Electric vehicle (EV) giant Tesla (NASDAQ:TSLA) has long been the market leader. Though the EV sector is overcrowded, no competitor has managed to overtake its market position or its relentless pursuit of innovation. This year’s macro headwinds posed some challenges for the EV maker, which reported lackluster Q3 earnings. However, many Wall Street analysts see a silver lining, with margins improving in the near future. As a result, I am also bullish on TSLA stock now.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Tesla offers a wide range of EVs that cater to various segments, ranging from luxury sedans to affordable SUVs. The stock has dropped 26.5% from its 52-week high due to price cuts that have resulted in margin compression this year. Yet, it has gained 96.1% year-to-date, outperforming the S&P 500’s (SPX) 11% gain.

Short-Term Headwinds Strained Tesla’s Q3

Tesla missed analysts’ revenue and earnings consensus estimates in the third quarter. Total revenue of $23.4 billion was around a 9% year-over-year increase, falling $794.4 million short of analysts’ expectations. Further, earnings per share (EPS) came in at $0.66, missing analysts’ consensus estimate by $0.07.

Globally, Tesla delivered 435,059 vehicles in Q3, down sequentially from 466,140 in Q2. Still, deliveries grew by nearly 27% year-over-year, and Tesla assured investors that it would hit its target of 1.8 million vehicle deliveries for the year.

This year, the company shifted its focus to volumes amid rising interest rates. It had to make price cuts on its EVs, which took a toll on its margins. Price cuts, rising production expenses for the Cybertruck, plus artificial intelligence (AI) and other research and development (R&D) projects all contributed to margin compression in the third quarter.

In the Q3 earnings call, CEO Elon Musk stated that there could be production challenges for the Cybertruck, but he still expects Tesla to produce 250,000 Cybertrucks per year by 2025.

However, Musk also said that the company’s Energy and Service division is becoming its “highest-margin business,” contributing “over $0.5 billion to quarterly profit.” Energy generation and storage revenue jumped a whopping 40% year-over-year in Q3.

The Long-Term Outlook is Bright

The company maintains a strong liquidity position. It ended the quarter with $26.1 billion in cash, cash equivalents, and investments, and free cash flow of $0.85 billion. These funds can be used for future projects. Tesla remains committed to maintaining a strong balance sheet while weathering the tough economic environment.

Tesla’s efforts to reduce costs, ramp up production, and invest in AI will position it well for long-term growth.

Additionally, Morgan Stanley (NYSE:MS) analyst Adam Jonas believes Tesla’s AI-powered Dojo supercomputer has the potential to unlock $500 billion in economic value. Dojo could provide Tesla with a moat, giving it a competitive advantage over its peers. The analyst has the highest target price of $380 (implying 79.2% upside potential) for TSLA with a Buy rating.

What Are Analysts Saying About Tesla?

Wall Street’s opinion on Tesla’s Q3 earnings was a mixed bag. Bernstein analyst Toni Sacconaghi found the Q3 results to be weak. Tesla’s “hesitancy” about its Mexico factory worried the analyst, as he believes the facility could have produced a lower-cost Model 2. The analyst rates the stock as Sell, with a $150 price target.

Meanwhile, on a more optimistic note, RBC Capital Markets analyst Tom Narayan said, “Investors will likely focus their attention on the cautious commentary on 2024 and on the potential delay of the Next Gen product, but we suspect this could be all part of a master pivot from being a volume car maker to becoming a Tier 1 supplier to [original equipment manufacturers].”

He added, “Tesla’s cars can still be a proof of concept and make money on selling [Full Self-Driving] subscriptions, but we think selling power electronics, batteries, charging, and ultimately FSD, could be far more profitable.” The analyst has a Buy rating with a target price of $301 (41.9% upside potential).

What’s more, five-star-rated Piper Sandler analyst Alexander Potter believes that Tesla’s margins will improve as the cost of goods sold per unit continues to rise, which could help margins recover. Tesla’s Energy segment also impressed the analyst.

The analyst rates the stock a Buy with a target price of $290. He referred to TSLA stock as his “favorite holding over the next year (and beyond),” even as it’s “tricky to identify upside catalysts in the next few months.”

Robert W. Baird analyst Ben Kallo also shared a similar opinion about Tesla’s Energy and Services business driving margins upward. He has a Buy rating with a target price of $300 for TSLA.

Looking ahead, for 2023, analysts expect Tesla’s revenue to jump 19.6% year-over-year to $97.4 billion, further increasing to $121.4 billion in 2024.

What is the Price Target for TSLA Stock?

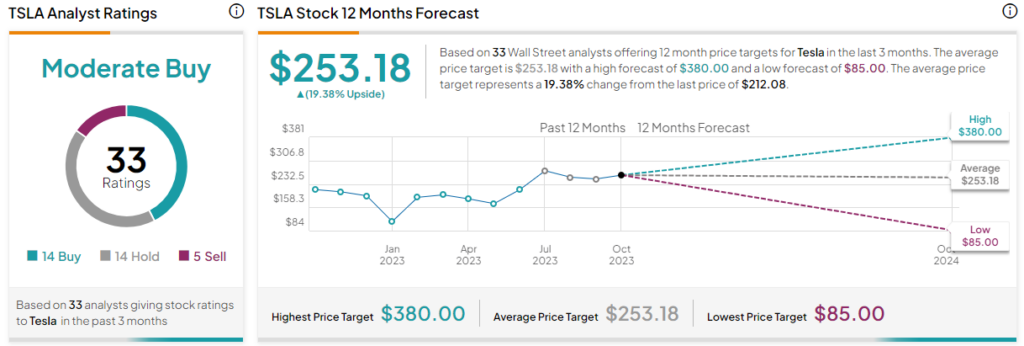

Overall, out of the 33 analysts covering TSLA stock, 14 recommend a Buy, and 14 recommend a Hold, while five say it’s a Sell. The average Tesla stock price target is $253.18, implying 19.4% upside potential.

The Takeaway for Tesla Stock

Summing up, Tesla has remained at the forefront of revolutionizing the way we perceive and use electric vehicles, with the goal of making electric mobility a mainstream choice. Despite the near-term pressure on its margins, most analysts believe the company will be able to recover in the long haul as macro-economic headwinds wane. The company is poised to grow as EV adoption advances, making it a promising EV pick.