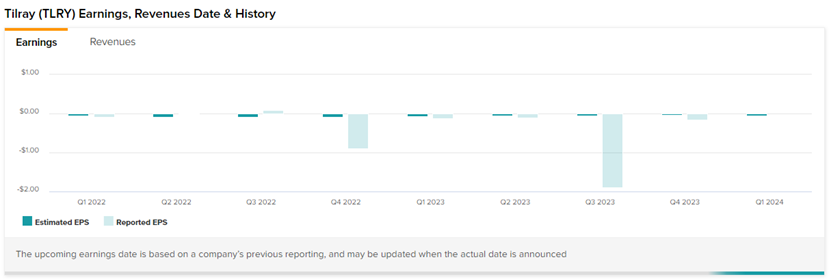

American cannabis company, Tilray (NASDAQ:TLRY) (TSE:TLRY), is scheduled to report its Fiscal Q1-2024 results on October 4 before the market opens. Tilray has failed to exceed earnings expectations in the past. Only in two out of the last eight quarters has the cannabis leader outperformed earnings estimates. Year-to-date, TLRY stock has fallen by 17.5%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Even so, the inclusion of cannabis businesses under the SAFE Banking Act could give a lift to the sector. Reports note that the Act would open up banks to legal cannabis operations and has a “pretty good” level of bipartisan support.

Moreover, the U.S. Department of Health and Human Services has proposed to the U.S. Drug Enforcement Agency (DEA)—to reclassify marijuana to a “Schedule III” drug from a “Schedule I” drug. A “Schedule III” drug is considered to have a “low risk for psychological or physical dependence.” This move will also boost the availability and adoption of cannabis lifestyle products.

What Wall Street Expects from Tilray Results

The Street expects Tilray to post a diluted loss of $0.05 per share on revenues of $174.31 million. In the prior year’s comparative quarter, Tilray reported a diluted loss of $0.13 per share on revenues of $153.21 million.

Importantly, Tilray completed the acquisition of eight beer and beverage brands from Anheuser-Busch (NYSE:BUD) on October 2. The transaction makes Tilray the fifth-largest craft brewer in the U.S., taking the company’s market share in the country to 5%. Such diversification efforts by Tilray enhance its future prospects.

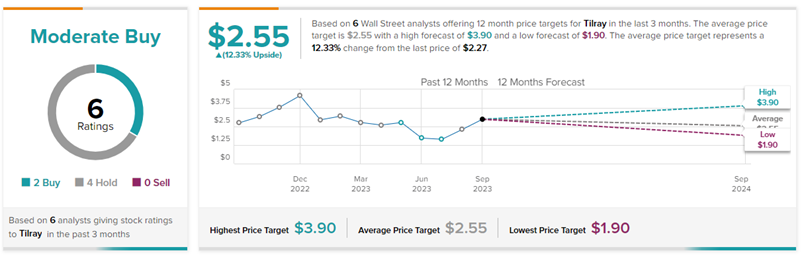

Is TLRY Stock a Buy, According to Analysts?

Tilray could be a good bet in the long run, especially with the recent acquisition of beer and beverage brands from Anheuser. A few more strategic moves by the company could lead to better days ahead for the company and related share price appreciation. Meanwhile, Tilray stock has a Moderate Buy rating on TipRanks, meaning analysts are cautiously optimistic about TLRY.

This is based on two Buys versus four Hold ratings assigned in the past three months. Also, the average Tilray stock price target of $2.55 implies 12.3% upside potential from current levels.