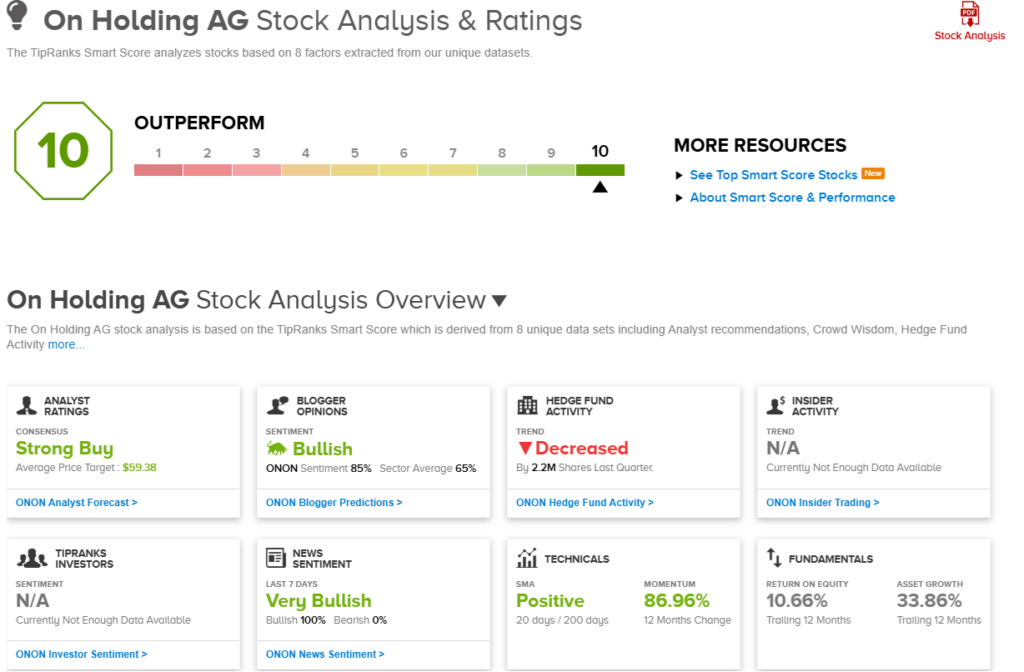

But what we really need is a tool to parse the huge volume of data in the market, and find the stocks with truly sound footings and upbeat prospects. This is where the Smart Score comes in, the advanced, stock-sorting data tool from TipRanks. The Smart Score uses a combination of AI and natural language algorithms to compare every public stock to a set of factors that have proven to be accurate predictors of future outperformance – and then gives those stocks a simple rating on an intuitive 1-to-10 scale, with the ‘Perfect 10s’ representing stocks that definitely deserve some closer attention.

We’ve gotten started on this, using the TipRanks data platform to look up 2 high-flying stocks that are poised to climb higher. Each of these stocks boasts a Strong Buy consensus rating and a ‘Perfect 10’ Smart Score – and has strongly outperformed the markets in recent months. Here are their details, presented along with comments from the Street’s analysts.

MasTec, Inc. (MTZ)

We’ll start with MasTec, a building firm that focuses its attention on energy and infrastructure. MasTec brings the skills, experience, and expertise needed to build out complex infrastructure projects, including community-scale public sewage systems, fiber and copper cable upgrades at military installations, large-scale solar power generation installations, city-scale water storage and water treatment plant improvements, and natural gas pipeline construction. This is just a sampling of MasTec’s recent project list; the company is capable of executing major projects in a wide range of engineering niches.

Among MasTec’s more important capabilities is its expertise in building power plants. Energy is a vital resource, no matter what its source, and MasTec is able to engineer and build power plants based on thermal power, alternative fuels, wind farms, and solar generation. MasTec can both design and build such plants from the ground up, as well as expand and maintain existing facilities, and is considered one of the top power plant builders in the US.

All of this requires a mass effort, and MasTec has the scale to match its projects. The company boasts a market cap exceeding $10 billion, and employs some 22,000 people – in every field imaginable, from architecture and administration to designers and engineers to drivers and pipefitters. In addition to its work in building power plants, MasTec is also heavily involved in deploying new technologies, and even in building out electric vehicle charging stations.

