If you looked at the chart for meal-kit provider Blue Apron (NYSE:APRN) stock in recent weeks, it might appear a strong enterprise based on its robust performance. However, take away the speculation toward its elevated short interest (the short percentage of its float was 15.2% as of April 28), and you’re left with a company that lacks fundamentals. Therefore, I am bearish on APRN stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

APRN Stock Delights Day Traders

Undeniably, Blue Apron stock delighted day traders last week, returning over 23%. Therefore, many who entered the arena with the idea of making some quick profits benefited handsomely.

Moreover, APRN stock may have been a target to spark a short squeeze. Under a normal (bullish-based) investment framework, a trader buys a security in the hopes that it will move higher. Here, the ultimate risk is that the underlying shares could go to zero. On the other hand, a security incurs no theoretical upside limit. Therefore, traders taking the opposite (short) bet potentially suffer the risk of unlimited liability.

To avoid this obviously painful prospect, short traders wishing to mitigate the damage of a bearishly targeted security accelerating higher is to close the position. For shorts, this process involves buying the security in question. Naturally, bears panicking creates upside pressure for contrarian bulls. That’s why some traders deliberately seek out troubled entities like APRN stock.

However, attempting to catalyze a short squeeze carries risks for the bulls as well. Primarily, investors should never lose sight of the fact that – assuming the existence of rational players – high short interest in a security typically points to vulnerabilities in the targeted business. Thus, contrarians may be bidding up a sinking ship.

Coincidentally, the end of last week did not end on a high note for APRN stock. Instead, shares tumbled nearly 15% on May 19. So, those that hopped on the bandwagon on that day may have suffered steep losses.

Blue Apron’s Core Business Lacks Relevance

While eating healthy should be everyone’s goal, it’s a tough proposition in the best of circumstances. For one thing, families must spend time buying various ingredients. Second, it takes time to learn new recipes and then to prepare them. With Blue Apron’s meal-kit deliveries, the program provides the ingredients and the instructions. Therefore, anyone with a modicum of culinary abilities should be able to prepare quality meals.

However, in the post-pandemic new normal, consumers who work white-collar jobs have plenty of time. Therefore, a business model that aims to save time loses relevance. To be sure, that’s not Blue Apron’s fault. However, it may have a lingering impact on APRN stock.

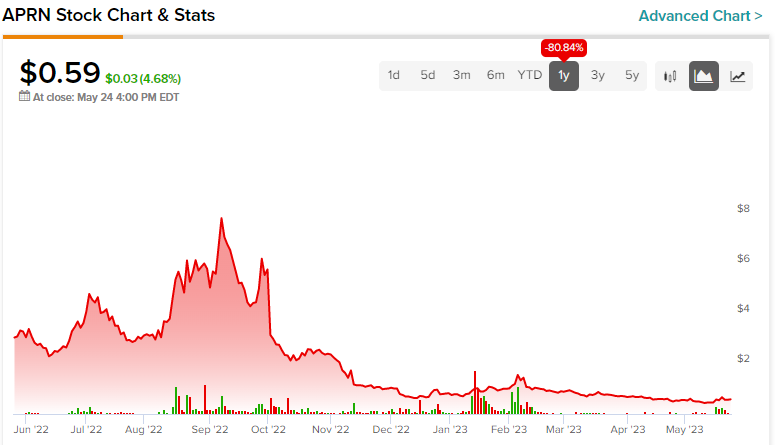

After all, while shares bounced higher last week, for the year, they’re down almost 23%. And in the trailing one-year period, APRN stock fell an alarming 81%. Such losses wouldn’t materialize if the underlying business was truly relevant and viable.

In addition, with consumer prices remaining stubbornly elevated, households are looking for any way to save money. In this ecosystem, Blue Apron is a luxury that the average family doesn’t need. They can save on groceries by buying in bulk. Further, learning new recipes isn’t that difficult with social video networks broadcasting educational content across a variety of subjects.

Financials Moving in the Wrong Direction

As expected, the COVID-19 narrative that helped normalize dynamics, such as working from home, negatively impacted Blue Apron’s financials. For example, in 2020, the company posted revenue of $460.61 million, up about 1.3% against the prior year’s result of $454.87 million. Also, in the following year, revenue popped higher to $470.38 million.

Back then, such services made sense as the fear of COVID-19 incentivized people to stay at home. However, in 2022, revenue slipped to $458.47 million. A combination of fading fears but also economic pressures stemming from blistering inflation sparked a loss of demand. Unfortunately, conditions have not improved substantively enough for households to warrant meal-kit delivery services. Thus, investors should be careful with APRN stock.

Is Blue Apron Stock a Buy, According to Analysts?

Turning to Wall Street, APRN stock has a Hold rating based on just one Hold assigned in the past three months. The average APRN stock price target is $3.50, implying 497% upside potential.

Takeaway: APRN Stock Tantalizes Investors, but It’s Not Attractive

Although Blue Apron managed to delight traders with a tantalizing jump in value last week, it might not hold up in the long run. That’s because the underlying utility of the business isn’t wholly relevant to the post-pandemic environment. Therefore, investors should be very cautious about APRN stock.