Amidst the noise of blue-chip giants, penny stocks quietly beckon investors with the allure of undiscovered potential. For those willing to dive deep into the market’s undercurrents, these low-priced equities promise a treasure trove of opportunity.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The ‘pennies’ are stocks priced under $5 per share, and simple math tells us that even a small gain in absolute value will quickly turn into a high-percentage return.

What’s the flip side? Minor share price depreciation can fuel major percentage losses. By nature of these massive movements, penny stocks are notoriously volatile.

The analysts at Piper Sandler are willing to shoulder this risk – and they are recommending two pennies in particular for massive gain. According to the analysts, these two stocks could jump at least 300% in the coming year.

According to the TipRanks database, both have also been cheered by the rest of the Street, as they boast a ‘Strong Buy’ consensus rating. Let’s take a closer look.

Zura Bio (ZURA)

We’ll start with a clinical-stage biopharmaceutical company, Zura Bio. This company is focusing on the creation of new drugs in the field of immunology, specifically in the treatment of autoimmune and inflammatory conditions. Zura is following a dual-pathway approach, to meet patients’ therapeutic needs and provide a tangible improvement to their well-being. To this end, the company has three assets in the development pipeline, all of which have completed Phase 1 clinical trials and are considered ready to advance to Phase 2.

The company’s leading asset is tibulizumab, an anti-IL-17 and anti-BAFF dual antagonist that is potentially first in its class for the treatment of both hidradenitis suppurativa (HS) and systemic sclerosis (SSc). The first of these conditions is an inflammatory follicular skin disease and is estimated to impact between 300,000 and 400,000 patients in the US. The second condition is an autoimmune disease causing tissue inflammation and fibrosis and is potentially fatal. Tibulizumab showed promise in early testing and is currently scheduled to initiate a Phase 2 study in the treatment of SSc during 4Q24, as well as a Phase 2 study in HS during 2Q25.

The company’s second asset is ZB-168, described as a ‘fully human-IgG1 monoclonal antibody targeted against the IL-7Rα,’ a pathway that plays an important role in the development, functioning, and homeostasis of immune system T cells. Zura believes that ZB-168 offers promise as a therapeutic choice for autoimmune diseases that involve the IL-7 or TSLP signaling paths.

Finally, Zura is working with torudokimab, its third drug candidate. This drug is another monoclonal antibody, described as fully human and high affinity. Torudokimab’s action is described by the company as neutralizing IL-33, preventing ST2-dependent and ST2-independent (e.g., RAGE) inflammation.

Based on the potential of Zura’s solid set of assets, and its $3.43 share price, Piper Sandler analyst Yasmeed Rahimi thinks that now is the time to get in on the action.

“Zura Bio is a clinical stage biotech company that is thoughtfully developing a pipeline of best-in-class antibodies that act across dual pathways for the treatment of diseases across inflammation and immunology with high unmet need… ZURA has 3 differentiated assets in Ph2 development across 4 indications, where we point out that all of these compounds have been in-licensed from leading large pharma companies such as Eli Lily and Pfizer, substantially de-risking these assets and positioning ZURA for rapid commercialization in our view,” Rahimi noted.

“Considering the multitude of upcoming catalysts with 9 in IL-17/BAFF, 14 in IL-7 and TSLP, and 5 in IL-33, we believe these catalysts will drive significant share gains as they validate the potential for pipeline expansion opportunities, opening the door for a ‘pipeline-in-a-product’ and unlocking further sequential value across each of ZURA’s assets,” Rahimi added.

To this end, Rahimi rates ZURA stock an Overweight (i.e. Buy), and her price target of $26 implies a robust one-year upside potential of 659%. (To watch Rahimi’s track record, click here)

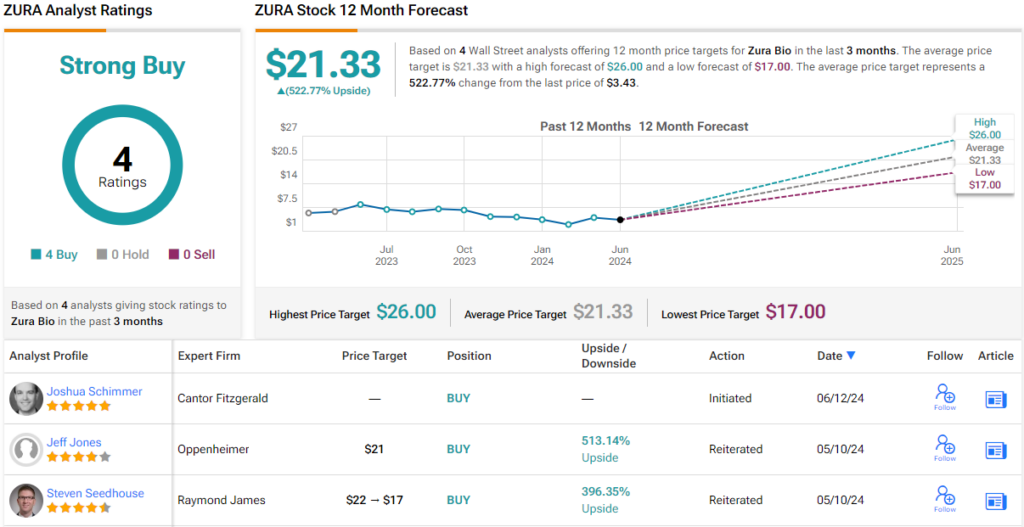

Are other analysts in agreement? They are. 4 Buys and no Holds or Sells have been issued in the last three months. So, the message is clear: ZURA is a Strong Buy. Given the $21.33 average price target, shares could soar ~523% from current levels. (See ZURA stock forecast)

