Markets kicked off 2025 with a bit of a rollercoaster ride, fueled by fresh data on jobs and inflation that pushed investors in different directions.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The jobs numbers showed an increase of 256,000 new positions in December, the best print since last March. At the same time, inflation appeared to cool, with the core CPI rising only 0.2% from November and dipping to 3.2% annually after holding steady at 3.3% since September 2024.

Taken together, the jobs and inflation data point to conflicting predictions for the Federal Reserve’s interest rate policy.

So, moving forward, what does this all mean for investors? Watching the situation from Truist, chief market strategist Keith Lerner sums up a bullish case, stating, “We would prefer a stronger economy with fewer rate cuts than a weaker economy that requires more aggressive rate cuts… A resilient economy should continue to support higher corporate profits, and the economy has proven to be somewhat less interest-rate sensitive relative to history over recent years.”

With all of that in mind, Truist’s stock analysts are suggesting three stocks for investors to watch, equities that stand to gain as stronger economic conditions drive stocks higher. Looking into the TipRanks database, we find that all three are Buy-rated on Wall Street. Here’s a closer look at each of them.

Atlassian Corporation (TEAM)

We’ll start Down Under, with the Australian-American software firm Atlassian. This software company has built its business and its reputation on a line of collaboration tools designed for market, project, and product management. These tools are well-suited to the digital workplace, especially given the rise in remote working, and Atlassian’s products – including the well-known Jira software package – have proven popular. Other products include Confluence, which is designed to bring company data into one place; Guard, for cloud security; and Compass, for maintaining software health. Taken together, Atlassian’s product suite lets workers function as a team, assigning and tracking tasks, organizing information, and maintaining a secure digital environment.

Atlassian is a global company, with an employee presence in 13 countries and more than 300,000 enterprise customers in 200 countries around the world. The customer base includes such well-known names as The New York Times, Dropbox, Audi, and the NBA. Atlassian even works with NASA, and likes to boast that its software is in use on two planets – the Jet Propulsion Laboratory, which controls the Mars Curiosity rover, uses Atlassian’s software products.

The company’s fiscal year 2025 started last summer, and the 1Q25 report, released in October, showed solid gains. Atlassian brought in $1.19 billion in revenue, exceeding the forecast by $30 million and growing 21% year-over-year. At the bottom line, the company realized non-GAAP earnings of 77 cents per share, up 12 cents per share from the prior year and beating the forecast by 12 cents. Cloud revenue was a major driver of the gains, growing 31% year-over-year.

Looking ahead, Atlassian is predicting continued growth. The company is guiding toward fiscal 2Q25 revenue in the range of $1.23 billion to $1.24 billion, slightly above the $1.23 billion consensus, and expects that Cloud revenue will show y/y growth of 25.5%.

In his coverage of Atlassian for Truist, 5-star analyst Joel Fishbein lays out his belief that the company’s prospects are better than the published guidance. He writes of the software firm, “While we may have missed the first leg of the move up following their most recent earnings report, we believe that there is still room for upside from here… We believe Atlassian has the most favorable near term model setup out of the companies in our infrastructure coverage. Given the runup in valuation that we saw at the end of the year, we prefer shares of companies that we think can continue a beat-and-raise cadence through the Q4 earnings season without a reset. Specifically, we think that the company is baking in an added amount of conservatism to their topline outlook this year because they do not have the benefit of a server end-of-life event that they are comparing against.”

Fishbein goes on to put a Buy rating on TEAM, with a $300 price target that suggests the stock will gain 18% over the next year. (To watch Fishbein’s track record, click here)

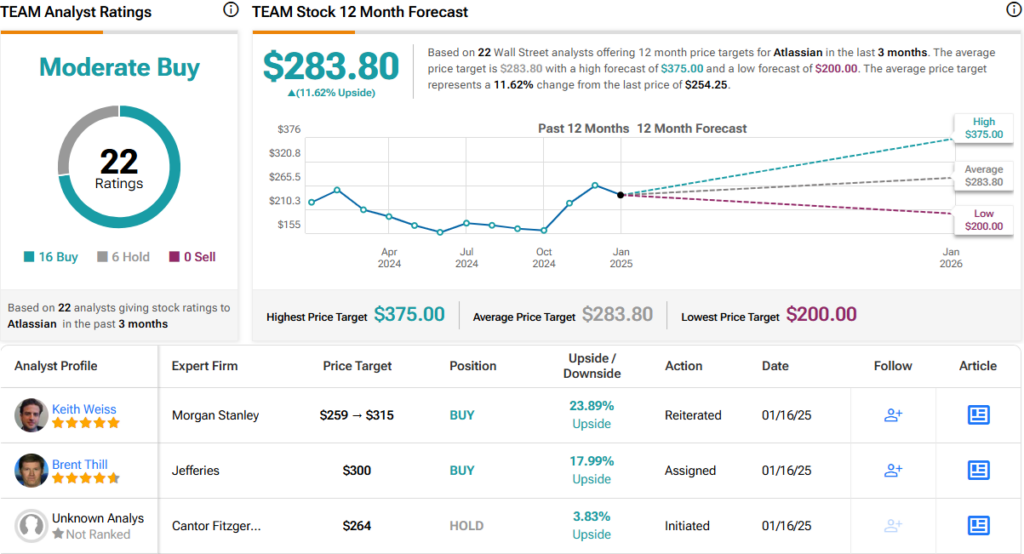

Atlassian’s Moderate Buy consensus rating is based on 22 recent Wall Street reviews that include 16 Buys to 6 Holds. The shares are priced at $254.25, and their $283.80 average target price points toward a one-year upside potential of 11.5%. (See TEAM stock forecast)

