“Sell in May and go away” might be a well-known maxim telling investors to keep their distance from the stock market for a while during this time of year, but if a Bank of America prediction is about to play out, investors may want to consider re-entering the market before the hot season kicks off.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

That’s because BofA technical strategist Stephen Suttmeier thinks various technical indicators are signaling the stock market is readying to push higher by as much as 5% over the summer – that is, after it heads a bit lower first. Suttmeier’s advice is to make use of the drop by “buying a May dip for a summer rip.”

So, essentially an opportune time to load up on stocks which have pulled back in recent times. With this in mind, we took a dip into the TipRanks database and picked out 3 names that have been on the backfoot over the past few months but also share another trait; all are rated as Strong Buys by the analyst consensus.

So, let’s check the details of some stocks that might just be too cheap to ignore ahead of a possible “summer rip.”

ModivCare Inc. (MODV)

First up is ModivCare, an interesting company in the healthcare sector. ModivCare works in healthcare services, offering non-emergency patient transport, remote monitoring, meal deliveries, and personal care for out-patients in home-based care situations. The company also provides assessment and care management services, with the goal of improving patients’ long-term outcomes.

ModivCare achieves its goal through addressing social determinants of health, aiding patients in accessing care to reduce costs without compromising treatments. The company’s services are centered on patients, but reduced costs and time in care also provide benefits for both public and private payors.

This stock saw its most recent peak in February of this year, when reached around $110 per share. Since then, MODV has fallen sharply, losing 38% from that peak.

This loss has come even as the company posted strong numbers for the last quarter of 2022. ModivCare saw top line revenues of 653.9 million, up 13% year-over-year – and beating the forecast by $35.5 million. At the bottom line, the non-GAAP figures showed an adjusted EPS of $2.11 per share, which beat the forecast by a solid 55 cents.

The forward guidance, however, came in just below expectations. The company published 2023 full-year revenue guidance in the range of $2.575 billion to $2.6 billion, where the Street had been expected a guide of $2.61 billion. The company will be releasing its first-quarter results tomorrow before the market opens.

That revenue guide doesn’t bother Jefferies analyst Brian Tanquilut, who writes of the stock: “MODV’s guidance appears conservative for FY23, which should lead to positive earnings surprises, which, combined with improving FCF and a growth acceleration outlook for CY24, should translate to stock upside… Looking ahead, expect contract wins in NEMT (non-emergency medical transportation) to drive EBITDA growth acceleration beginning in ’24.”

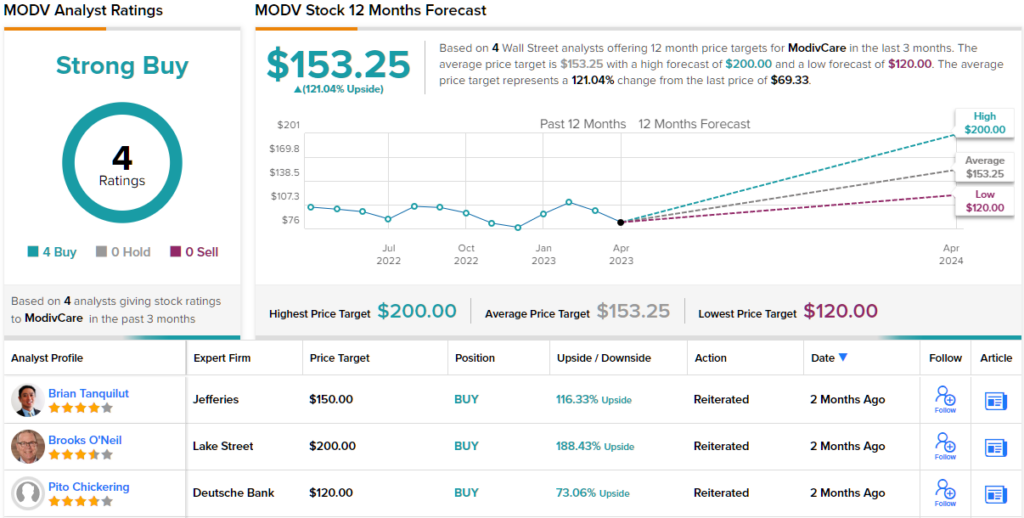

To this end, Tanquilut gives MODV shares a Buy rating, along with a $150 price target that suggests a share appreciation of a strong 118% in the coming year. (To watch Tanquilut’s track record, click here)

