The S&P 500 has surged 22% year-to-date, underscoring a renewed wave of investor optimism that’s propelling stocks and strengthening the long-term bull market. While gains have been driven primarily by the ‘Magnificent 7’ tech giants and other mega-cap stocks, there are plenty of other stocks showing great growth potential in this environment.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

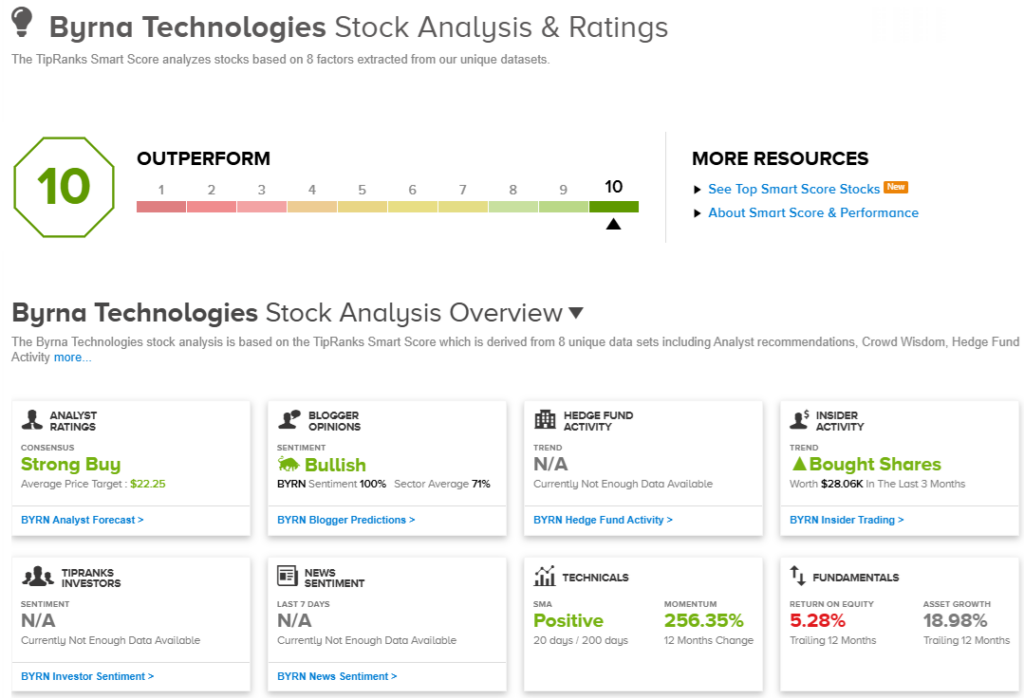

The only challenge is finding them, and that’s where the Smart Score comes in handy. This is a sophisticated data collection and collation tool from TipRanks, putting AI tech and natural language processing to work for investors – by gathering the vast data of the stock market and thoroughly parsing it. The Smart Score algorithm analyzes every stock and compares it to a set of factors that are known to predict future outperformance – and then it gives them a simple rating, a score on a scale of 1 to 10, to show investors at a glance where the shares are likely to go in the near term.

We’ve opened up the TipRanks database to find a couple of small- and mid-cap stocks that have earned the ‘Perfect 10.’ These are top-scoring stocks, and their combination of a high Smart Score and high growth potential should definitely attract investors’ attention. Here are the details.

Chart Industries (GTLS)

We’ll start in the clean energy industry, where Chart Industries operates as a provider of cryogenic cooling technology necessary for the production and transport of liquefied natural gas. In addition, Chart develops and distributes cryogenic and compression equipment used in the industrial gas markets. The company’s product portfolio is vital in every aspect of the liquefied gas supply chain, including the upfront engineering, service and maintenance, and repair.

Liquefied natural gas, LNG, is an essential component of the global transition toward clean energy sources. Natural gas is the cleanest burning of fossil fuels, and combines that with a relatively low cost. Chart, with its sound niche in the LNG supply chain, is well-positioned to continue gaining in this $100-billion-plus industry.

Chart has a global position, with offices and facilities in the Americas, Europe, Asia, Africa, and Australia. The company is always working to expand its presence in its markets, and earlier this month Chart entered into an agreement with ExxonMobil to provide IPSMR liquefaction process technology to the oil giant’s Rovuma LNG project in Mozambique.

