The S&P 500 hit its recent trough on October 27, when it bottomed out at 4,117. Since then, however, the index has had its single best week of 2023 – and it’s up 6% from that low point.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The catalyst? A solid Q3 earnings season. With more than half of the S&P 500 companies having reported so far, 78% are beating expectations – well above the historical rate of 75%. In addition, the average ‘beat’ is well over 7%. The strong earnings have economists predicting Q3 earnings growth of about 2.4% when all is said and done.

The solid earnings results outweighed a soft October jobs report, and provided fuel for the sharp jump in stocks. Investors are feeling bullish again, and Wall Street’s analysts are finding the shares that will provide the strongest gains.

Sounding off from the banking giant Barclays, two analysts are upgrading their stock calls, turning bullish as the overall markets are rising. It’s a clear signal for investors that these shares deserve a closer look. We’ll take a closer look at them, using details from the TipRanks database and the commentaries from the Barclays analysts.

Don’t miss

- Bitcoin Could Hit $150,000 by 2025, According to Bernstein — Here Are 2 Top Bitcoin Miner Stocks to Bet on It

- Top Analyst Sees Opportunity Brewing in These 2 Credit Card Stocks

- TipRanks’ ‘Perfect 10’ List: There’s an Opportunity Brewing in These 2 Top-Rated Stocks

Kontoor Brands (KTB)

We’ll start with Kontoor Brands, a manufacturer and distributor in the soft goods industry, making clothing for the global market. Kontoor specializes in denimwear and is the owner of both the Lee and Wrangler brands. The company is based in North Carolina and describes its mission as making clothes that ‘look good and feel right.’ It sounds simple, and it’s led Kontoor on a path of long-term success.

In addition to building success and reputation as a clothing company, Kontoor has also held fast to a conservationist commitment. Since 2008, the company has kept to a goal of saving water – an important resource in the clothing industry. In October of this year, Kontoor announced that it had met its goal of saving a cumulative 10 million liters of fresh water, some two years ahead of schedule.

On the financial side, reducing water consumption and waste did not prevent Kontoor from posting solid earnings numbers for the third quarter of this year. At the top line, Kontoor reported $655 million in total revenue, a figure that was up 8% year-over-year and came in $14.3 million better than had been expected. The earnings figure was somewhat mixed; the GAAP EPS of $1.05 was up from the 90 cents per share reported in 3Q22 but missed the forecast by 13 cents per share. At the same time, the non-GAAP earnings came to $1.22 per share, 3 cents better than had been expected.

The key metric, however, was in the gross margins. Kontoor reported a 3Q23 gross margin of 41.5%. This was down 200 basis points year-over-year – but that decrease was attributed to an unanticipated duty expense and a proactive inventory management action. Without those charges, the gross margin would have registered a y/y improvement.

In his coverage of Kontoor Brands for Barclays, analyst Paul Kearney cited the gross margin recovery as his first point in upgrading the stock. Kearney wrote of his reasons for the change in stance, “Our upgrade is based on 1) Gross margin recovery in the intermediate term driven by lower cost product, favorable mix, and significantly cleaner inventory; 2) wholesale channel normalization; and 3) tangible market share gains within U.S. total denim driven by wholesale.”

These points support Kearney’s Overweight (i.e. Buy) rating on KTB, while his price target, now set at $59, implies a one-year upside potential of 19% for the stock. (To watch Kearney’s track record, click here)

Overall, KTB shares have a unanimous Strong Buy rating from the analyst consensus, based on 3 recent positive reviews from the analysts. The stock is selling for $49.58, and its $58.33 average price target indicates room for ~18% gain in the next 12 months. (See KTB stock forecast)

Park Hotels & Resorts (PK)

The second stock we’re looking at is Park Hotels & Resorts, a real estate investment trust, a REIT. The company owns and operates 43 premium, brand-name hotels and resorts, boasting a total of around 26,000 rooms in prime US markets. The company’s property portfolio is entirely in the US, with approximately 86% of the total rooms falling into the luxury or upper-level upscale segment. Park works with renowned, top-end hotel brands such as Hilton, Marriott, and Hyatt.

