As 2023 draws to a close, investors are beginning to rediscover some pockets of the stock market they have avoided in the past year. Thus, November’s stock rally was led by small-cap stocks, which were previously the laggards of the market but are now seemingly back in favor, thanks to the Goldilocks economic outlook and bets on lower interest rates in 2024. Will small caps shine next year, or was this just another bounce that they will struggle to sustain?

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Are We All Goldilocks Now?

Stock markets surged in November, closing their best month of the year, which so far has been much better for investors than many strategists forecast. One of the strongest November rallies on record was led by increasing bets that the Federal Reserve’s hiking campaign is over, and the central bank will soon pivot to easier monetary policy.

Markets appear virtually certain that the economy is headed for a “soft landing” in 2024, with many data points, such as consumer spending, job creation, and inflation rates, adding to evidence that the U.S. economy is gradually slowing, and price increases are weakening. Meanwhile, there isn’t much risk of a recession reflected in the data received so far, despite weakness in some pockets of the economy such as the manufacturing sector.

The Fed officials acknowledged that inflation is easing, lending even more ground to the markets’ expectations of rate cuts beginning in the first half of 2024. While strategists at Wall Street’s largest banks and money managers are mentioning two rate cuts in 2024, the derivatives markets price in a greater-than-50% chance of the Fed’s rates falling by at least 1.25% by the end of next year.

However, analysts warn that investors’ yearning for lower rates leads them to a dangerous point since these large and fast rate cuts aren’t very probable without the economy slipping into an outright recession. While currently not a base-case scenario, recession, according to JPMorgan Chase & Co. (JPM), is still on the table in the coming year. But at the moment, these warnings are falling on deaf ears, as investors are skeptical after Wall Street’s recession warnings haven’t materialized this year.

Yesterday’s Losers May Be Tomorrow’s Winners

Based on the Goldilocks scenario of no recession and falling inflation, stocks continued their 2023 rally in November, with the S&P 500 (SPX) rising to a level comparable with its all-time high, notched in December 2021. As a result, stocks are becoming expensive versus their long-term average valuations, with a “soft landing” fully priced in.

With the large-cap market leaders’ rich valuations limiting their gain potential, and the optimistic economic outlook lifting risk sentiment, investors broadened their scope in the recent month or so. They are now seeking bargains in the most beaten-up corners of the market, looking for low prices as well as protection against a possible top in tech mega-caps.

For most of last year, the lion’s share of market gains were concentrated within a handful of large, mostly tech names. This led to wide skepticism towards the viability of stock market increases, as narrow upward movements are typical for bear-market rallies.

Notably, in the past several weeks, the rally has significantly broadened, with the optimistic tide lifting almost all boats, a behavior associated with bull markets. In addition, fund managers who underperformed their benchmarks because of their conservative positioning are trying to narrow the performance gaps, betting on what they believe will be the next market winners. Money managers, preparing for next year’s expected broad rally, are snapping up last-year losers at sale-price valuations, propping up their rebound.

Investors Snap Up Cheap Small Caps

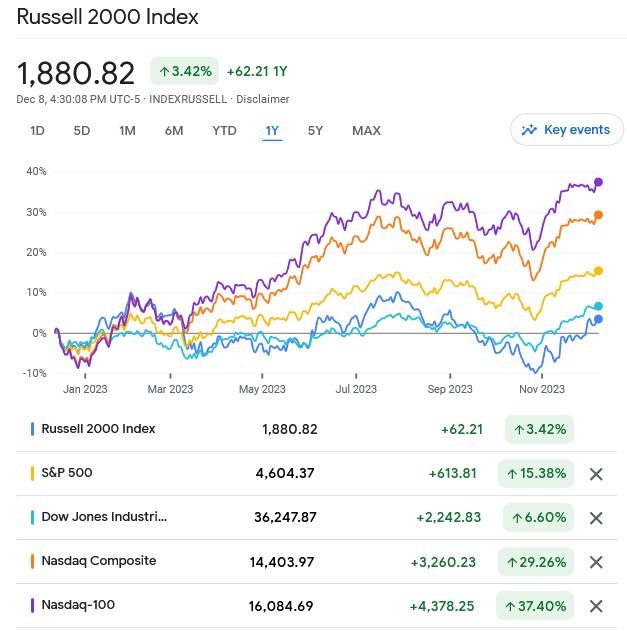

One of the spheres where this improving market breadth is most apparent is small-cap stocks. The small-capitalization Russell 2000 Index strongly underperformed the S&P 500 since March; it is now up 6% year-to-date versus the SPX’s 19% gain.

This performance gap is much narrower than it was just three weeks ago, when the Russell 2000 was at its worst underperformance ratio versus large caps since 1998. For most of 2023, the most- followed gauge of small-cap stocks was harshly pressured by negative investor sentiment on the back of these companies’ much larger vulnerability to high interest rates, leading to surging costs of debt.

Source: Google Finance

The small-cap underperformance trend changed at the end of October, with the Russell surging over 13% from its October 27 low, while the S&P 500 rose about 10% at the same time. Up until that date, the Russell 2000 was at a loss of almost 8%, compared with the large-cap index, which maintained positive results throughout the year. Last month, the small-cap gauge capped a gain of 11%, one of its best Novembers in recent decades.

Source: Google Finance

Not only mutual fund managers are flocking into small caps; retail investors’ growing interest is reflected in strong inflows into small-cap ETFs, such as iShares Core S&P Small-Cap ETF (IJR) and iShares Russell 2000 ETF (IWM), since mid-November. Small caps are now trading about 20% below their long-term valuation averages, versus a ~15% average premium investors are now paying for large-cap stocks. Thus, for investors counting on a broad bull market going forward, smaller companies’ stocks are a rare bargain, with the largest gap in valuations versus the SPX since 2007.

Will The Small-Cap Rally Gain Steam?

Since the Federal Reserve started lifting rates in March 2022, the main moving factors for stocks besides the regular one, earnings, have been inflation, jobs, and the Federal Reserve. Now, if the Goldilocks scenario plays out as expected, i.e., inflation continues to trend down, while the job market weakens enough to remove wage-price pressures but remains more or less robust, the Fed will officially pivot to a much more dovish stance.

In this scenario, the Fed’s dovish pivot will finally negate the greatest fear hanging over the markets: that the central bank will over-tighten, and the economy will enter an outright recession. While that doesn’t necessarily mean that policymakers will begin cutting rates as soon as March, as some analysts expect, the mild economic scenario will remove the pressure to hold rates “higher for longer” – and the “risk-on” sentiment, propped by easing financial conditions, will do the rest.

Of course, in this case, we’ll see the “everything rally” on steroids, but the main winners will be the assets that have taken the most beating and are selling at the lowest valuations, as well as risk assets. Since small caps combine these two traits, in the Goldilocks scenario they can be expected to rally the most.

Besides, their story will be backed up by economic reality, not just sentiment. Declining interest rates will take a lot of pressure off their margins, as smaller companies’ debt repayments comprise a much higher percentage of their revenues than those of their larger counterparts. In addition, a still-robust economy will provide a solid base for revenue growth, which will add to rally catalysts, when reflected in their earnings reports.

A Rally When Stars Align

However, this “happily ever after” is far from being a given. First of all, the fact that the Fed’s hiking cycle is over doesn’t mean that the financial conditions are now firmly on an easing path. This cycle was the longest and strongest since the 1980s, and the rate increases will continue feeding into the economy for months to come, with their full extent becoming apparent somewhere around mid-2024, if not later.

Of course, if the economy turns south more than expected, the Fed will start easing sooner rather than later. However, this wouldn’t be a reason to cheer, as a weak economy will pressure small caps foremost, and risk-off sentiment will depress their stock performance.

Meanwhile, U.S. companies are still saddled with a vast amount of debts, taken on before the hikes, when debt was practically free. According to Bloomberg estimates, the additional interest costs of refinancing debts maturing in 2024-2026 will amount to $27 billion. These costs are much less manageable for small, growing companies, as they tend to have higher debt ratios than large, established firms. Besides, the large caps in the S&P 500 have their debts spread into a much longer timeline, whereas more than 60% of Russell 2000 companies’ debt load will mature in the next five years.

Source: Bloomberg

To sum up the problem, small caps tend to have higher debt ratios, less favorable term distribution, and a higher percentage of debts at floating rates, than their larger peers. At the same time, they have much lower pricing power, which means that the weakening economy hurts their revenue the most.

Not All Small Caps Are Created Equal

Historically, small caps tend to strongly outperform the broader market in the periods between the Federal Reserve’s last hike in the cycle, and the first cut of the new cycle. Small-cap gains in these periods, averaging nine months, was 16.5%, versus 13% for large caps.

This time, given that the Russell 2000 index’s average price-to-earnings (P/E) ratio is at 14-month low, small-cap investors are expecting about a 20% average gain. However, it must be noted that for many of the index’s constituents, there is no “E” to put into that equation, as over 30% of companies in the Russell 2000 are unprofitable.

If the economy were to weaken more than expected, the percentage of loss-making companies would rise even more. But even if the Goldilocks scenario plays out according to the script, earnings will still be a pressing issue. According to FactSet, the average annual revenues for companies in the S&P 600 (another popular small-cap index) will decline by 1% in 2023 compared to the previous year, leading to a 14% contraction in earnings-per-share.

2024’s earnings are still a wild card even if there’s no economic contraction, because of the heightened uncertainty about the health of consumer spending. Next year, we will see in the rear window, which small-cap companies survived and even flourished, and which sunk deeper below the breakeven threshold, or even went bankrupt. Meanwhile, looking ahead, it is best to choose quality, in all shapes and sizes.

Quality Isn’t Optional

All the risks described above don’t suggest that investors shouldn’t wage into the small-cap waters. Some stocks have the potential to break out, bringing outsized gains to their investors. But at this level of uncertainty, investors are advised to prefer careful stock picking over passively following indexes, which contain a large proportion of companies at risk of never recovering, let alone outperforming.

I suggest looking for quality stocks: companies with low debt levels, leaving them with more wiggle room, and healthy margins. While growth investing is a legitimate, often profitable strategy, now may not be the best time to bet on still-unprofitable, barely viable firms – instead, I’d choose those that already turn in a stable and growing net profit. These healthy small-caps have higher chances to survive a recession, were it to happen, as well as to sustain a major rally once the growth outlook improves.

Finding healthy and robust small caps, which have the potential to reward their investors with significant gains, is not an easy task. The vast number of differences in these companies’ financial and business metrics, as well as their prospects, calls for a thorough analysis, which requires digging into the data, analyzing companies’ finances, industry competitiveness, growth prospects and risks, and more.

Thankfully, at TipRanks, investors can leverage the existing analysis, utilizing research done by Wall Street’s leading analysts, collected and made accessible by TipRanks. TipRanks also has several additional tools, which employ the vast amounts of data and research stored in its database, helping discerning investors pick the best stocks according to their outlook, risk tolerance, and financial goals.

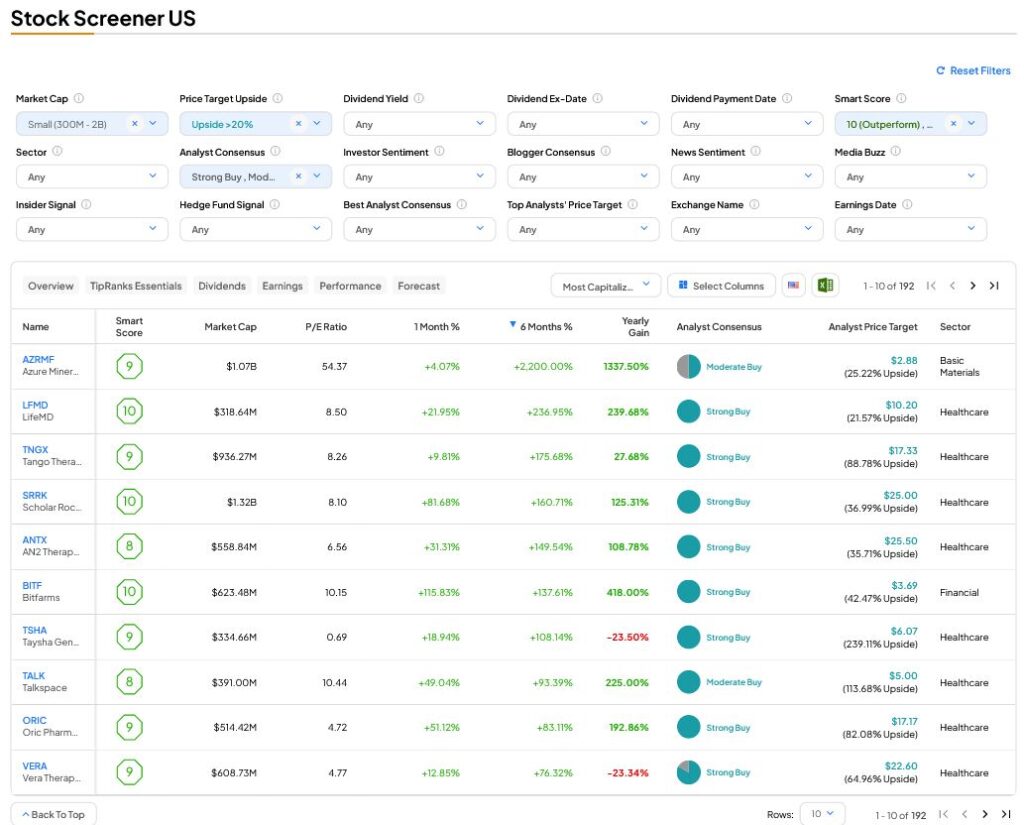

For example, investors can use the TipRanks Top Smart Score Stocks screener, filtering for companies with the highest Smart Score to find the potential winners among those with a small market capitalization:

Alternatively, investors can use the general TipRanks Stock Screener tool, slicing and dicing the database of stock analysis according to their preferences:

To conclude, small caps may hold a significant outperformance potential going into 2024, but they are riskier than large-cap stocks, and thus require a higher level of due diligence. Investors are advised to analyze the companies’ fundamentals and prospects to pick the quality winners that can create value for their shareholders.