The semiconductor sector has been outperforming many others in the market and shows few signs of slowing down. With that in mind, let’s take a look at two popular semiconductor ETFs to see which is the better choice for investors — the VanEck Semiconductor ETF (NASDAQ:SMH) or the SPDR S&P Semiconductor ETF (NYSEARCA:XSD).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While these are both great ETFs that invest in semiconductor stocks, they differ quite a bit in several key ways, which we’ll explore in this article.

What Is the SMH ETF’s Strategy?

According to VanEck, SMH “seeks to replicate… the price and yield performance of the MVIS US Listed Semiconductor 25 Index (MVSMHTR), which is intended to track the overall performance of companies involved in semiconductor production and equipment.”

VanEck explains, “Rather than attempting to pick individual stock winners in this ever-evolving sector, the VanEck Semiconductor ETF provides exposure to the top 25 most liquid U.S.-listed semiconductor companies, spanning the entire industry value chain from chip design and fabrication to manufacturing machinery.”

What Is the XSD ETF’s Strategy?

XSD seeks to give investors exposure to the semiconductor sector of the S&P Total Market Index (TMI) by investing in the S&P Semiconductor Select Industry Index.

The key difference between XSD and SMH is that this is a “modified equal weighted index which provides the potential for unconcentrated industry exposure across large, mid and small cap stocks.” We’ll discuss this further when we compare the funds’ holdings.

Portfolio Comparison

SMH is index-weighted. It owns 25 stocks, and its top 10 holdings account for over three-quarters of its assets.

Below is an overview of SMH’s top 10 holdings using TipRanks’ holdings tool.

On the other hand, XSD uses a modified equal-weighted approach, so it is much less concentrated. It owns 40 stocks, and its top 10 positions make up just 33.5% of the fund. Below is an overview of XSD’s top 10 holdings.

You’ll immediately notice that these different strategies result in very different-looking portfolios, even though these are both semiconductor ETFs. Right away, you’ll see that Nvidia is the top holding for both funds, but it makes up over one-quarter of SMH’s assets while it accounts for a smaller, more manageable 4.2% of XSD’s assets.

However, this isn’t necessarily a bad thing for SMH. The generative AI leader has skyrocketed to a 235% gain over the past year, so SMH has benefited from this significant exposure, as it has propelled the ETF to significant gains. On the other hand, you can also make the case that XSD’s smaller, more manageable position gives it less exposure to risk if Nvidia shares pull back.

Beyond weightings, the funds also differ in another key way.

As discussed above, SMH’s investments in the semiconductor space span “the entire industry value chain from chip design and fabrication to manufacturing machinery.” This means that SMH invests in the companies that fabricate semiconductors, like Taiwan Semiconductor (NYSE:TSM), as well as the companies that make the equipment used in the semiconductor fabrication process, like Lam Research (NASDAQ:LRCX), Applied Materials (NASDAQ:AMAT), and ASML Holding (NASDAQ:ASML).

Notably, while XSD is nominally more diversified than SMH in that it holds fewer stocks and is less concentrated, this segment of the semiconductor supply chain is conspicuously absent from its portfolio, meaning that it is not as diversified as SMH in this regard.

To me, this gives SMH a clear edge over XSD in terms of who has the better portfolio. This is a bit of a shame for XSD because these are great companies that are generating stellar returns for their shareholders. For example, Applied Materials is up 83.2% over the past year, while Lam Research is up 96.9%. Taiwan Semiconductor and ASML are up 51.9% and 51.1%, respectively.

These semiconductor equipment companies are also highly rated by TipRanks’ Smart Score system. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. Taiwan Semiconductor and ASML Holding receive ‘Perfect 10’ Smart Scores, while Lam Research receives a 9. Applied Materials receives a Neutral-equivalent Smart Score of 7.

Overall, eight out of SMH’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or higher, while seven of XSD’s top 10 holdings do. SMH receives an Outperform-equivalent ETF Smart Score of 8, while XSD receives a Neutral-equivalent ETF Smart Score of 7.