Dynatrace, Inc. (DT)

The second stock we’ll look at is Dynatrace, a software intelligence and observability company with a platform designed especially for use on the enterprise cloud. The company’s platform focuses on supporting flawless and secure digital operations, allowing customers to simplify a complex cloud environment with AI-powered data management, intelligent automation, and practical data analytics. Customers can unify their network management and cloud monitoring for faster, more efficient operations that do more with less difficulty.

Dynatrace’s platform products are applicable to the full breadth of today’s tech and business worlds. It makes use of AI to improve automation, digital security, and infrastructure monitoring, vital aspects of any business cloud. The model has proven popular, and the company, which was founded in 2005, today has over 4,000 customers and generates more than $1.6 billion in annual recurring revenue (ARR).

That last is a key metric, an important predictor of future performance, and one that Dynatrace is working to improve – as ARR growth showed a slowing trend in 2024. As of March 31 last year, the company’s year-over-year ARR growth was 20%; it was reported as 19% in fiscal 2Q25 (the quarter ended on September 30, 2024).

While ARR growth is slowing slightly, Dynatrace’s revenues and earnings continue to show a rising trend. The company’s top line in fiscal 2Q25 came to $418 million, up 19% year-over-year and $11.7 million better than had been anticipated. The bottom-line earnings figure, 37 cents per share by non-GAAP measures, beat the forecast by a nickel and was up 6 cents year-over-year.

This is another stock covered by Truist’s Fishbein. The analyst, rated by TipRanks among the top 2% of the Street’s stock experts, notes the company’s slowing ARR growth – and its initiatives to address the issue. Fishbein says of Dynatrace, “We view 2025 as a pivotal year for the Dynatrace story. After a year of decelerating net new ARR growth, the company has put a number of initiatives in place on both the product and go to market sides of the business that should have an impact this year. From a product perspective, the company has been looking to leverage their platform architecture to expand horizontally into new verticals like security for over three years now. At the end of last fiscal year, they delayed their goal of hitting $100M in ARR from their application security offering by 12 months.”

Looking ahead, the analyst believes that Dynatrace can execute on its plans, and adds, “We believe that the go to market changes that the company is making are more critical than the technology needs at this time. The two key changes that we see impacting the model in 2025 are the maturation of their DPS offering and the increased focus on strategic accounts.”

Fishbein’s Buy rating on DT is accompanied by a $70 price target, indicating his confidence in a 37% upside potential on the one-year horizon.

Overall, Dynatrace has 25 recent analyst reviews on record, backing up the Moderate Buy consensus with an 18 to 7 split that favors Buy over Hold. The shares are trading for $51.06, and their $62.44 average target price implies a 12-month gain of 22%. (See DT stock forecast)

Couchbase (BASE)

We’ll wrap up our list of Truist picks with Couchbase, another database platform provider offering services to support cloud, edge computing, and AI applications. Couchbase’s database products are based on the popular as-a-service model, and dubbed DBaaS (database as a service). The company’s flagship product, Capella, provides a faster platform for database transactions, searches, and analytics, as well as AI and edge computing applications.

Couchbase’s high-end database services are used in fields as varied as retail, travel, and gaming – and also in such essential sectors as healthcare or utilities. The company counts such major names as GE, Tommy Hilfiger, and United Airlines in its enterprise customer base.

Last month, Couchbase introduced an important addition to Capella’s capabilities, unveiling Capella AI Services, designed to meet the specific data challenges of the AI boom. Like the company’s larger product line, the new offering is cloud-based, scalable, and secure.

Also in December, Couchbase released its fiscal 3Q25 results, covering the quarter that ended on October 31. The company had total quarterly revenues of $51.6 million, up 13% year-over-year and $830,000 ahead of expectations. Couchbase runs a net earnings loss – but its fiscal Q3 non-GAAP loss of 5 cents per share was 3 cents better than had been anticipated.

Analyst Miller Jump covers Couchbase for Truist, and sees the company in a sound position to make gains going forward. As Jump puts it, “We see Couchbase shares as having a favorable risk-reward profile to start 2025. The company’s enterprise customer concentration led to some lumpiness in the revenue model this year, but we believe that they are poised to stabilize growth in 2025. As their Capella DBaaS offering accounts for an increasing part of the business mix, we also believe that they can smooth the glide path for revenue additions in the year ahead as they are adding higher volumes of customers that ramp gradually on the consumption model.”

These comments support Jump’s Buy rating on BASE, while his $21 price target implies a 28% one-year upside potential. (To watch Jump’s track record, click here)

There are 14 recent analyst reviews on record for Couchbase, and their breakdown of 12 Buys, and 1 Hold and Sell, each, gives the stock its Strong Buy consensus rating. Shares are priced at $16 and have an average price target of $23.50, suggesting a 12-month share appreciation of 43.5%. (See BASE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.