The company’s resort portfolio has recently benefited from favorable market conditions in New York and Hawaii, where the company owns properties on the ‘Big Island’ and in Honolulu. These markets were unaffected by the Maui wildfires, which has reduced competition. Additionally, ongoing renovations at properties in Florida, in Orlando and Key West, hold the promise of improved earnings in the future.

In its Q3 earnings report, Park Hotels & Resorts delivered solid results, reporting $679 million in revenues, exceeding expectations by over $11 million. On the bottom line, the funds from operations reached 51 cents per share, showcasing a substantial 21% increase from the prior year and surpassing the forecast by 8 cents.

Park also declared a 15-cent common share dividend – a payment that was supplemented by a 77-cent common share special dividend. The company’s regular dividend annualizes to 60 cents per share and yields 4.5%. The Board has already made it clear that it is committed to paying out an additional special dividend during the fourth quarter.

For Barclays analyst Anthony Powell, the combination of secular tailwinds and a solid dividend together are reason for an upgrade. He writes of this stock, “Looking into 2024, PK should benefit from secular tailwinds in Hawaii and New York, renovation uplift in Key West and Orlando, and strong group trends. Importantly, PK’s generous ongoing cash returns to shareholders is back, including a dividend yield that is one of the highest in all of REITs.”

All in all, Powell upgraded this stock from Equal Weight (i.e. Neutral) to Overweight (i.e. Buy). His price target of $19 suggests the stock will appreciate by 41% on the one-year horizon. (To watch Powell’s track record, click here)

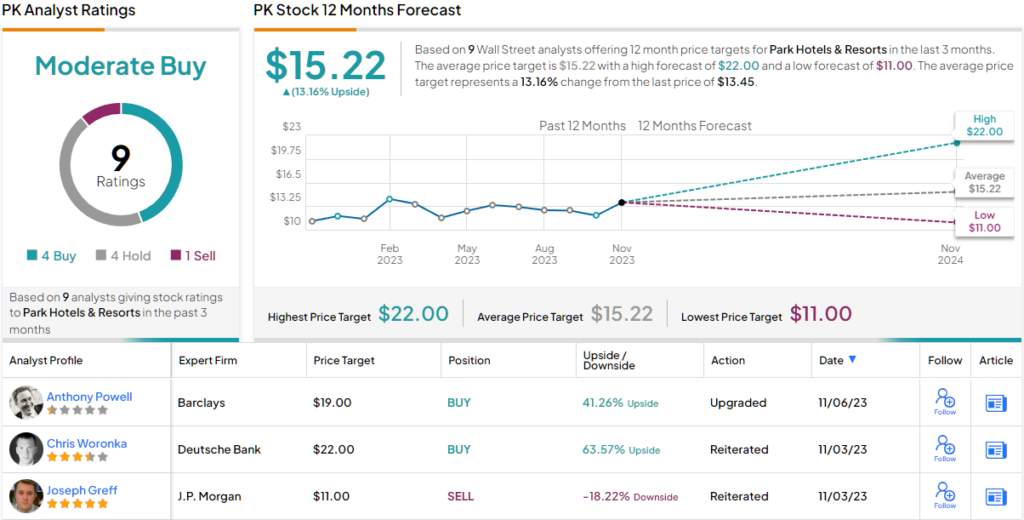

While the Barclays view here is highly bullish, opinions from other analysts are more spread out. The shares have a Moderate Buy consensus rating, based on 9 recent analyst reviews that break down to 4 Buys, 4 Holds, and 1 Sell. The stock’s $13.45 trading price and $15.22 average target price together imply a 13% one-year upside potential. (See PK stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.