The Jefferies view on this stock is no outlier; MODV has 4 recent analyst reviews, all positive, for a unanimous Strong Buy consensus rating. The shares are trading for $69.33 and their $153.25 average price target implies a one-year upside potential of 121%. (See MODV stock forecast)

GitLab Inc. (GTLB)

Next up is GitLab, a tech company offering an open-source DevSecOps platform. GitLab’s innovative platform brings users the twin advantages of increased speed and efficiency, while also maximizing the return from the end-product. Users and collaborators can all contribute – and individuals or as groups – through the open-source code, allowing for greater creativity in planning, building, and deploying the platform. The company uses the ‘freemium’ model, allowing all users to access the basic services while offering higher-level upgrades for paying subscription users.

The company has been in business for just over a decade, and in that time has expanded to boast more than 30 million users. This total includes over 1 million ‘active license,’ or subscription users. GitLab has over 3,300 code contributors offering upgrades and additions to the open source, and the company employs more than 1,800 people worldwide.

Recently, GitLab announced new AI-driven features, along with plans to expand those features to resolve security vulnerabilities. The new feature uses natural language to explain vulnerabilities to users and coders. In its statement, GitLab emphasized that its AI features are designed to protect users’ own intellectual property within the open-source platform.

In March, GitLab released its numbers for the fourth quarter and full year of fiscal 2023, which ended on January 31. The company’s overall results were sound, beating the forecast for both revenue and earnings. The top line came to $122.9 million, $3.3 million above expectations and up an impressive 58% y/y. The non-GAAP earnings, at 3 cents per share, marked the third quarter in a row of moderating losses, and beat the analyst forecast by 11 cents.

In addition to these strong revenue and earnings numbers, GitLab also provided solid customer retention numbers. The company reported 7,002 customers with more than $5,000 in annual recurring revenue, for a 52% increase y/y. This number included customers with significantly higher ARR – the $100,000+ category was up 42% y/y, and the $1 million+ category was up 62%.

That’s all well and good, however, GitLab’s guidance failed to impress. The company published a fiscal 2024 revenue prediction in the range of $529 million to $533 million, well below the $586 million that the Street had been looking for.

Since its peak in February, the stock has been in a downward trend, and its decline continued after the earnings report, leading to a total decrease of 52%

Nevertheless, assessing GitLab’s prospects, Truist’s Joel Fishbein believes this stock is a long-term plat. The 5-star analyst writes: “Through the beginning of 2023 GTLB has evolved into a story with multiple significant moving parts that have driven volatility in shares. Investors continue to dig into the competitive landscape for their DevOps platform offering and the potential changes posed by the introduction of large language models and AI more broadly. We believe that, as is the case with many new technologies, the impacts of AI are being overestimated in the near term, and we think that the investments that GitLab is making into their own AI capabilities will be accretive to platform adoption in the long term.”

