Just when the UK retail sector was enjoying the recovery phase after the pandemic, the fears of recession and reduced consumer spending started building up. Even though companies are struggling with the rising costs, the analysts feel the long-term prospects are bright.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

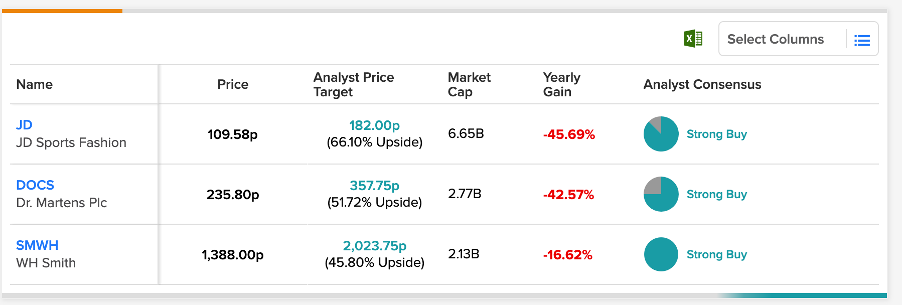

Keeping that in mind, we have shortlisted three retail stocks that have ‘Strong Buy’ ratings from the analysts. JD Sports Fashion (GB:JD), Dr. Martens (GB:DOCS), and WH Smith (GB:SMWH) are three such stocks that have been trading down in the last year, but analysts feel they have huge potential to grow.

Here, we have used the TipRanks Stock Screener tool to list out the strongly rated stocks in the retail sector. With the help of this tool, we can screen stocks from any particular sector based on different criteria.

Let’s see why the analysts are so positive about these stocks.

JD Sports Fashion Stock

JD Sports Fashion is a UK-based retailer of footwear and apparel specialising in sports and outdoor categories. The company has its brand labels along with some global brands such as Nike, Adidas, Puma, and more.

JD Sports’ stock is down by 45% in the last year. With discretionary income going down, the company’s sales are affected just like many retail brands. However, analysts are bullish on the stock considering the solid customer base for the company. The main customers for the company is the younger generation who have a strong desire to own the latest brands.

The company recently put an end to the governance issues and appointed Regis Schultz as the new chief executive of the company. Schultz has huge experience across different retail formats, and the shareholders are expecting a smooth resolution of its investigations.

In its full-year results for 2022, the company posted a record profit before tax of £947.2 million, as compared to £421.3 million in 2021. This reflected the company’s strength in brand partnerships and improved consumer engagement in both offline and online mediums.

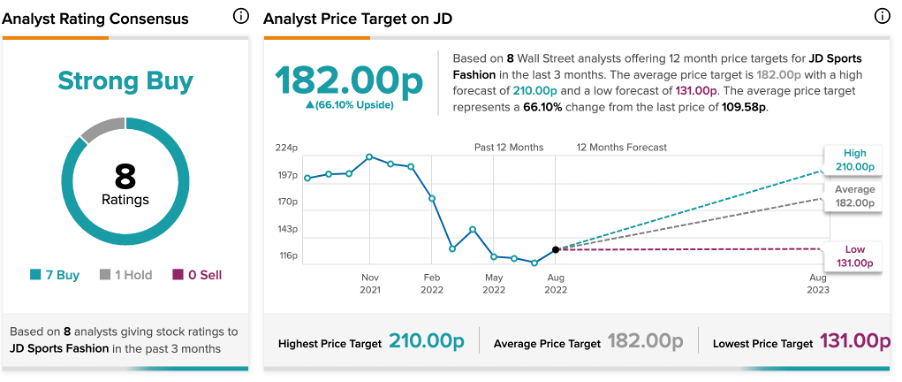

The JD Sports Fashion target price is 182p, which has around 66% upside potential from the current price level. The stock has seven Buy ratings and one hold rating.

Dr. Martens’ Stock

Dr. Martens operates as a manufacturer and seller of footwear and accessories. It is headquartered in the UK but has a global presence. The company has the advantage of a strong brand lineage, which gives it a loyal customer base.

The company posted an 18% growth in its revenue of £908.3 million for the full year of 2022. The profit before tax jumped by a huge 207% to £214.3 million. The results were ahead of market expectations and largely benefited from a focused approach on DTC (direct to consumer) sales. The DTC segment contributed 49% to the total sales, and the company expects it to increase to 60% in the medium term.

Dr. Martens is an ambitious company. The company announced its intentions to further expand into some of the most profitable markets, such as China, Japan, Germany, and the U.S.

Increased marketing budgets for e-commerce and DTC channels, geographical expansion, and brand recognition make the future look brighter than ever. Also, the stock has been trading down by 43% in the last year, making it the right time to buy.

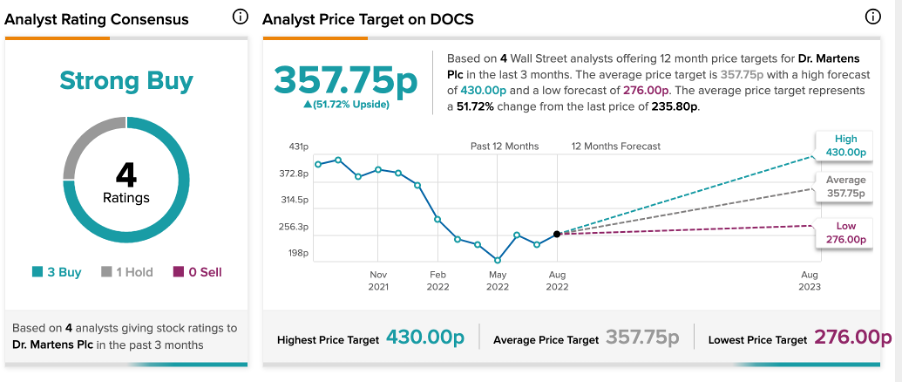

Dr. Martens’ average target price is 357.7p, which is 51.7% higher than the current price level. It has three Buy ratings and one Hold rating.

WH Smith Stock

WH Smith is a global retailer with a chain of stores mainly at airports, railway stations, workplaces, and hospitals. The product range mainly includes confectionery items, stationery, newspapers, etc. The company also sells products online through its websites.

The company has a strong buy rating based on four buy ratings from analysts. The SMWH target price is 2,023.7p, which shows a growth of 45% on the current price level. Richard Taylor from Barclays has recently reiterated his rating on the stock with a target price of 2,180p.

Just like its peers, WH Smith’s stock is also down by 15% in the last year. However, the company has shown better flexibility in terms of facing the pandemic and now the tough retail situations. This is primarily due to its increased emphasis on travel stores, which are experiencing a significant sales recovery.

In June 2022, the company posted its trading update for the third quarter with a strong performance in the travel segment. The total group revenue was 7% ahead of 2019 levels and the travel segment’s revenues were 23% ahead of 2019 levels.

With strong sales at airport outlets and 125 new stores yet to open, WH Smith is well-placed to gain from these growth opportunities. The company expects its full-year revenue to be on the top end of the guidance numbers.

Conclusion

All three companies have posted impressive numbers in their results and have recovered well after the pandemic. Rising inflation does pose some headwinds, but the overall growth story is bullish.