Based on these Smart Scores and the absence of chipmakers and equipment makers from XSD’s portfolio, I’m giving SMH the distinctive edge in terms of portfolio composition.

Head-to-Head Performance

SMH has also outperformed XSD over the years when it comes to the investment returns that it has generated. As of January 31, SMH has soundly beaten XSD over the past three years, with a three-year annualized return of 18.8% versus XSD’s three-year return of just 5.8%. Over the past five years, SMH has also beaten XSD with an annualized return of 32.1% versus a 24.5% annualized return for XSD. To be clear, these are both very good returns, but SMH’s are markedly better.

Lastly, over the past 10 years, the gap narrows a bit, but SMH’s 26.1% annualized return still trumps XSD’s 22.0% return.

Some of the gap in recent years comes down to the scintillating performance of SMH’s largest position, Nvidia. Past performance is no guarantee of future results, and in the event of an Nvidia pullback, XSD could potentially outperform SMH in the future, but one would still have to give the edge to SMH in the performance category.

Identical Fees

These ETFs directly compete for customers and their investment dollars, so it is perhaps unsurprising that they feature identical expense ratios of 0.35%, making this category a tossup. This means that an investor in either fund will pay $35 in fees annually on a $10,000 investment.

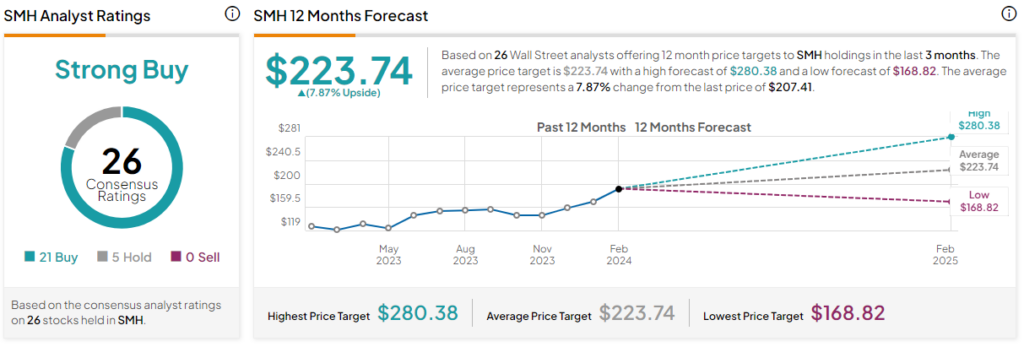

Is SMH Stock a Buy, According to Analysts?

Turning to Wall Street, SMH earns a Strong Buy consensus rating based on 21 Buys, five Holds, and zero Sell ratings assigned in the past three months. The average SMH stock price target of $223.74 implies 8.0% upside potential from current levels.

Is XSD Stock a Buy, According to Analysts?

Turning to Wall Street, XSD earns a Moderate Buy consensus rating based on 34 Buys, seven Holds, and zero Sell ratings assigned in the past three months. The average XSD stock price target of $256.65 implies 17.5% upside potential from current levels.

Interestingly, sell-side analysts see more potential upside from XSD. This is likely because, after the massive run Nvidia has had, analysts expect more potential upside from some of the sector’s laggards, which XSD is more allocated towards.

Adding It All Up

In reality, these are both great ETFs that have generated significant returns for investors over a long period. I give the edge to SMH, as its portfolio looks stronger based on TipRanks’ Smart Score and because its portfolio includes semiconductor fabrication and equipment stocks, which are unfortunately lacking from XSD’s portfolio. Furthermore, SMH has been a stronger performer over the past three, five, and 10 years.

In my view, SMH is the hands-down winner based on these factors, but you can make the case for owning either ETF. For more conservative investors who don’t feel comfortable having over 25% exposure to Nvidia and who are looking for a less concentrated way to approach the semiconductor space, XSD would likely be the way to go. Furthermore, if Nvidia slows down and some of the space’s less-heralded stocks begin to catch up to it, XSD could outperform SMH.