Tech stocks roared back, wrapping up the first six months with massive gains. The prospect of less aggressive interest rate hikes in the future, moderation in the inflation rate, and the grand entrance of Generative AI (Artificial Intelligence) are behind investors’ buoyant mood. While the economy still exhibits weakness and valuations appear rich, the recovery in cloud computing and AI-led opportunities indicate that the bull run in tech could sustain in the second half of 2023.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While the sector is expected to benefit from secular trends, investors should note that there could be select buying opportunities across the tech landscape in the second half of this year. But before we move ahead, let’s look at the recent price performance of technology stocks.

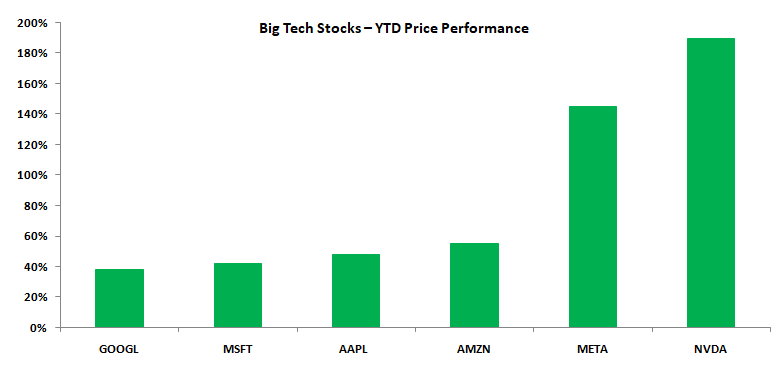

Tech Stocks – The Stellar 1H Price Performance

Contrary to the fears of recession and weak end-market demand, the buzz around AI led Nvidia’s (NASDAQ:NVDA) stock to attain $1 trillion in market cap. Meanwhile, shares of Meta Platforms (NASDAQ:META) are up about 145% year-to-date, thanks to the implementation of deep cost-cutting measures and growing momentum in its products and platforms.

At the same time, Amazon’s (NASDAQ:AMZN) stock has gained over 55%, reflecting the easing of the inflationary environment, cost-cutting initiatives, and an expected recovery in its AWS (Amazon Web Services) segment.

Apple’s (NASDAQ:AAPL) stock grew about 48% due to the momentum in Services revenue and easing supply-chain headwinds. Meanwhile, Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) stocks also defied the weak general market trend and have gained 42% and 38, respectively, on a year-to-date basis.

Thanks to this recovery, the tech-heavy NASDAQ 100 Index (NDX) is up about 39%. Further, tech and AI-focused ETFs (Exchange-Traded funds) like the Invesco QQQ Trust (QQQ) and Global X Robotics & Artificial Intelligence ETF (BOTZ) have also delivered substantial gains and witnessed large inflows of cash.

The 2H 2023 Outlook

Thanks to the solid secular tailwinds, it is hard to find shorts among these large tech companies. Exposure to generative AI, a recovery in cloud computing, and a rebound in end-market demand could continue to fuel growth for these companies.

TipRanks’ Stock Comparison tool shows that Wall Street analysts are bullish about these tech stocks. All of these stocks command a Strong Buy consensus rating on TipRanks. However, analysts’ average 12-month price targets show limited upside potential.

Nvidia is the only big tech stock offering double-digit upside potential based on the average price target. Despite the stellar gains, the double-digit upside potential in NVDA stock shows the recognition of NVDA’s leadership in the AI space.

Besides for NVDA, shares of Amazon could exceed analysts’ average price target, reflecting reacceleration in AWS’ growth rate, AI-led tailwinds (AWS’ Generative AI offerings), and cost-saving measures.

Besides for these mega-cap stocks, the Top Wall Street analysts are also bullish about Advanced Micro Devices (NASDAQ:AMD), CrowdStrike (NASDAQ:CRWD), ACM Research (NASDAQ:ACMR), Axon Enterprise (NASDAQ:AXON), and EngageSmart (NYSE:ESMT).

These tech stocks offer decent upside potential over the next 12 months based on analysts’ price targets.

Bottom Line

Despite macro uncertainty, the recent rally in technology stocks shows investors’ optimism in the sector. Further, analysts’ Strong Buy consensus rating on these stocks also substantiates the bullish view. Moreover, the expected increase in IT spending by enterprises on cloud and AI applications bodes well for growth.