Metro (TSE:MRU), one of the largest Canadian grocery retailers, has enjoyed nice gains this year, rallying 17% year-to-date, not including dividends. This begs the question, how much more can MRU stock rally? As of right now, despite MRU being a good stock, it looks like there isn’t much short-term upside potential here following its recent rally. As a result, we are neutral on the stock.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

What Makes Metro a Good Company?

Being in the resilient grocery industry, as well as the drugstore industry with its ownership of Jean Coutu, Metro enjoys strong demand even in harsh economic times. In its most recent Q4-2022 earnings release from last week, Metro stated that its revenue increased by 8.3% to C$4.43 billion. Consequently, its adjusted diluted earnings per share increased by 13.6% year-over-year to C$0.92 (beating the C$0.90 consensus), aided by buybacks.

In fact, the company recently renewed its buyback program, allowing it to repurchase just under 3% of its outstanding shares within the next year. Given Metro’s strength, it’s easy to see why investors have flocked to the stock.

Why It Might be Too Late to Buy Metro Stock

The answer is simple. Metro stock looks like it has gone up too much, too fast. This is mostly true from a technical analysis standpoint but also a valuation standpoint, although to a lesser extent. If you look at Metro’s stock chart below (each candlestick represents one month’s worth of price action), you’ll see that MRU stock is far away from its 30 and 50-month moving averages (red and blue lines). Generally, when this happens, the stock price eventually pulls back to either moving average, both of which have been good entry points in the past. Therefore, buying now may not be the best move.

Even its valuation is elevated relative to its past. Its forward (next 12 months) price/sales multiple of 0.92x is higher than its five-year average of 0.8x, and its forward EV/EBITDA multiple of 11.5x is higher than its five-year average of 10.8x.

In a higher-rate environment relative to the past five years, its valuation should arguably be lower than average to compensate for the higher rates. It’s understandable that its multiple has expanded due to being viewed as a safe haven, but it’s also not ideal to pile in on a stock after its upside potential has already been realized — more on upside potential below.

Is Metro a Good Stock to Buy, According to Analysts?

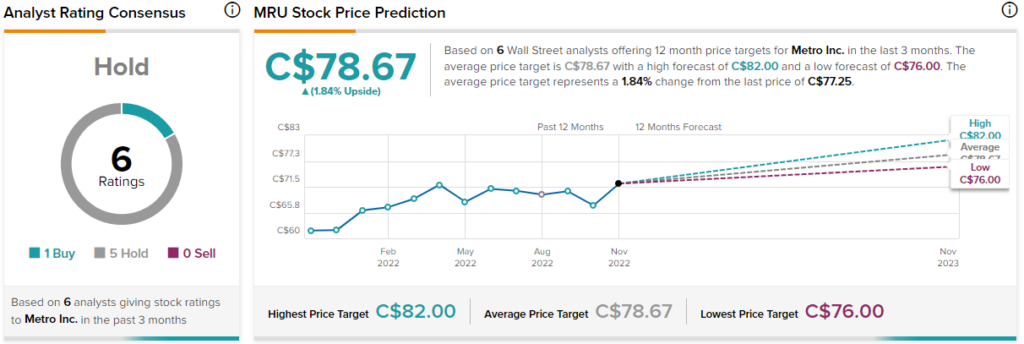

According to analysts, Metro stock comes in as a Hold based on one Buy and five Holds assigned in the past three months. The average MRU stock price target of C$78.67 implies just 1.8% upside potential. Given the Hold rating and low upside potential, analysts seem to have the same view as us.

Conclusion: Wait for a Dip

Metro has been a steady performer this year and in the long term. However, like most other stocks, it’s always been better to buy MRU on a dip rather than after a rally. Even its valuation suggests that it’s gotten a bit ahead of itself. Therefore, we are neutral on the stock despite its positive qualities.