Tesla (NASDAQ:TSLA) surged after posting its Q1-2024 results. The stock rallied by 12% after its earnings were released and added an additional 5% the day after. Despite the notable two-day rally, shares are still down by more than 30% year-to-date. I am bearish on the stock and believe that its year-to-date trend is a better indicator of what’s to come than the stock’s recent post-earnings rally.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Earnings Report Was Not Great

Tesla reported a 9% year-over-year revenue decline. That alone should spook many investors since the stock trades at a 43x P/E ratio. Even a 30% year-to-date drop does not change the fact that shares are overvalued.

It’s even worse when investors notice that the company’s GAAP net income attributable to common shareholders dropped by 55% year-over-year. Tesla cannot sustain its lofty valuation if it continues to lose market share in key areas like China. Other Chinese EV manufacturers are making it more difficult for Tesla to expand.

Competition is common among automakers, but it’s a thorn for Tesla more than any other. Other automobile stocks have much lower valuations, which gives them higher margins of safety.

Tesla needed to be perfect, and it was far from that in its latest earnings report. The move to offer more affordable vehicles may hurt profit margins, and the recent job cuts can make it more difficult for Tesla to achieve production goals.

Is Tesla a Tech Company?

When discussing the company’s earnings, Elon Musk focused on Tesla being a tech company rather than a car company. The company’s Q1-2024 slide deck mentions that the company increased its AI training compute by more than 130% in Q1 and reduced its FSD subscription to $99/mo.

Tesla has been selling subscriptions and software upgrades in its cars, but it still relies on cars to generate business. Total Automobile revenues came to $17.4 billion in Q1 2024 compared to total revenues of $21.3 billion. Based on these numbers, more than 80% of the company’s revenue comes from selling automobiles.

Energy Generation and Storage revenue increased by 7% year-over-year, while Services and Other revenue jumped by 25% year-over-year. Those gains weren’t enough to offset declining Automobile revenue. Furthermore, those two segments depend on Automobile sales and retention to achieve high growth rates.

Tesla’s profit margins in the first quarter definitely resembled a car company. GAAP net income came to $1.3 billion compared to $21.3 billion in total revenue. Those numbers come to a 5.3% net profit margin.

Bad Optics with the Pay Package Request

Tesla has initiated cost cuts in an attempt to improve margins while maintaining productivity. Many corporations have been making similar moves, but for Tesla, it comes at a jarring time. Tesla is seeking approval from shareholders for Elon Musk’s $56 billion pay package.

It seems odd to reward a $56 billion pay package when the company only generated $1.3 billion in GAAP net income in Q1 2024. This move actively takes away significant funds from the company. For context, the top two highest-paid CEOs of 2022 took home over $200 million.

Three top Twitter executives received $122 million after Musk fired them. I’m sure many people thought that number was high when it came out, and it is. However, it further demonstrates the significance of a $56 billion pay package.

The pay package request doesn’t strike me as a move that values shareholders. It’s reminiscent of when Musk touted Dogecoin in 2021, only for the bubble to burst. He also got involved in an insider trading lawsuit related to Dogecoin.

What Musk does outside of Tesla normally shouldn’t matter. However, his willingness to pump Dogecoin and his pursuit of a $56 billion pay package amid cutting 10% of his workforce doesn’t suggest a focus on generating value for shareholders.

Is TSLA Stock a Buy, According to Analysts?

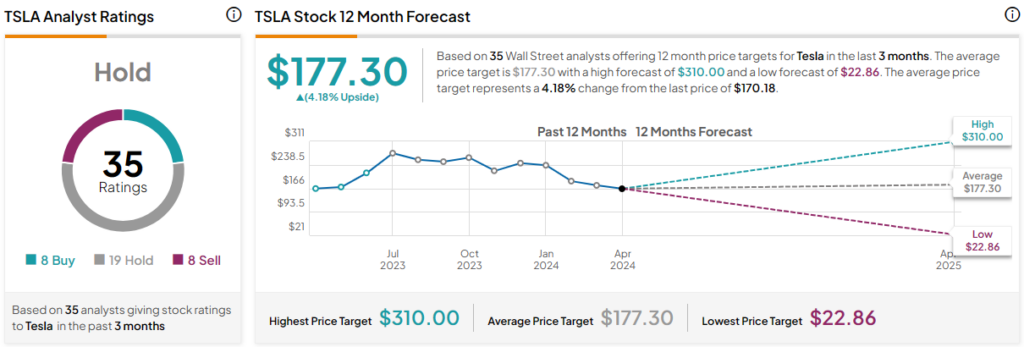

Analysts are on the fence with this stock. Tesla currently has a Hold rating. It’s split down the middle with the number of analysts with Buy recommendations versus the number of analysts with Sell recommendations.

Analysts have been assigning new price targets and reiterating their current stances. These price targets are spread across the board. Roth MKM believes Tesla is due for a 50% haircut, while RBC Capital is projecting a 72% upside from current levels. While many analysts are projecting for either extreme, some analysts are seeking price targets that suggest minimal upside or downside. Overall, the average TSLA stock price target of $177.30 implies 4.2% upside potential.

The Bottom Line on Tesla Stock

Tesla is a car company that masquerades as a tech company. The company has tech components such as software and subscriptions, but more than 80% of its sales come from automobiles. It’s losing ground in big markets like China and has seen its net profits dwindle.

Despite the negative context, Musk is pushing forward with a proposal for a $56 billion pay package. These decisions do not suggest that the company is focused on rewarding long-term shareholders. The stock has impressive five-year gains, but the future does not look bright. The valuation is far too high for an automobile company that is losing ground.