Monte Rosa Therapeutics (GLUE)

The second penny stock on the list of Piper Sandler picks is Monte Rosa, another biopharmaceutical company. Monte Rosa is working with protein degradation to develop new treatment approaches for a variety of disease conditions. The company came to this approach through the realization that many human disease conditions are caused or exacerbated by abnormal intracellular protein function, specifically, irregularities in protein degradation, the process by which old, nonfunctioning, or irregular proteins are broken down and cleared from healthy cells and tissues.

Monte Rosa uses molecular glue degraders (MGDs) to induce protein-protein interactions, and to enable the elimination of targeted proteins. The company believes that this approach may open up new treatment options, by the elimination of therapeutically relevant proteins that have resisted treatment by the current panoply of small molecule drugs on the market.

For now, Monte Rosa is working with MGDs that promote degradation of targeted proteins by facilitating interactions between those targeted proteins and a ubiquitin ligase. The MGDs bind to the ubiquitin ligases, and create new surfaces on the targeted proteins. These surfaces are complementary to the therapeutically relevant targets, and allow promotion of protein degradation. The company uses its QuEEN platform, a proprietary technology, to rationally design, develop, and deploy the MGDs.

The leading drug candidate, created on the QuEEN platform, is MRT-2359. This MGD is ‘potent, selective, and orally bioavailable,’ and is designed to promote targeted degradation of the GSPT1 protein, through induction of interactions between cereblon (CRBN), a component of the E3 ubiquitin ligase and the translation termination factor GSPT1. This drug candidate is advancing in an ongoing Phase 1/2 clinical trial, and data from the Phase 1 segment is expected for release during 2H24.

This company’s novel approach and early success with its QuEEN platform have caught the eye of Piper Sandler analyst Edward Tenthoff.

“While computational approaches are common in protein degradation, QuEEN is sophisticated and comprehensive, enabling the company to rationally design MGDs… Importantly, QuEEN is now rapidly yielding MGDs against therapeutically relevant targets. We expect Monte Rosa to create shareholder value by reporting clinical data on MRT-2359, and by advancing and expanding its early MGD pipeline, and potentially signing additional partnerships… We see the opportunity for Monte Rosa to close the valuation gap with other TPD plays Arvinas and Kymera…”

In Tenthoff’s view, GLUE shares deserve an Overweight (i.e. Buy) rating, and his $16 price target on the stock suggests that a 12-month gain of 315% lies ahead. (To watch Tenthoff’s track record, click here)

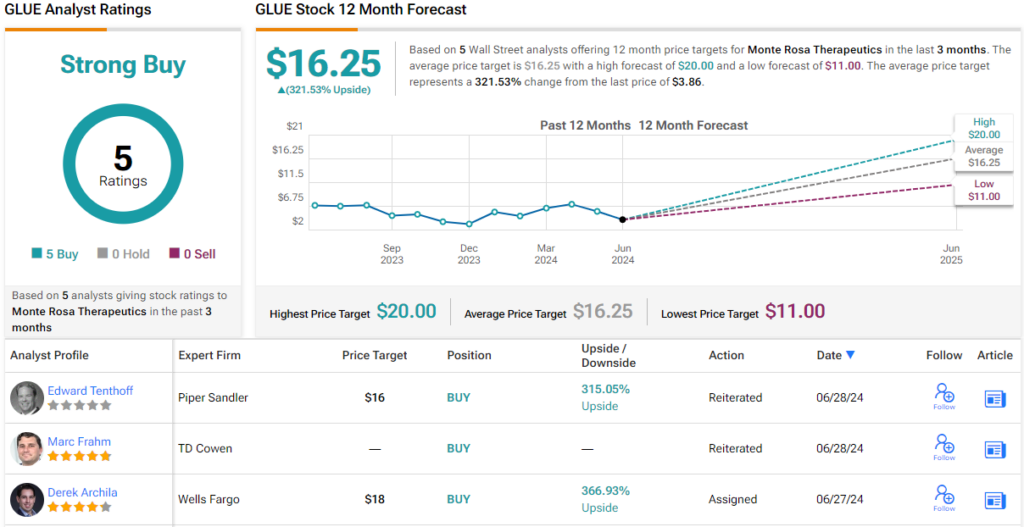

Do other analysts agree? They do. Only Buy ratings, 5, in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. The shares are trading for $3.86 and their $16.25 average target price indicates room for a 321% increase from that level. (See GLUE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.