Gaming is now the most lucrative entertainment sector and the largest dollar generator of paid content, outpacing books, movies, and music by several multiples. Three console gaming giants have stood the test of time and now compete for gamers’ hearts and minds on Wall Street: Sony (SONY), Microsoft (MSFT), and Nintendo (NTDOY) are three of the most recognizable names in gaming because they manufacture dedicated consoles to attract a growing crowd of curious adults. Since younger generations take gaming more seriously than adults, easy-to-install consoles pave the way for a quick entry into the gaming world for consumers.

The sector is bustling with activity as notable future gaming titles like Grand Theft Auto 6 are expected to rake in billions in sales within days of release.

In 2025, competition is fiercer than ever, with each company charting distinct paths to capture gamers’ attention (and spending power) worldwide. Let’s disassemble each gaming powerhouse to see how they’re making their market, how they operate commercially, and, most importantly, how their market strategies can benefit opportunistic investors.

Sony (NYSE: SONY) | PlayStation Still Powers SONY’s Revenues

Sony has long been a powerhouse in gaming, and its recent numbers confirm it’s still riding high on the success of the PlayStation ecosystem. In Q3 FY2024, Sony’s operating profit shot up by almost 70%, landing at ¥338.5 billion ($2.24 billion). That boost wasn’t just due to its gaming division, as it spanned music and network services, though it certainly boosted its overall momentum.

In particular, the PlayStation 5 (PS5) remains a key revenue driver, with hardware sales up 23.3% to ¥584.8 billion ($3.96 billion). Notably, Sony’s commitment to exclusive titles and high-margin network services keeps gamers spending money within PlayStation’s ecosystem. So-called “exclusive” titles are the lifeblood of consoles, and Sony excels here, with franchises like God of War and Horizon drawing in loyal fans who continue in-game spending for years on end.

There is plenty of optimism for Sony’s future prospects, with its focused strategy of adding high-quality studios to its portfolio and generating exclusive money-spinning game titles. Each exclusive release can serve as a significant price catalyst. Notable acquisitions, such as Bungie (known for its Destiny series) and Crunchyroll, have broadened Sony’s reach into new entertainment avenues. Strategic value-accretive acquisitions enable Sony to diversify beyond a single revenue stream, giving the company a hedge against volatility or a poor title that leaves sales lagging.

Overall, management has proven they can blend iconic gaming IP, strong hardware performance, and entertainment services cross-sells, setting Sony up for lasting growth, even as the competition intensifies.

What is SONY’s Price Target in 2025?

Sony stock is currently traded on multiple exchanges worldwide, including the United States, Japan, Germany, and the United Kingdom. Compared to its U.S. listing, the company’s Japanese shares obtain the most trading volume and, therefore, the most analyst attention.

Sony Group stock carries a Strong Buy consensus rating based on nine Buy, two Hold, and zero Sell ratings over the past three months. Sony’s average price target of ¥3,771 per share (~$25) indicates a meager 1% potential upside compared to current prices.

Microsoft (NASDAQ: MSFT) | Cross-Platform Ecosystem Outmaneuvers Console Rivals

Microsoft (MSFT) has always had deep pockets. Still, we’ve seen a notable pivot in the last few years: the company is less concerned with old-school console wars and more concentrated on developing a far-reaching ecosystem that includes PC gamers. This vision hinges on integrating Xbox with Windows platforms (including handheld devices) and investing heavily in cloud-based gaming services.

The goal is straightforward: Microsoft wants to make games accessible anytime, anywhere, whether on a gaming PC, smartphone, or dedicated console. Bridging the console-PC divide is incredibly challenging because their respective software and hardware architectures are vastly different, making compatibility a vast and costly issue. Given the difficulty, MSFT’s success establishes a protective moat.

Regarding raw performance figures, Microsoft reported over $245 billion in annual revenue in 2024, a 16% increase year-over-year, and operating income of more than $109 billion, reflecting a 24% growth. Of course, most of MSFT’s revenue sources are outside of gaming. Yet the $75 billion acquisition of Activision Blizzard a couple of years ago indicates the company is committed to strengthening its game library, even as other segments, notably Intelligent Cloud, including Azure, tend to steal the spotlight.

In the meantime, securing blockbuster franchises that generate repeat sales with cult-classic hits like Call of Duty, Diablo, and Overwatch could be a significant edge in expanding Xbox Game Pass, Microsoft’s cross-platform subscription service.

