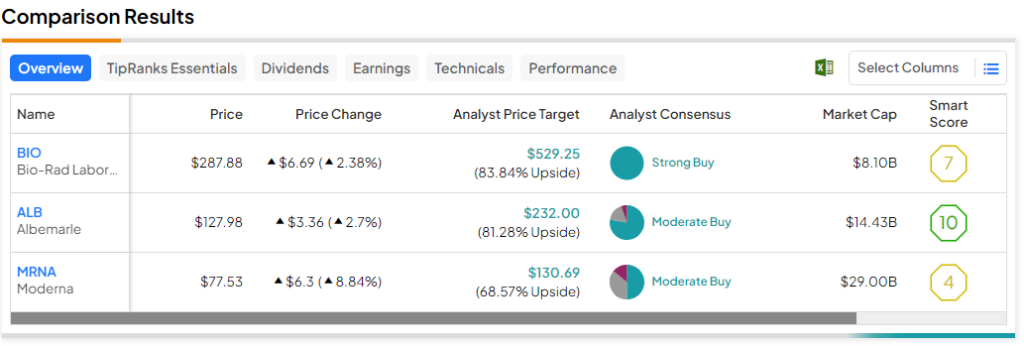

The S&P 500 (SPX) just had its best week of 2023, as it gained about 5.9%. Nonetheless, there are a few S&P 500 stocks (not the same old big-tech stocks) that, according to analysts, still have plenty of upside potential. The three S&P stocks with the highest upside potential are Bio-Rad Laboratories (NYSE:BIO), Albemarle (NYSE:ALB), and Moderna (NASDAQ:MRNA).

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a look at them below using TipRanks’ Comparison Tool.

Bio-Rad Laboratories (NYSE:BIO)

As you can see above, the S&P 500 stock with the highest upside potential is BIO, as analysts expect it to gain almost 84% in the next 12 months. It also has a Strong Buy rating since all four analysts covering the stock are bullish on it. Bio-Rad Laboratories makes and sells products for scientific research and healthcare labs to conduct tests and experiments in fields like medicine and biology. The stock is down 33% YTD.

Albemarle (NYSE:ALB)

Albermarle also has high upside potential (81.3%), according to analysts. The company produces a wide range of specialty chemicals for various industries, including electronics, construction, and pharmaceuticals, with a focus on lithium compounds for batteries, bromine for safety applications, and catalysts for oil refining. ALB is a giant in the lithium mining industry, and Elon Musk says, “Lithium batteries are the new oil,” so this is a stock worth checking out. It’s currently down 41.6% YTD.

Moderna (NASDAQ:MRNA)

Lastly, we have Moderna, which most investors are probably familiar with. Moderna is a biotech firm that creates vaccines and treatments for various diseases by using mRNA technology. The stock has fallen by over 56% YTD. As a result, analysts expect it to rebound by 68.6% over the next year.

The Takeaway

While the S&P 500 just had its best week of 2023, and the index itself is up about 15% for the year, the three stocks mentioned above are all down significantly this year. Yes, these stocks have the potential to be bargains because of their low share prices (and optimistic analyst price targets), but it’s important to recognize that they can still continue much lower before maybe rebounding. Nonetheless, these stocks are worth looking into for risk-taking investors.