I’m highly optimistic about Microsoft (MSFT) after digging through its Q1 results last week. The company surprised the market by very comfortably beating expectations and posting strong growth across its most critical segments, such as Azure cloud computing and AI products. This indicates MSFT is progressing a sound business strategy with quality execution, and a solid reason to believe that the stock will continue rebounding in the next 12 months amid favorable macro conditions and sustained demand.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The market took MSFT’s Q1 results very positively, lifting the stock to highs around $440 per share and erasing all losses the company suffered in 2025. Year-to-date, MSFT is up 3.5%.

Microsoft Is Grabbing Cloud Expansion by the Horns

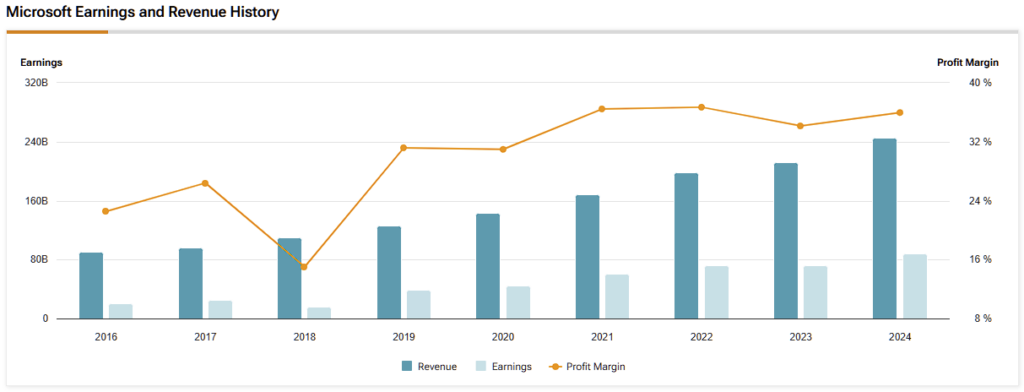

In the first quarter of 2025, Microsoft improved revenues by 13% to $70 billion year-on-year. The Intelligent Cloud division was the star, with revenues of $26.8 billion, primarily driven by Azure’s 33% growth, which was nothing short of spectacular.

AI solutions accounted for about half of Azure’s revenue growth rate, showing Microsoft’s emphasis on AI-based solutions. CEO Satya Nadella specifically cited the importance of AI and cloud solutions to global industries amid Microsoft’s continued investment in data centers. This strong growth in cloud services makes me believe that Azure will remain one of the biggest contributors to Microsoft’s share price rise next year.

Software Strength Drives Operational Excellence

Microsoft’s Product and Business Process segment also did well, with revenues rising 10% year-over-year to $30 billion. Office 365 did well, especially in business subscribers, with new functions and AI driving average revenue per user substantially. Microsoft 365 consumer subscription also increased, even after price increases in recent quarters, demonstrating customer stickiness.

LinkedIn exceeded expectations with 7% growth because it was utilized more, even though the job market isn’t excellent. Dynamics 365 (the company’s enterprise software platform) also did better, with 16% growth amid taking market share from older providers. These core software wins indicate robust revenue growth in the near term and are consistent with my optimistic expectations for the stock.

Gaming and PC Recovery Are Promising

Microsoft’s More Personal Computing segment, home to Windows and Xbox, bounced back after several quarters of struggles. The segment brought in $13.4 billion, up by 6% year-over-year, showing that the PC market is stabilizing. Windows OEM license revenue ticked slightly, proving that PC manufacturers hold better-than-expected inventories. Microsoft also benefited from more firms upgrading to Windows 11, up 75% in commercial deployments compared to last year.

Search and advertising revenues recovered robustly behind more significant usage of Bing, particularly through AI-driven features. Gaming also recovered robustly, with Xbox gaming and entertainment growing by 8%, driven by strong game titles and Activision Blizzard acquisition content. This recovery in customer-facing segments is one of the primary catalysts supporting the robust growth I forecast for Microsoft stock in the coming months. Secular tailwinds are proving decisive amid macro uncertainty.

But what excites me about Microsoft is its robust and increasing profits. Operating income improved by 16% to $32 billion, surpassing revenue growth and demonstrating excellent cost control. Microsoft has maintained its lid on operating expenses, leading to increasing profit margins despite heavy spending on cloud computing. Robust free cash flow of $20 billion also enabled Microsoft to return nearly $9.7 billion in dividends and share repurchases during the quarter. Such strong cash returns testify to Microsoft’s shareholder-friendly strategy and support my view of its stock as a long-term growth play.

Focusing on Value, Not the Naysayers

On the macroeconomic front, all is well with Microsoft, despite scary news headlines. Global spending in the IT segment is steady, companies are pursuing digital transformation, and there are early signs that PC demand is stabilizing. That’s good news.

Tax and deregulation tailwinds and possible interest rate cuts by the Federal Reserve will only enhance the appeal of growth stocks like Microsoft. Currency markets are a danger, but recent weakness in the dollar’s value will boost revenues from foreign buyers.

Moreover, Microsoft possesses strong subscription-based revenues and is best positioned in the AI and cloud segment, providing shock absorption during economic weakness. Despite the market’s caution in the short term, the macroeconomic outlook supports my bullish view on Microsoft stock.

Technical Indicators Point Toward Additional Upside

Technically, Microsoft stock has appreciated fairly substantially lately. The stock rallied approximately 7% immediately after reporting earnings last week, above the stock’s 50-day and 200-day moving averages. The 14-week Relative Strength Index (RSI) is slightly above the middle of the neutral range, showing strong market sentiment that is not excessively speculative.

There may be some minor dips in the near term, but these will almost certainly be offset by medium-term growth. My view is that there is room for the price to move toward the low $500s or better in 12 months, assuming AI and cloud computing tailwinds improve further and the economy remains in good health.

Is Microsoft a Buy, Hold, or Sell?

Wall Street is overwhelmingly bullish on MSFT. Microsoft stock carries a Strong Buy consensus rating, with 30 Buys, four Holds, and zero Sells over the past three months. The average MSFT target price is $506.31, which implies an upside of about 17% in the next 12 months.

Earlier today, UBS, Barclays, and DBS analysts reiterated their bullish recommendations on MSFT, with each setting price targets close to $500 per share.

Microsoft Is Set to Drive Sustainable Growth

Microsoft’s strong financial results, fueled by accelerating cloud and AI growth, steady business execution, and rebounding consumer segments, set the company up to keep stock value appreciation in motion. Pragmatic capital management, favorable shareholder returns, and robust macroeconomic fundamentals — despite the headlines — support my bullish view. Technical analysis also favors a bullish outlook, complementing the optimistic projection. For the next 12 months, I firmly expect Microsoft’s share price to rise, fueled by steady earnings expansion and shrewd leadership.