The financial market cliché holds that past performance does not guarantee results – and that’s true, as far as it goes. We cannot predict the future.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

But stock investors do their best to predict just that. How else can they build a profitable portfolio? And as Shakespeare said in The Tempest, ‘past is prologue;’ what came before will inform what is to come. That applies in the stock market as much as it does in literature, or in magic. Where a stock has been, where it comes from, and how it has performed will all combine to point toward its likely future path.

Discerning that path is no easy trick. It’s defined by the volumes of data generated in every day’s trading – thousands of traders dealing in thousands of stocks multiplies into tens of millions of transactions every day. That’s a deep well of data to hold the answers we need.

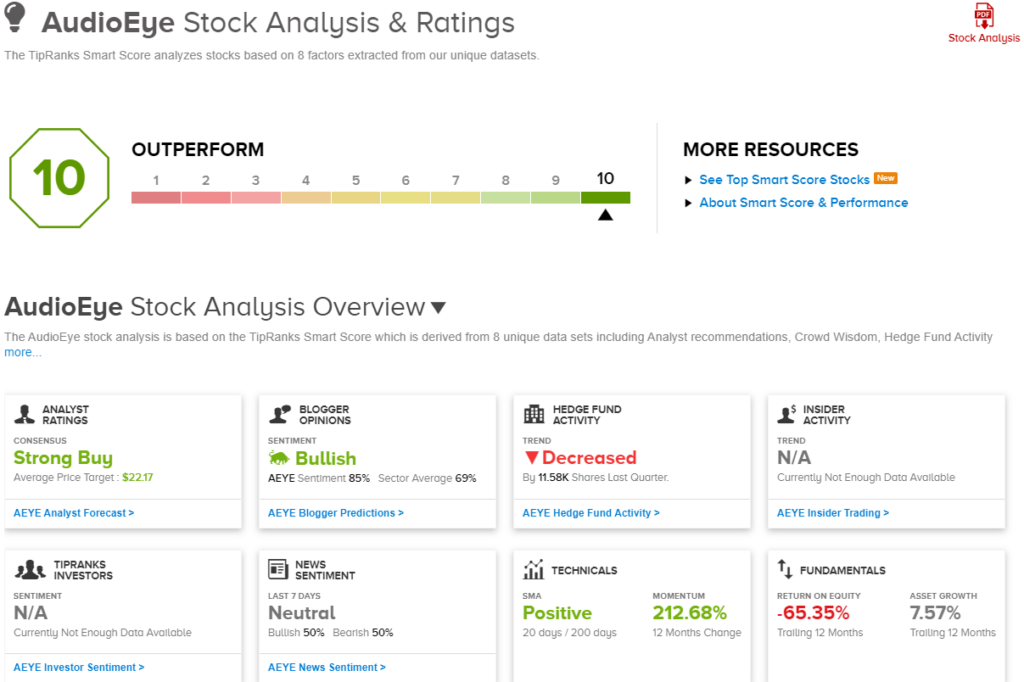

Getting those answers out of the well is no mean feat, but the Smart Score data tool facilitates the process. The Smart Score is based on the TipRanks database, and uses a sophisticated AI-powered natural language algorithm to collect and sort the volumes of market data – and to extract usable insights for every stock, based on a set of factors known to predict future outperformance.

That’s a valuable tool for investors, and one that everyone can use. We’ve gotten a head start on it, pulling up the latest information on two stocks that have been ticking all the right boxes and have earned the Smart Score’s highest rating – a Perfect 10. Each of these shares has also shown triple-digit growth this year, and holds a Strong Buy rating from the Wall Street analysts. Here are the details.

Dave, Inc. (DAVE)

Founded in 2017, Dave is a banking app, based on bringing simplicity and efficiency to the regular banking services that we use in our day-to-day lives. Think about your bank account – chances are, you opened it at a branch office, and you regularly deal with the same cashiers or bankers. While that brings the comfort of familiarity, the branch office and its personnel represent a considerable overhead expense for the bank. Dave does away with that, putting all of the ordinary banking services online, accessible through your PC or mobile device – and allowing the banking company to direct a higher portion of its resources directly toward serving the customers.

Among its key features, Dave offers unique tools such as Extra Cash, allowing customers to access up to $500 in a cash advance; Side Hustle, a jobs portal that brings the gig economy direct to your banking app; and the ordinary Spending Account, linked to the Dave Debit Mastercard, Apple Pay, or Google Pay – the choice is yours – and offering ways to track your spending. By keeping its overhead low, Dave can avoid charging many of the fees that we are familiar with from banks, minimum balance, ATM, etc, making its accounts more cost-effective for a lower-income customer base. In addition, the company uses an AI system to analyze customer cash flows and expenses when determining loan approvals, rather than relying on the traditional credit score system. And finally, Dave is covered by the FDIC for up to a quarter-million dollars per account, and maintains security through 24/7 fraud monitoring.

These are serious advantages for a banking app to bring to the table – advantages that make Dave an excellent fit for today’s digitally savvy generation of college grads and workforce entrants.

