Many signs and expert predictions hint at a fast-approaching recession. At such times, most investors find it safe to hold cash and stay as far away from the market mayhem as possible, which is understandable.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Notably, corporate insiders have a clear understanding of the fate of a company. Wouldn’t it be great to get information about these trades so we can follow their views and make informative decisions as well? Well, TipRanks has a solution for this! TipRanks’ insider trading tool tracks around 92,619 insiders and updates their daily trading activities.

Today, in our Expert Spotlight, we will look at expert insider Clifford Sosin, founder and portfolio manager of CAS Investment Partners. Sosin has a Bachelor of Science in Engineering (High Honors) and a Bachelor of Arts in Economics from Swarthmore College.

Before starting his own company, Sosin worked as a Director in the Fundamental Investment Group of UBS, analyzing equities and fixed income securities, and also worked as an analyst at Silver Point Capital, a hedge fund specializing in distressed asset investments.

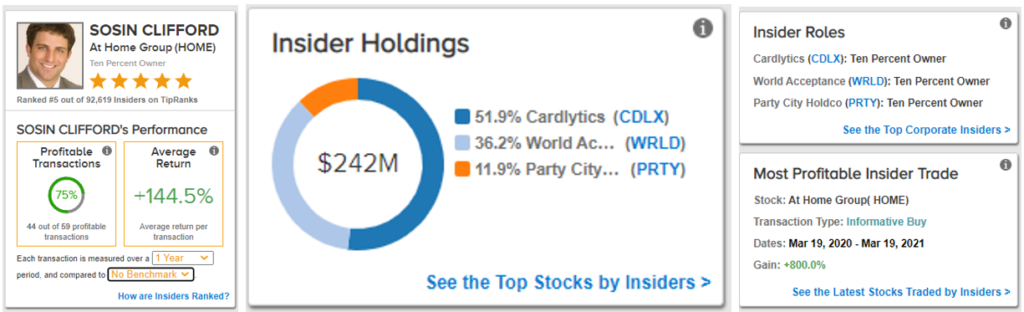

According to the TipRanks Star Ranking system, Sosin currently holds the #5 spot among the 92,619 corporate insiders in its universe.

Through his business acumen, 75% of Sosin’s transactions have been able to generate positive returns, with an average return of a whopping 144.5% over the past year.

Additionally, during the same period, our expert’s calls have generated an alpha of 119.3% over the S&P 500 (SPX) and an alpha of 112.7% over the sector’s performance.

Sosin’s Most Prominent Trades

Sosin has been a shareholder of four companies (more than 10% stake), one of which, At Home Group, went private in a 2021 buyout deal. It was during that time that Sosin made his most profitable trade to date with an informative Buy call between the periods of March 19, 2020, and March 19, 2021, and generated an exceptional 800% return.

Currently, Sosin has around $242 million invested in the other three companies. Let us study Sosin’s calls on them.

Cardlytics (NASDAQ: CDLX)

Atlanta-based Cardlytics is a digital advertising platform that serves banks and other financial services providers to run loyalty programs that drive customer loyalty and deepen relationships. CDLX stock closed up 11.2% at $25.78 yesterday but has lost 62.4% year to date.

A majority (51.9%) of Sosin’s funds are invested in CDLX, with a current value of $125.55 million. Sosin has been a constant Buyer of CDLX stock and enjoys a success rate of 77% with an average profit on the stock of a hefty 104.2%.

However, as per TipRanks Insider Trading Activity, insider confidence is currently Negative on CDLX stock, as corporate insiders have sold $1.5 million worth of CDLX shares in the last three months.

Party City Holdco (NYSE: PRTY)

Next up is a New York-based supplier of decorated party goods, Party City Holdco. PRTY stock makes up 11.9% of Sosin’s investments and is currently valued at $28.75 million. Sosin has been a consistent buyer of the stock. However, last month, Sosin made an informative Sell call on the stock worth $639,900.

Notably, as per TipRanks Insider Trading Activity, insider confidence is currently Positive on PRTY stock, as corporate insiders have bought $5.8 million worth of PRTY shares in the last three months.

Sosin has a 50% success rate on his calls on PRTY stock with an average return of 121.3% per stock. PRTY is a penny stock hovering around $1.44 and trading at about an 86% discount from its yearly peak of $10.43.

World Acceptance Corp. (NASDAQ: WRLD)

South Carolina-based World Acceptance Corp. engages in the small-loan consumer finance business, offering short-term small installments, medium-term larger loans, related credit insurance, ancillary products, and services to individuals.

WRLD closed at $116.50 on June 21 and is 56% off its all-year high. Although Sosin has not actively engaged in trading the WRLD stock lately, his portfolio has a 36.2% exposure to the stock and is currently valued at $87.40 million. Sosin boasts a 100% success rate on the WRLD stock, with an average profit per stock of 78%.

Concluding Thoughts

With his expertise, Clifford Sosin has a proven healthy track record. Although not very popular, Sosin’s investments seem to be generating huge profits.

Every investment comes with its own risk-reward story. If you want to hedge the current uncertainty and volatility in the market, it would likely be relatively safe to follow the convictions of TipRanks’ Top Experts’ opinions to successfully steer your investment decisions.