To say investors were pleased with Sono Group’s (SEV) latest business update would be something of an understatement; Shares of the German electric and solar-powered vehicle maker soared by 65% in a single session last week after the company announced financial results for 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company has just begun to generate revenues, having delivered a number of products to B2B clients over the past few months. That said, Berenberg analyst Michael Filatov thinks it is the “qualitative updates rather than near-term financials,” which are exciting investors the most, and the analyst, too, applauds the updates provided on the earnings call.

So, what was Filatov particularly impressed by?

Well, for one, pre-production initiatives for the solar electric vehicle the Sion are ramping up nicely. Production capacity has now been secured, and the design of the Sion has been “frozen” ahead of the planned series production in 2023. The company is also producing 37 series-validation prototypes, a development Filatov says is a “next major milestone that could act as a fundraising catalyst.” Sono has also set its sights on 20,000 reservations by the end of the year with “minimal incremental marketing spend.”

On the solar business side, momentum is building, too, and Filatov thinks the market is underestimating its potential.

B2B solar partnerships rose from two to 17 between 2021 and Q122, and these include “successful integrations” with public transit buses, a last-mile delivery truck, and a U.S. RV retailer.

Furthermore, noises made by management indicate that by the end of the year, Sono Solar technology could be “retrofitted” onto several hundred buses.

“We estimate that this could equate to several million dollars of revenue that we were not previously modelling,” says the analyst. “If we simply applied the EV pure-play EV/2024E sales multiple (ex-Lucid Group and Tesla) to our 2024 Sion sales estimate, it implies that the market is currently attributing no value to the solar business.”

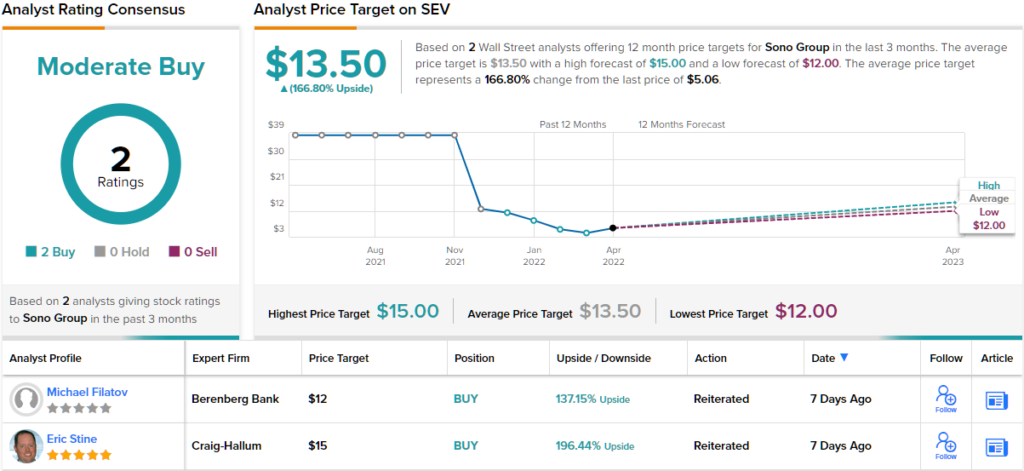

To this end, Filatov rates SEV stock a Buy along with a $12 price target. As such, Filatov sees shares skyrocketing ~140% from the current price. (To watch Filatov’s track record, click here)

Overall, 2 Buys and no Holds or Sells have been assigned in the last three months. Therefore, the analyst consensus is a Moderate Buy. At $13.50, the average price target puts the upside potential at ~167%. (See SEV stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.