So, it’s no surprise that Dave has been showing solid growth in recent months. In the recently released results for 1Q24, the company reported 566,000 new members – while keeping acquisition costs flat. The number of Monthly Transacting Members bumped up 14% to 2.2 million. The company reported 10.8 million total members, up from 8.7 million in 1Q23.

These solid membership numbers supported solid revenue and earnings growth. The quarterly top line came to $73.6 million, up 25% year-over-year and beating the forecast by $2.85 million. At the bottom line, the company had an EPS, by GAAP measures, of $2.60, a sharp turnaround from the $1.19 per-share loss reported in the prior-year quarter – and a solid $2.88 ahead of the estimates.

These strong growth numbers, both in customer numbers and financial results, provided a firm foundation for investor optimism – and DAVE shares have gained a very impressive 328% so far this year.

This stock’s growth, and its potential to keep growing, has caught the eye of Seaport analyst Jeff Cantwell, who writes, “We believe DAVE has significant runway to further grow its user base, deepen its customer relationships, and drive more profitable growth over time… We expect DAVE to execute against its strategy, growing into its massive TAM of 180MM potential users while doing so in a ‘smart second mover’ way that to us, sounds like it will be increasingly profitable over time… Bottom line, we believe DAVE has multiple years of 20%+ revenue growth ahead of it, and also think there’s a credible adj. EBITDA ‘story’ which we expect to be characterized by expanding adj. EBITDA dollars and margins annually. We believe there’s plenty of runway for the company both in terms of growing its MTMs and expanding ARPU…”

For Cantwell, this adds up to a Buy rating, while his $58 price target points toward a potential upside of 62% on the one-year horizon. (To watch Cantwell’s track record, click here.)

There are only 4 recent analyst reviews on file for Dave, but they are all positive – giving the stock a unanimous Strong Buy consensus rating. The shares are priced at $35.87 and the average price target of $64.50 implies a 12-month gain of 80% for the shares. (See Dave’s stock forecast.)

AudioEye, Inc. (AEYE)

Now we’ll turn to AudioEye, a company focused on digital accessibility. There is so much in life that we take for granted – things as simple as navigating a sidewalk or opening a website – but for people with disabilities, those tasks can be far from easy. According to the US Census Bureau, as recently as 2021 there were some 42.5 million people living with some form of disability, or about 13% of the noninstitutionalized population. Federal laws – and in many cases, state laws as well – require that public and private entities provide accommodations for people with disabilities.

AudioEye has turned those legal mandates into a business. The company operates a software platform based on digital accessibility, giving customers and users high-end tools designed to better open the digital world for people with disabilities – and to put enterprise clients into compliance with legal mandates such as the Americans with Disabilities Act (ADA). The AudioEye platform’s accessibility tools include both automated and self-managed plans to put websites and digital platforms into compliance with ADA standards, using such features as closed captioning, content organization, alternative text, and subtitling. In addition, AudioEye can offer continuous site monitoring to ensure that customers remain in compliance; legal protections; and recognized certification of ADA compliance.

It’s important that end users – that is, site users with disabilities – receive the full range of information presented through digital means, and from this end-user perspective, AudioEye’s products are easy to use and touch on multiple aspects of digital inclusion. Voice interfaces, altered screen colors, and audio playback to data inputs are just some of the tools put onto websites. For webmasters and subscribers, the key point here is that AudioEye does not alter the webpage source code or underlying architecture and that it keeps current with the frequently changing requirements of legal compliance regimes.

AudioEye’s last quarterly release, covering 1Q24, was described by the company as showing the ‘thirty-third consecutive period of record revenue,’ an impressive achievement. The first quarter revenue came to $8.1 million, up more than 4% year-over-year, and it slid over the forecast by $60,000. The company’s non-GAAP earnings-per-share, of 8 cents, came in 2 cents per share better than had been anticipated. While the company’s stock has pulled back in recent weeks, it remains up by 214% so far this year.

The basic story on AudioEye is upbeat, and Richard Baldry, an analyst ranked amongst the top 2% of Wall Street stock pros, thinks so too. “We believe AEYE’s digital accessibility platform is a uniquely valuable Cloud Services franchise,” the 5-star analyst said. “Recent regulations appear poised to pressure website and application providers to improve accessibility over the intermediate-term, which should disproportionately benefit AEYE. We also believe its recurring revenue model offers investors attractively rebounding revenue growth (forecasting 17.5% in 4Q24 versus 4.0% in 1Q24) and improving profitability (forecasting 13% AEBITDA margin in 2024 versus 2023’s 4%).”

Baldry goes on to outline a clear path forward for this stock’s long term, adding, “We view AEYE as a well-executing SaaS vendor that should continue to support a premium valuation given our outlook for rapidly rising growth in revenues and earnings, and a belief that 10-20% revenue growth can be sustained for an extended period of time (at least 5-10 years).”

These comments support Baldry’s Buy rating on AEYE shares, while the analyst’s $25 price target implies that the stock will gain 47% by this time next year. (To watch Baldry’s track record, click here.)

Once again, we’re looking at a stock whose Strong Buy consensus rating comes from four unanimously positive analyst reviews. The stock is selling for $17.01 and has an average target price of $22.17, indicating room for a 30% one-year upside potential. (See AudioEye’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.