Chart will release its Q3 results on November 1, but a review of its Q2 2024 performance offers insights into its current standing. Chart reported record revenue of $1.04 billion, a 14.5% year-over-year increase, though slightly below forecasts by $70 million. On earnings, the company posted a non-GAAP EPS of $2.18, missing projections by 27 cents per share. Looking ahead, total orders for the quarter reached $1.16 billion, up 12.1% from Q2 2023, with Chart guiding for full-year 2024 EPS in the range of $10.75 to $11.75.

This clean energy industrial stock has caught the eye of Seaport analyst Walt Liptak, who describes it as a ‘top pick,’ and notes the company’s strong product base and sound earnings potential.

“GTLS is one of our favorite stocks and a top pick due to the unique positioning of the products for the energy transformation toward cleaner fuels including LNG and Hydrogen. We believe that the fundamental demand for GTLS products are solid, and should provide stronger 2025 sales visibility. We are increasing our 2024 and 2025 EPS estimates to $10.83 (from $10.75) and $13.74 (from $13.59), respectively, due to slightly lower interest expense than our previous forecast,” Liptak opined.

“We believe that the GTLS operations should generate stronger future free cash flow to help lower the debt level to $3.4B (from $4B in Q2:24). We reiterate our Buy rating, due to the expected sales and profit growth, and the low valuation,” the analyst added.

Liptak’s Buy rating comes with a $235 price target, which suggests a 12-month gain of 90% in store for the stock. (To watch Liptak’s track record, click here)

Zooming out to the Street view, we find that the stock has a Strong Buy consensus rating, based on 12 analyst reviews that break down 9 to 3 favoring Buy over Hold. The shares are priced at $123.68 and the $178.45 average price target implies a 44% one-year upside potential. (See GTLS stock analysis)

Byrna Technologies (BYRN)

The next stock on our list, Byrna Technologies, lives in an entirely different niche – the self-defense industry, specifically, the less-than-lethal weapons niche. Byrna develops, produces, and markets a line of CO2 guns – gas-powered projectile weapons designed to provide a less-than-lethal option for self-defense use or as an option for law enforcement officers. Byrna’s guns, designed to mimic the appearance of semi-automatic pistols or rifles, fire pellet projectiles, either solid ‘kinetic energy’ rounds or bursting chemical rounds. The former are solid shots, designed to deter an assailant, while the latter are designed to incapacitate attackers, using either pepper spray or tear gas derivatives.

Byrna’s weapons are designed to give users the advantages of a firearm without the liability of using deadly force – while avoiding the need for close-range or hand-to-hand combat. The guns are powered by carbon dioxide compressed-gas cartridges, pressurized to 800psi, and are constructed of the same high-grade steel and aluminum used in standard firearms. Because they are not firearms, and are designed to be non-lethal, the Byrna guns are legal in all 50 states, and can be ordered and delivered through ordinary mail service.

In the last few years, urban crime has become a hot-button political issue, based in part on a perception that crime rates are skyrocketing. One side effect of that has been a ready market for self-defense products – and Byrna has been a beneficiary. The company reported record-level revenue of $20.9 million in its fiscal 3Q24. That top line beat the forecast by a hair’s breadth, $50,000, but more importantly, was up 194% year-over-year. The company’s bottom-line EPS of 4 cents per share was a penny better than had been expected. The stock is up 141% so far this calendar year.

In coverage of the stock for Roth Capital, analyst Matt Koranda sees several reasons why this stock should bring good news for investors, including: “(1) Byrna remains on-track to deliver a strong 4FQ; (2) we see the CL as driving a new product cycle and growth in F2025 and beyond; (3) Byrna’s store expansion strategy looks attractive and underpins part of our F2025/F2026 sales outlook; and (4) Byrna can self-fund growth capital needs for the foreseeable future, while also buying its own stock.”

To this end, Koranda puts a Buy rating on Byrna shares, with a $20 price target to indicate potential for a ~30% gain in the year ahead. (To watch Koranda’s track record, click here)

Overall, the stock has garnered unanimous support from analysts, with a Strong Buy consensus rating. Currently trading at $15.43, BYRN shares carry a $22.25 average price target, suggesting a potential 44% upside over the next 12 months. (See BRYN stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.