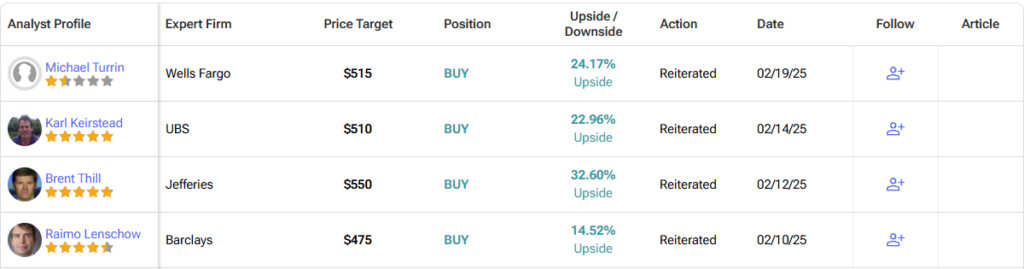

Is MSFT Stock a Buy, Hold, or Sell?

On Wall Street, MSFT stock carries a Strong Buy consensus rating based on 29 Buy, three Hold, and zero Sell ratings over the past three months. MSFT’s average price target of $510.38 per share implies ~23% upside potential over the next twelve months.

Nintendo Co (OTC: NTDOY) | Classic Reinventor Still Produces the Goods

Nintendo (NTDOY) has a rich history of shaking up the gaming world with creative ideas, and so I believe it would be unwise to count them out from the gaming race despite recent challenges. The company reported its fifth consecutive quarter of profit decline from April to September 2024, with revenues down 34.3% and net profit plummeting by nearly 60%. Most analysts point to the Nintendo Switch entering its final stages of marketability, with hardware sales slowing after an extended blockbuster run.

Still, you may have noticed that Nintendo’s playbook is rarely about competing in the raw performance specs space. Instead, it concentrates on beloved IPs and fresh ways to deliver them to their loyal fans. From Legend of Zelda to Super Mario, these franchises command multi-generational loyalty. Looking ahead, Nintendo plans to double down on iconic characters with new titles and expansions that could reignite consumer excitement from gamers who already own the company’s flagship handheld console, Switch. There’s also talk of next-generation hardware, often rumored to be a “Switch 2” or a similarly hybrid concept, that could deliver a rejuvenated user experience and cash flows.

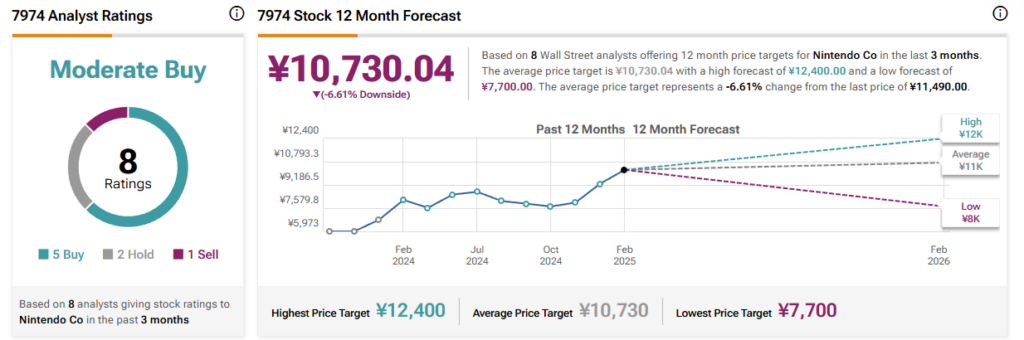

What is the Price Target for Nintendo in 2025?

Similar to Sony, this Japanese gaming giant’s stock is primarily traded in Japan, although investors can access it via the U.S., German, and British stock exchanges. These exchanges track the stock one-to-one with its Japanese counterpart listed on the Tokyo Stock Exchange.

Currently, Nintendo stock carries a Moderate Buy consensus rating based on five Buy, two Hold, and one Sell ratings obtained over the past three months. Nintendo’s average price target of ¥10,730 per share (~$70) implies about 7% downside over the next 12 months.

Revenue King MSFT Pips Exclusivity SONY and Cult Classic NTDOY

All three powerhouses are shaping the gaming industry with unique playbooks. Sony leans on exclusive franchises and a strong network service ecosystem, supported by fitting acquisitions that strengthen its entertainment empire. Microsoft pursues a broader vision anchored by cloud gaming and blockbuster acquisitions, seeing to capture revenue across consoles, PCs, and mobile devices. Nintendo, meanwhile, continues to bet on innovation and the enduring appeal of its iconic characters to offset declining Switch sales and prepare for the next big hardware leap.

From a purely financial perspective, MSFT is probably the best bet, considering how enormously diversified the company is away from gaming and how its other business units supplement and complement its gaming efforts without prioritizing gaming. Moreover, out of the three console gaming stocks, it has the highest target price among Wall Street analysts.

Which gaming giants fit investor portfolios best will depend on personal risk appetite. However, what’s undoubted is that gaming as an industry niche will continue to eclipse all other forms of entertainment in generating revenue, which means gaming isn’t for kids anymore. Likewise, investing in gaming could be something for investors to consider.