Last year brought us a solid bull market, and so far this year stocks are continuing the winning streak. A look at the NASDAQ shows a 12-month gain of 30%, and the S&P 500 index is up 25% over the same period. It’s an environment that has investors looking for solid choices with more room left to run.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The usual move is buying low and selling high – but that’s not the only route to find a winning investment. There are plenty of sound investments to be found in shares that have already given us the ‘show-me’ story, with strong outperformance in recent months. While these stocks are up, their outperformance doesn’t mean that they’ve hit the wall, and they frequently still have room for more growth.

Wall Street’s analysts are looking at just that theory, and are picking out stocks that are showing triple-digit percentage gains in the last 12 months and are still going strong. We’ve opened up the database at TipRanks, to look at the latest scoop on two such stocks; each has a Strong Buy consensus rating from the Street, and upbeat comments from the analysts. Here are the details.

Soleno Therapeutics (SLNO)

We’ll start with Soleno Therapeutics, a biopharma company working on the development of new drug candidates for the treatment of rare, genetic diseases. The company has recently completed a clinical trial series on its leading candidate, diazoxide choline, or DCCR, and has submitted the New Drug Application to the FDA. The agency is expected to announce, by the end of August, whether the drug has been accepted for review.

DCCR has been developed as a treatment for Prader-Willi Syndrome, a serious, life-altering genetic disease that is typically diagnosed in earliest childhood. The drug, a proprietary extended-release formulation of a crystalline salt of diazoxide, was tested in a once-daily oral tablet formulation, and in clinical trials demonstrated clinically significant positive results. DCCR has shown high potential as a treatment for hyperphagia, or excessive hunger, commonly associated with Prader-Willi.

The company’s progress in developing DCCR, and in moving the drug through the clinical trial and regulatory submission process, has provided a solid underpinning for the stock over the past year. In September of last year, after a positive data release on 77 patients in the clinical program, the stock jumped from $4.43 to more than $26 – and it has continued moving up since then. For the past 12 months, SLNO stock is up a huge 869%.

Baird analyst Brian Skorney has staked out an upbeat position on Soleno, based on the potential of DCCR. He believes that this drug, with its potential patient base between 8,000 and 10,000 in the US, is on track for approval – a good outlook for investors. He writes of the company, “We think the regulatory approval of Soleno’s lead drug candidate is more likely than the market is currently crediting. The FDA has openly discussed needing to adjust for studies run during COVID (as was the case here) and being flexible when it comes to rare diseases (also the case here). Ultimately, we see DCCR as fitting nicely into a range of recent orphan approvals that have all resulted in substantially bigger opportunities (despite regulatory controversy) than implied by Soleno’s valuation.”

Skorney goes on to give SLNO shares a rating of Outperform (Buy), and his $72 price target implies an upside potential of almost 40% for the next 12 months. (To watch Skorney’s track record, click here)

While there are only 4 recent reviews of this stock on record, they are unanimously positive – giving the shares a Strong Buy consensus rating. The stock has a $70.75 average price target, suggesting a 37% increase from the current trading price of $51.55. (See SLNO stock forecast)

MoneyLion (ML)

The next stock on our big gainers list is MoneyLion, a fintech company in the personal banking segment. The company offers a wide range of personal financial services, including options for advisory, lending, and investing, with all of the services oriented toward the consumer market. MoneyLion counted 14 million customers last year, and it targets the ‘average American,’ that majority of the US population that makes ends meet while surviving paycheck to paycheck. The company makes a set of streamlined, high-quality financial options available to this customer base.

MoneyLion bills itself as a populist financial services company, one that uses tech to boost its product offerings. The company offers ‘access for all,’ making it possible for low-heeled consumers to make use of personalized banking and to make educated financial decisions. MoneyLion handled some 205 million customer inquiries last year, averaging more than 50 million every quarter.

All of this makes for a popular service, one that powered the company to 15.5 million customers per its 1Q24 report – for a 98% increase year-over-year. In the financial results, the company reported $121 million in quarterly revenue, up by 29% y/y and beating the forecast by $4.69 million. The company turned a profit in the quarter, of 60 cents per share by GAAP measures – a figure that came in 68 cents per share better than had been expected. In addition, the GAAP net income total, of $7 million, marked a company quarterly record.

The strong results have helped power the stock, which for the past 12 months is up an impressive 635%.

For Lake Street’s Jacob Stephan, it’s the combination of execution and potential for further growth that forms part of the appeal here. “We believe MoneyLion has executed well diversifying enterprise segment revenues with adjacent product offerings,” said the analyst. “Revenue mix from personal loans is now just 60% of revenue, down from 90% at the time of the acquisition. Management has highlighted further diversifying its enterprise revenue mix is a focus for 2024, and we expect to see more credit card, mortgage, and insurance offerings hit the platform. Ultimately, we think more shots on goal (offers) will result in more goals (offer redemptions) for MoneyLion.”

Stephan follows this up with a Buy rating on the stock, and with a $109 price target that indicates a one-year upside potential of 25% (To watch Stephan’s track record, click here)

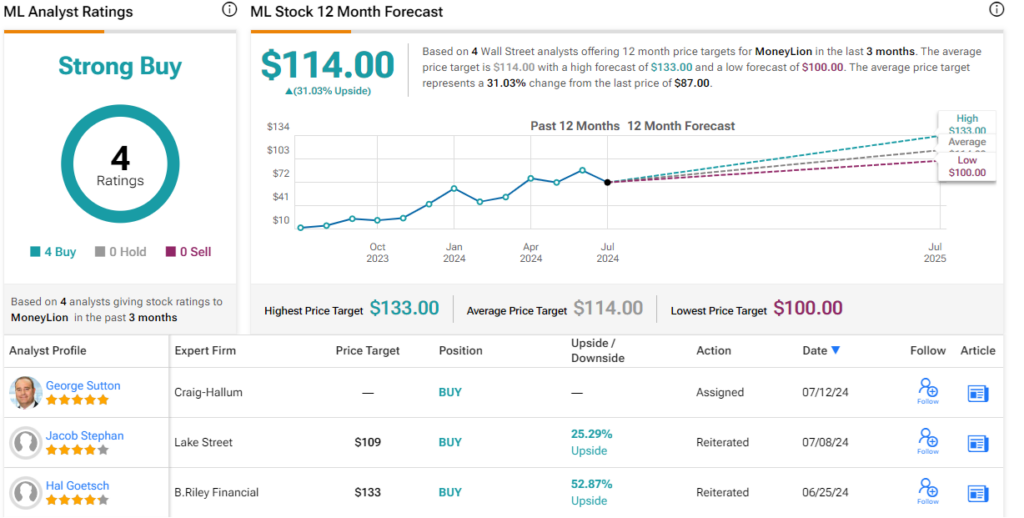

Once again, we’re looking at a stock with 4 unanimously positive analyst reviews and a Strong Buy consensus rating. The shares are trading for $87 and have a $114 average price target that suggests a gain of nearly 31% over the one-year timeframe. (See MoneyLion’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.