Tilray, Inc. (TLRY) engages in the research, cultivation, production, and distribution of medical cannabis and cannabinoids, focusing on medical cannabis research, cultivation, processing, and distribution of cannabis products worldwide. Its headquarters are in Canada, and it was founded in 2018. Tilray has subsidiaries in Australia, Canada, and Germany, and it produces medical cannabis in Canada and Europe.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

One of the most critical events in 2021 for Tilray was its business combination with Aphria, which was officially closed on May 3, 2021. Is this business combination what Tilray needed to become a global cannabis leader?

I am bearish on TLRY stock as I believe its weak fundamentals are disconnected from the current market capitalization. (See Analysts’ Top Stocks on TipRanks)

Tilray Business Highlights

Tilray’s leading brands, SweetWater Brewing Company and RIFF Cannabis have collaborated to launch SweetWater RIFF, its first ready-to-drink (RTD) cocktail in the U.S. market.

Tilray continues its expansion of medical cannabis footprint in Europe, as “it has been selected by the Luxembourg Ministry of Health as a supplier of Good Manufacturing Practice (GMP) certified medical cannabis products for the country’s medical cannabis program.”

Focusing on strengthening its market share in Canada Tilray signed a distribution agreement with Great North Distributors, Inc. to become its exclusive representative of adult-use cannabis products in Canada, except for the Quebec area.

Tilray has a wide range of brands such as Good Supply, Riff, Solei, Canaca, The Batch, Chowie Wowie, and Broken Coast.

Tilray Business Combination with Aphria: The Big Bet on Synergies

On May 3, 2021, Tilray announced the official closing of the transaction, making the new business combination of Tilray with Aphria. The main goal of this strategic deal was to take advantage of synergies, about $81 million annual pre-tax cost-saving synergies within 18 months.

Additional benefits include further financial strength, accelerated growth, and sustained profitability. Tilray has a bold vision to transform the global cannabis industry based on its diversified brands. Can it succeed? It is too early to answer as we should wait for the synergies to materialize first.

I argue, though, that based on the recent Q1 2022 earnings report and mostly on its financial performance, Tilray has a long and challenging pathway to achieve profitability.

Q1 2022 Earnings: Positive Revenue Growth, Net Losses Widened

Tilray reported its Q1 2022 financial results stating on the positive side that net revenue and gross profit increased 43% and 46%, respectively, it was the 10th consecutive quarter of positive adjusted EBITDA, and that $55 million in cost-savings achieved already on a run-rate basis to date.

The revenue growth of 43% to $168 million during the first quarter from $117 million in the prior-year quarter is very positive. Digging down the report, though, investors read that Tilray reported a net loss of $34.6 million during the first quarter compared to a net loss of $21.7 million in the prior-year quarter.

The U.S cannabis legalization is currently a hot topic, but unfortunately, Tilray’s cannabis remains illegal on the federal level. In the scenario that there will be a legalization of cannabis in the U.S. market, then Tilray will benefit significantly from revenue growth. The same thing applies to Europe as well, as cannabis is not legal for use.

From a fundamental perspective, Tilray has had strong sales growth over the past four consecutive years. The weak spots for Tilray are that it is losing money and has decided to fund its growth plans at the expense of shareholders. Shareholders have been diluted in the past year, with total shares outstanding growing by 46.3%.

TipRanks’ Smart Score

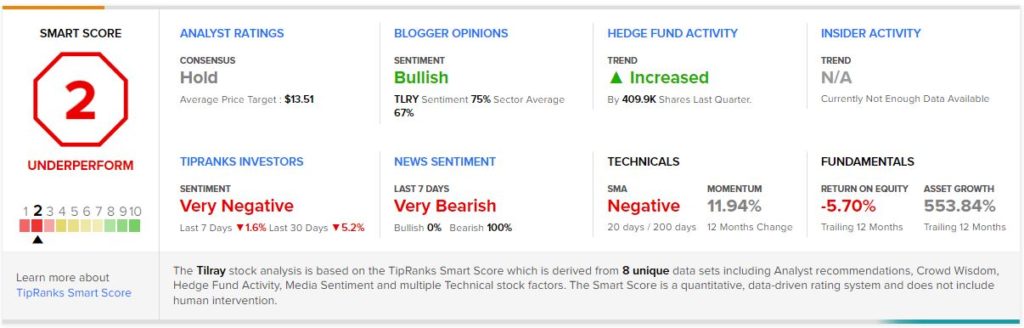

Looking at TipRanks’ Smart Score rating system, TLRY scores a 2 out of 10, signaling that it may underperform the market. TipRanks investors share very negative sentiment now.

Financial Metrics

Turning to longer-term trend analysis of key financial metrics, Tilray, on an annual basis, has narrowed its gross margin to 24% for FY 2021, the lowest for the past five consecutive years.

Its operating margin has been weak for Fiscal Years 2017-2021, being only barely positive in 2020 and negative all the other years. For Fiscal Year 2021, the operating margin reported was -13.4%. This is a key catalyst that shows that for the moment, Tilray cannot make a profit from its core operations.

Investors should wait for the synergies to turn to profitability by saving costs. However, a global expansion means higher capital expenditures, and free cash flow is another very weak trend for Tilray. The debt/equity ratio of 0.20 for Fiscal 2021 may not seem excessive, but debt has to be repaid via positive free cash flows, which have been absent for all years in the last five trend history.

Wall Street’s Take

Turning to Wall Street, Tilray has a Hold rating consensus, based on two Buys, eights Holds, and one Sell rating assigned in the past three months. The average Tilray price target of $13.50 implies 45.6% upside potential.

Disclosure: At the time of publication, Stavros Georgiadis, CFA did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >