I’m currently neutral on Taiwan Semiconductor Manufacturing (TSM), also known as TSMC, as I consider it overvalued amid high AI demand. Although the company has an unprecedented moat in advanced semiconductor manufacturing, it is exposed to geopolitical risks and has also been weaponized by the U.S. in its economic competition with China. Given these factors, investing in this market-leading company may not be prudent right now.

TSMC Is the World’s Most-Coveted Semiconductor Company

I’m neutral on TSMC despite its dominance in the advanced semiconductor chip market, where it produces approximately 90% of the most advanced chips and has a 60% share of the global semiconductor foundry market. While the company’s high-value position and proximity to China place it at the center of U.S.-China geopolitical tensions, it is diversifying internationally. With approximately $100 billion invested in overseas fabrication facilities, TSMC’s risk profile could decrease over time.

However, for now, the company is still being weaponized. The U.S. has directed TSMC to halt shipments of advanced chips to China, a move that aligns with U.S. efforts to restrict China’s position in AI and potentially increases the risk of a Chinese invasion of Taiwan. Notably, China is making strides in establishing a domestic semiconductor manufacturing industry, though Taiwan remains an “inalienable part of China” under the CCP’s “One-China Policy,” intensifying tensions.

Additionally, TSMC is unable to produce its frontier-generation chips outside of Taiwan due to strategic considerations, meaning that the company’s overseas fabrication facilities will produce chips with less advanced nodes. Consequently, TSMC’s diversification efforts are somewhat less impactful than initially expected. For now, the concentration of advanced semiconductor capabilities remains in Taiwan.

TSMC Is Overvalued and a Risky Investment

My neutral stance on TSM stock largely stems from its overvaluation. I estimate TSMC’s total revenue will reach $135 billion by December 2026, slightly above the consensus estimate of $127.7 billion. I also forecast an EBITDA of $95 billion, slightly higher than the consensus estimate of $89.9 billion. My outlook is optimistic due to anticipated sustained demand for AI infrastructure over the next few years.

TSMC’s five-year average forward EV-to-EBITDA ratio is 11, yet it currently stands at 13.5. Given this and my expectation of slowing growth as we approach December 2026 (the terminal date in my model), I project the EV-to-EBITDA ratio will normalize to approximately 11, consistent with its five-year average. Based on this, I estimate TSMC’s enterprise value will be around $1.045 trillion by December 2026.

With a current enterprise value of $953.58 billion, this projection implies only a 9.59% increase over two years. Furthermore, applying the company’s weighted average cost of capital of 12.53% to discount this future value to the present day yields an intrinsic enterprise value of $825.24 billion. This calculation suggests a current -13.46% margin of safety.

TSMC Remains a Viable Long-Term Holding

While I’m currently neutral on TSMC due to its overvaluation, I view it as a strong long-term investment as it tends to rise cyclically over time. The optimal alpha window would be within the next two years, as AI infrastructure demand boosts chip sales. However, TSMC’s current enterprise value already reflects much of this anticipated growth, making it an ideal point for short-term traders to take profits.

If I had bought TSMC a year ago, holding on might make sense; however, patience is key for new buyers. Once the stock’s valuation moderates, it could be an excellent addition to a portfolio. It’s essential to remember that semiconductor stocks exhibit cyclical returns, and TSMC is no exception. Although the company’s valuation is currently at an all-time high, it is likely to cycle down to a new trough. That will be the optimal time to initiate a long-term position in the company, not now.

What Does Wall Street Say About TSMC?

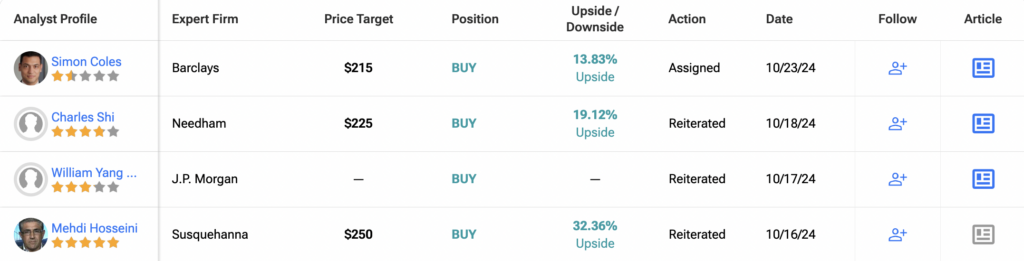

Wall Street holds a generally positive view of TSM stock, with five Buy ratings, zero Hold ratings, and zero Sell ratings, leading to an average TSM price target of $205. However, this suggests only a 6.9% upside potential, reinforcing my neutral stance.

Conclusion: Now Is Not the Time to Buy TSM Stock

Despite being one of the most exceptional companies globally, with a strong moat and well-positioned to capitalize on AI’s growth, TSMC’s valuation is extended because the market already recognizes these strengths. As a result, now is not an ideal time to buy TSM stock, either as a long-term or short-term investment.