MasTec’s share price has seen some explosive action over the past year. The stock has gained 146% in the last 12 months, and year-to-date has outperformed the broader market by a wide margin, gaining over 78% compared to the 23% ytd gain on the S&P 500.

The gains have come even in the face of a mixed Q3 report. In the quarter, MasTec reported revenues of nearly $3.3 billion, flat year-over-year, and missing the forecast by $140 million. However, the company’s bottom line was strong. The $1.63 non-GAAP EPS was 40 cents per share ahead of the forecasts – and was a strong increase from the 95 cents per share recorded in the prior-year period.

For Truist analyst Jamie Cook, MasTec represents a sound opportunity, even after the stock’s big runup. Justifying her stance, Cook writes, “While MTZ has been one of the best performers among our coverage year to date, we still believe there is a significant opportunity for the stock to re-rate as the top line and margin performance improves for the company’s Power Delivery, Clean Energy & Infrastructure, and Communications segments… We believe as margins improve closer to those of MTZ’s primary competitor, Quanta Services, MTZ can re-rate as both players are leaders in the industry and have similar end market exposure.”

Looking ahead, the 5-star analyst adds, “In short, we believe MTZ is firing on all cylinders going into 2025 and has largely the same secular growth drivers and market dynamics as PWR while trading at a significant discount.”

Cook’s Buy rating comes with a $173 price target that suggests a 28% share price gain in the next 12 months. (To watch Cook’s track record, click here.)

There are 12 recent analyst reviews on file for MasTec, and their 10 to 2 breakdown, favoring Buy over Hold, supports the stock’s Strong Buy consensus rating. The shares are priced at $135.32 and the $152.64 average price target implies a one-year upside potential of 13%. (See MasTec’s stock forecast.)

On Holding (ONON)

The second stock on our list is based in Zurich, Switzerland, but operates around the world, in the sportswear and sporting equipment niche. The company is best known for its lines of athletic shoes, mainly described as ‘lightweight performance running shoes’, and also offers its customers lines of athletic and sporting apparel and a wide range of accessories for outdoor sporting activities. The company was founded in 2010, and has become a $16-billion-dollar-plus player in the footwear industry.

On Holding has built its success on its reputation for quality. The company’s shoes are premium products, based on the firm’s proprietary CloudTec innovation, and featuring purposeful designs for high-performance running and other outdoor training activities. On Holding has a large footprint, with business operations in over 60 countries. The company prides itself on good global citizenship, and 33% of the materials used in its top-selling products come from renewable or recycled sources. Since its founding, On has sold over 50 million products.

Turning to the company’s recent results, we see that On earlier this month reported some mixed 3Q24 results. Net sales reached CHF 635.8 million in the quarter, growing more than 32% year-over-year to hit a company record. At the bottom line, the non-GAAP EPS of CHF 0.15 was down 5 cents year-over-year. In US dollar terms, at current exchange rates, the company’s sales were $716.13 million, and the EPS came to just under 17 cents.

A particularly bright spot in On’s performance during Q3 was in the direct-to-consumer realm. The company’s DTC channel saw sales of CHF 246.7 million, up almost 50% year-over-year.

We should note here that ONON stock has posted a spectacular year-to-date gain, rising more than 92% in 2024.

Analyst Janine Stichter, writing on this company for BTIG, is optimistic about the long-term prospects here, especially the solid growth in DTC. She says of On, “We view Q3 as a representation of ONON’s true top-line momentum and go-forward earnings power, vs. Q2 when the business was heavily constrained, esp. at DTC. Still, we note tailwinds forming into ’25 as the company continues to benefit from DTC mix shift, begins to lap EMEA door closures, and starts to see distribution benefits from the Atlanta warehouse automation. The product pipeline remains robust, supported by rapidly growing brand awareness as marketing investments pay off… While valuation is at the top of the peer group, growth far outstrips even the closest peer, suggesting a premium multiple is warranted.”

Stichter puts a Buy rating on the stock, and her $64 price tag implies it will gain 23% in the year ahead. (To watch Stichter’s track record, click here.)

This stock has earned a Strong Buy consensus rating, based on 17 analyst reviews that include 15 to Buy against just 2 to Hold. The shares are trading for $51.92 and their $59.38 average target price points toward a one-year gain of 14%. (See On Holding’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.