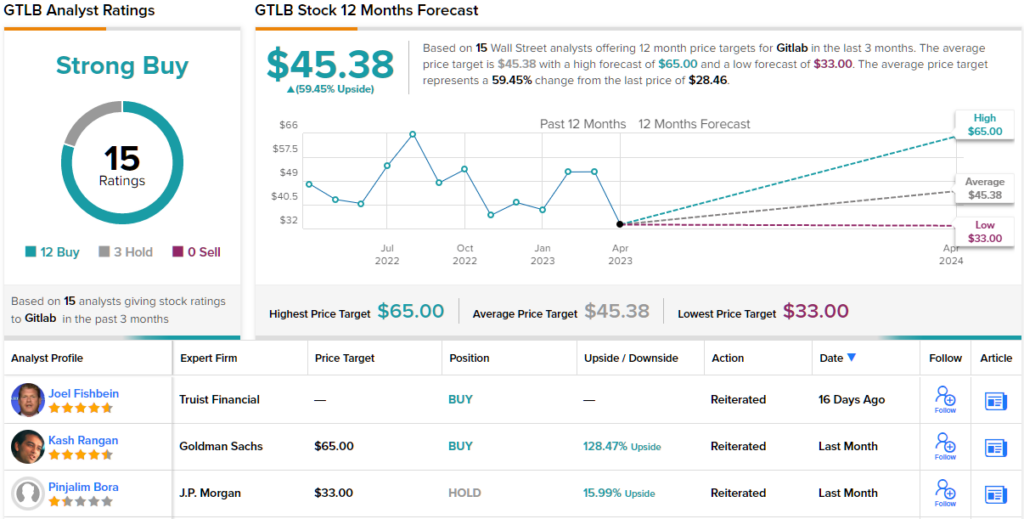

Taking this stance forward, Fishbein sees fit to rate GTLB as a Buy, while setting a $50 price target to indicate potential for a 76% upside in the next 12 months. (To watch Fishbein’s track record, click here)

Leading-edge tech firms like GitLab rarely fail to generate interest from the Street’s analysts, and this stock has 15 current analyst reviews on file. These break down to 12 Buys and 3 Holds, for a Strong Buy consensus rating, and the $45.38 average price target implies a 59% potential gain from the current $28.62 trading price. (See GitLab stock forecast)

BRT Apartments Corporation (BRT)

Last on our list is a REIT, a real estate investment trust. BRT Apartments focuses on the ownership, management, operation, and development of multi-family dwelling assets, mainly in prime Sun Belt locations. The company chooses property acquisitions according to a clear set of priorities, seeking out locations that are stabilized, undermanaged, or show potential to benefit from capital improvements.

The company looks for acquisitions in high-growth regions, especially adjacent to universities, commercial developments, and business centers – locations that are catalysts for rental unit demand. BRT’s ‘search image’ is fine-tuned to properties with more than 200 rental units, and a $5 million minimum equity need. The company is heavily invested in the Carolinas, Georgia, Tennessee, Alabama, and Texas. By the numbers, BRT has 29 properties in 11 states, with a total of 8,201 rental units.

Checking in with BRT’s earnings, we find that the company has been ahead of the curve lately. In its last report, for 4Q22, BRT showed revenues of $22.7 million, a total that just edged over expectations by $25,600, and was up 121% y/y. The company’s bottom line, however, gave a better result. Earnings were reported at a loss of 22 cents per share – but the Street had expected a 37-cent per share loss. The funds from operations, or FFO, a measure of the company’s cash flow, came in at an adjusted 40 cents per diluted share, more than enough to support the company’s current dividend of 25 cents per share.

That dividend deserves a second look. BRT has been gradually raising the payment for the last 6 years, and the current 25-cent per common share payout, annualizing to $1, gives a yield of 5.77%.

Despite BRT’s financial beats, and its high dividend yields, the stock is down some 20% from the peak it reached this past February.

This has opened up an opportunity, which JMP analyst Aaron Hecht describes: “We remain positive on Sunbelt-exposed portfolios, such as BRT, as they continue to experience outsized rental rate expansion and positive supply/demand fundamentals. We are particularly focused on the unaffordability of homeownership in BRT’s markets, which makes the company’s units increasingly attractive, in our opinion… BRT is currently trading at an implied cap rate of 7.7% that we believe is overly discounted. We remain buyers of the stock…”

Along with his comments, Hecht gives BRT shares an Outperform (i.e. Buy) rating, plus a price target of $28 that suggests a 62% upside on the one-year time horizon. (To watch Hecht’s track record, click here)

Overall, there are 4 recent analyst reviews here, and they are all positive, making the Strong Buy consensus rating on BRT unanimous. The shares’ $17.27 trading price and $25.75 average price target indicate room for the stock to grow 49% over the coming 12 month period. (See BRT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.